1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii Form

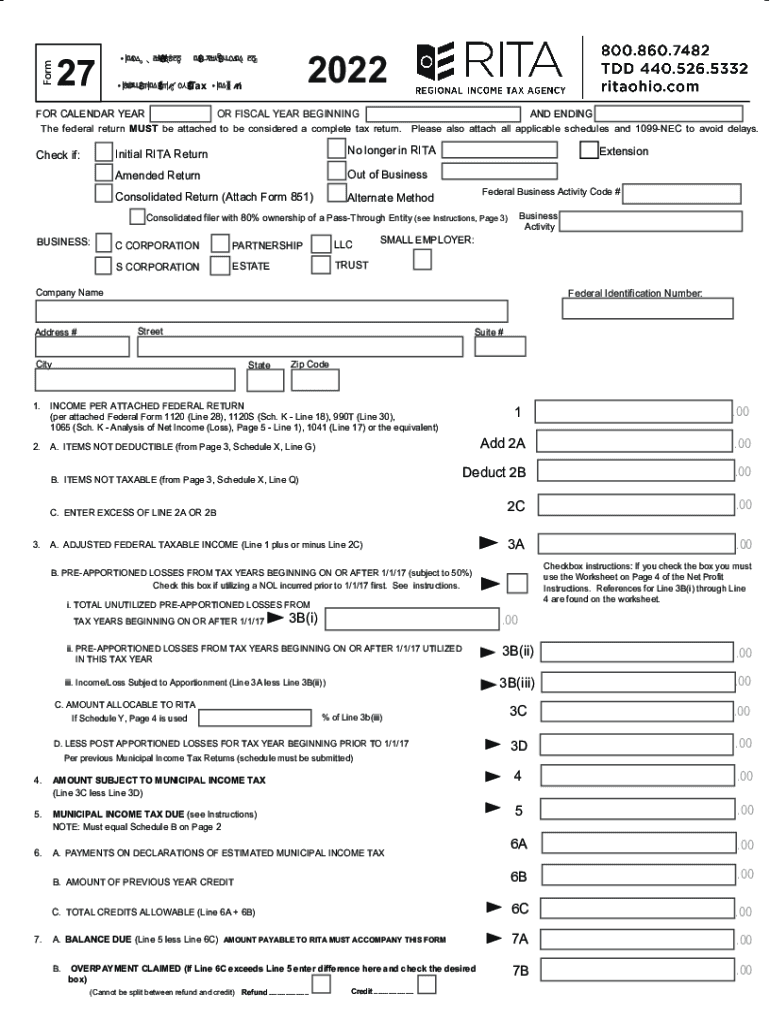

Understanding the Ohio 27 Form

The Ohio 27 form, also known as the RITA 27 form, is a crucial document for individuals and businesses required to report income and pay municipal income taxes in Ohio. This form is specifically used for filing the RITA (Regional Income Tax Agency) tax return. It is essential for taxpayers to understand the components of this form to ensure accurate reporting and compliance with local tax regulations.

Key Elements of the Ohio 27 Form

The Ohio 27 form includes several key sections that taxpayers must complete accurately. These sections typically involve:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all sources of income, including wages, self-employment income, and other earnings.

- Deductions: Taxpayers can claim specific deductions that may apply to their situation, reducing their taxable income.

- Tax Calculation: This section involves calculating the total tax owed based on the reported income and applicable rates.

Steps to Complete the Ohio 27 Form

Completing the Ohio 27 form involves several steps to ensure accuracy and compliance. Here’s a simplified guide:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section with accurate details.

- Report all income sources in the designated sections.

- Apply any eligible deductions to lower your taxable income.

- Calculate the total tax owed based on the provided tax rates.

- Review the completed form for accuracy before submission.

Legal Use of the Ohio 27 Form

The Ohio 27 form is legally binding once completed and submitted. It must be filled out in accordance with the laws governing municipal income taxes in Ohio. Taxpayers are advised to ensure that all information is accurate to avoid penalties or legal issues. The form must be signed and dated to validate the submission.

Filing Deadlines for the Ohio 27 Form

Timely filing of the Ohio 27 form is crucial to avoid penalties. The standard deadline for submitting this form is typically April 15 for most taxpayers, aligning with federal tax deadlines. However, specific municipalities may have different deadlines, so it's essential to check local regulations for any variations.

Form Submission Methods

The Ohio 27 form can be submitted through various methods, including:

- Online Submission: Many municipalities offer online portals for electronic filing.

- Mail: Taxpayers can print the completed form and mail it to the appropriate tax authority.

- In-Person: Some taxpayers may choose to submit their forms in person at designated tax offices.

Quick guide on how to complete 1 add 2a deduct 2b 2c 3a 3c 3d 4 5 6a 6b 6c 7a 7b 3bii

Complete 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii effortlessly on any gadget

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without delays. Handle 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii with ease

- Locate 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii and click on Get Form to initiate.

- Utilize the tools provided to complete your document.

- Highlight key sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii and ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 add 2a deduct 2b 2c 3a 3c 3d 4 5 6a 6b 6c 7a 7b 3bii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio 27 form?

The Ohio 27 form is a tax form used for various tax-related purposes, primarily to report certain income and tax credits in Ohio. airSlate SignNow makes it easy to prepare, send, and eSign the Ohio 27 form securely online, ensuring compliance and accuracy in your tax submissions.

-

How much does it cost to use airSlate SignNow for the Ohio 27 form?

airSlate SignNow offers affordable pricing plans that cater to different business needs. You can choose from various subscription options that allow unlimited eSigning, including support for filling out and submitting the Ohio 27 form, all while remaining budget-friendly.

-

What features does airSlate SignNow offer for the Ohio 27 form?

airSlate SignNow provides a user-friendly platform that includes features like document templates, customization options, and advanced eSignature capabilities specifically for the Ohio 27 form. Users can also utilize automated workflows, reminders, and secure cloud storage for their completed documents.

-

Can I integrate airSlate SignNow with other software for my Ohio 27 form needs?

Yes, airSlate SignNow easily integrates with a variety of third-party applications, enhancing your efficiency when handling the Ohio 27 form. Integrations with tools like Google Drive, Dropbox, and CRM systems streamline your document management process, making eSigning and submitting your forms hassle-free.

-

How secure is airSlate SignNow when preparing the Ohio 27 form?

airSlate SignNow prioritizes your security with industry-leading encryption standards and compliant practices when handling sensitive information, including the Ohio 27 form. You can trust that your data is safeguarded throughout the signing process, minimizing risks associated with online document handling.

-

What are the benefits of using airSlate SignNow for my Ohio 27 form?

Using airSlate SignNow for your Ohio 27 form simplifies the eSigning process, ensures faster turnaround times, and enhances collaboration among your team. The platform's intuitive design allows users to navigate easily, making it an ideal choice for both individuals and businesses managing tax forms.

-

Is there customer support available for using the Ohio 27 form with airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support resources, including tutorials and live chat options, specifically to assist users with the Ohio 27 form. Our dedicated team is available to answer your questions, ensuring that you can confidently navigate the eSigning process.

Get more for 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii

Find out other 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3Bii

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy