Form DTF 95 Business Tax Account Update Revised 922

What is the Form DTF 95 Business Tax Account Update Revised 922

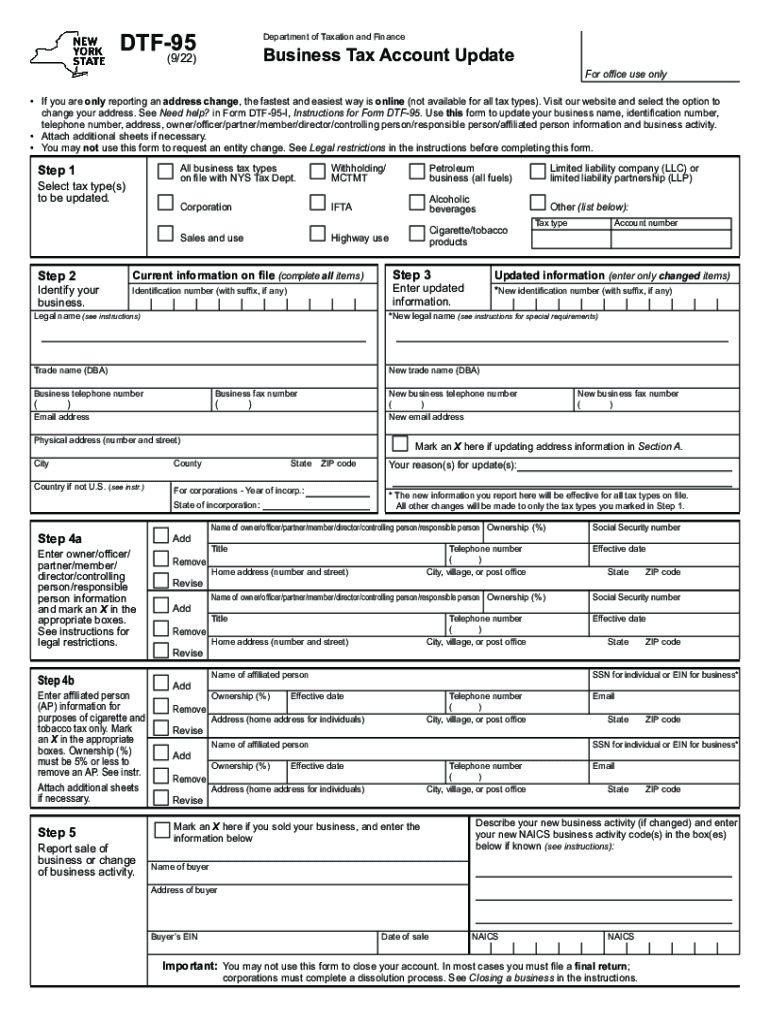

The Form DTF 95 is a crucial document used by businesses in New York State to update their tax account information. This form is specifically designed for the Business Tax Account Update, allowing entities to report changes such as ownership, address, and business structure. Understanding the purpose and function of the DTF 95 is essential for maintaining compliance with state tax regulations. By ensuring that all information is accurate and up-to-date, businesses can avoid potential issues with the New York State Department of Taxation and Finance.

Steps to complete the Form DTF 95 Business Tax Account Update Revised 922

Completing the Form DTF 95 involves several key steps to ensure accurate submission. First, gather all necessary information, including the current business name, tax identification number, and details of the changes being reported. Next, fill out the form carefully, ensuring that all sections are completed. It is important to double-check the information for accuracy to prevent delays. Once the form is filled out, it can be submitted either online or via mail, depending on the preference of the business. Keeping a copy of the submitted form for your records is also advisable.

How to use the Form DTF 95 Business Tax Account Update Revised 922

The Form DTF 95 is utilized by businesses to communicate changes to their tax accounts to the New York State Department of Taxation and Finance. To use the form effectively, businesses should first identify the specific updates they need to make. This could include changes in business ownership, address modifications, or updates to the business structure. After identifying the necessary changes, businesses can accurately fill out the form and submit it to ensure that their tax records reflect the most current information.

Key elements of the Form DTF 95 Business Tax Account Update Revised 922

The Form DTF 95 contains several key elements that are critical for proper completion. These include the business's legal name, the tax identification number, and the specific changes being reported. Additionally, the form requires the signature of an authorized representative, affirming that the information provided is accurate. Each of these components plays a vital role in ensuring that the tax account is updated correctly, which is essential for compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Form DTF 95. The form can be submitted online through the New York State Department of Taxation and Finance website, which allows for a quicker processing time. Alternatively, businesses can mail the completed form to the designated address provided on the form itself. In some cases, in-person submissions may be accepted at local tax offices, although this is less common. Choosing the right submission method can help ensure that the updates are processed efficiently.

Penalties for Non-Compliance

Failure to submit the Form DTF 95 when required can result in penalties for businesses. These penalties may include fines or additional taxes owed to the state. It is crucial for businesses to stay compliant with tax regulations by submitting the form promptly whenever there are changes to their tax account. Understanding the potential consequences of non-compliance can motivate businesses to prioritize timely updates, thereby avoiding unnecessary financial burdens.

Quick guide on how to complete form dtf 95 business tax account update revised 922

Easily Prepare Form DTF 95 Business Tax Account Update Revised 922 on Any Device

Online document organization has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage Form DTF 95 Business Tax Account Update Revised 922 on any device via the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Method to Modify and eSign Form DTF 95 Business Tax Account Update Revised 922 Effortlessly

- Locate Form DTF 95 Business Tax Account Update Revised 922 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow supplies for that specific purpose.

- Create your eSignature using the Sign tool, which requires just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Form DTF 95 Business Tax Account Update Revised 922 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dtf 95 business tax account update revised 922

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys dtf and how does it relate to airSlate SignNow?

The nys dtf refers to the New York State Department of Taxation and Finance, which requires businesses to file certain documents electronically. airSlate SignNow provides an efficient solution for eSigning and sending these documents, ensuring compliance with nys dtf requirements.

-

How can airSlate SignNow help with nys dtf compliance?

airSlate SignNow streamlines the eSigning process for documents required by the nys dtf. With our secure platform, businesses can easily sign, send, and manage tax documents, thereby maintaining compliance with state regulations.

-

What features does airSlate SignNow offer for handling nys dtf documents?

Our platform offers various features for managing nys dtf documents, including customizable templates, automatic reminders, and integration with other software. This helps businesses efficiently manage their tax-related documents and ensure timely submission.

-

Is airSlate SignNow cost-effective for managing nys dtf documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for all your document management needs, including nys dtf forms. With flexible pricing plans, companies can choose a package that fits their budget while ensuring they meet compliance requirements.

-

Can I integrate airSlate SignNow with other software for easier nys dtf document management?

Absolutely! airSlate SignNow easily integrates with various applications like CRMs and accounting systems, enhancing your workflow for nys dtf document management. This seamless connection allows for more efficient processes and reduces the risk of errors.

-

What benefits does using airSlate SignNow provide for nys dtf eSigning?

Using airSlate SignNow for nys dtf eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that documents are signed and managed securely, which is critical for maintaining compliance.

-

How secure is the airSlate SignNow platform for nys dtf documents?

airSlate SignNow takes security seriously, employing advanced encryption and authentication methods to protect your nys dtf documents. You can trust that your sensitive tax information will be safe and secure while using our platform.

Get more for Form DTF 95 Business Tax Account Update Revised 922

Find out other Form DTF 95 Business Tax Account Update Revised 922

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free