FL DoR DR 225 Form 2023-2026

What is the FL DoR DR 225 Form

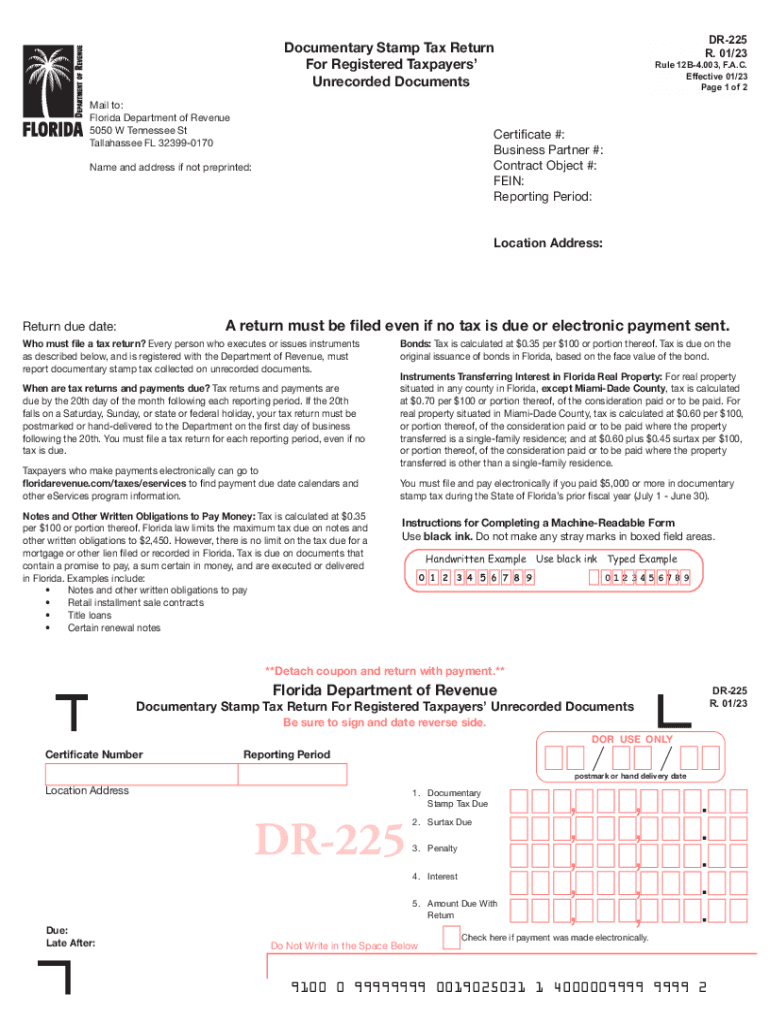

The FL DoR DR 225 form, officially known as the 2010 Florida Documentary Stamp Return, is a crucial document used for reporting and remitting documentary stamp taxes in the state of Florida. This form is typically required when a transaction involves the transfer of real estate or other taxable documents. It serves as a declaration of the amount of documentary stamp tax owed to the Florida Department of Revenue. Understanding this form is essential for compliance with state tax regulations.

How to use the FL DoR DR 225 Form

Using the FL DoR DR 225 form involves several key steps. First, gather all necessary information regarding the transaction, including details about the parties involved and the nature of the document being executed. Next, accurately fill out the form, ensuring that all amounts are correctly calculated based on the applicable tax rates. Once completed, the form must be submitted along with the payment for the calculated tax amount. It is important to retain a copy of the submitted form for your records.

Steps to complete the FL DoR DR 225 Form

Completing the FL DoR DR 225 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the FL DoR DR 225 form from the Florida Department of Revenue website.

- Provide your name, address, and contact information in the designated fields.

- Detail the transaction by specifying the type of document and the date of execution.

- Calculate the documentary stamp tax owed based on the transaction amount and applicable rates.

- Complete the payment section, indicating your chosen payment method.

- Review the form for accuracy and completeness before submission.

Legal use of the FL DoR DR 225 Form

The FL DoR DR 225 form is legally binding when completed and submitted in accordance with Florida state law. It must be filed within the required timeframe to avoid penalties. The form serves as proof of compliance with tax obligations related to documentary stamps. Ensuring that the form is filled out correctly is vital, as inaccuracies can lead to legal issues or financial penalties.

Key elements of the FL DoR DR 225 Form

Several key elements are essential to the FL DoR DR 225 form:

- Identification Information: This includes the names and addresses of the parties involved in the transaction.

- Document Type: Clearly indicate the type of document that requires the documentary stamp tax.

- Transaction Amount: Accurately report the amount involved in the transaction, as this determines the tax owed.

- Payment Details: Specify how the documentary stamp tax will be paid, whether by check, electronic payment, or other methods.

Form Submission Methods

The FL DoR DR 225 form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many users prefer to file electronically through the Florida Department of Revenue’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate address as specified by the Department of Revenue.

- In-Person: Individuals may also choose to submit the form in person at designated Department of Revenue offices.

Quick guide on how to complete fl dor dr 225 form

Configure FL DoR DR 225 Form effortlessly on any gadget

Digital document management has become increasingly favored by corporations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle FL DoR DR 225 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

The easiest method to alter and eSign FL DoR DR 225 Form without hassle

- Find FL DoR DR 225 Form and click on Get Form to initiate the process.

- Make use of the tools available to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign FL DoR DR 225 Form and guarantee effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl dor dr 225 form

Create this form in 5 minutes!

How to create an eSignature for the fl dor dr 225 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for the DR 225 plan on airSlate SignNow?

The DR 225 plan offers competitive pricing that is tailored to meet the needs of businesses of all sizes. Customers can choose from different subscription tiers based on features required, ensuring cost-effectiveness without compromising on functionality. To find the best pricing options available for your needs, visit our pricing page.

-

What features are included in the DR 225 package?

The DR 225 package includes a variety of features designed to enhance document management efficiency. Users can send, track, and eSign documents seamlessly, plus access templates and automated workflows. These functionalities empower organizations to streamline their operations effectively.

-

How can businesses benefit from using DR 225?

Businesses benefit from the DR 225 plan by gaining a user-friendly platform that simplifies the eSigning process. It reduces paperwork, speeds up contract execution, and enhances collaboration among teams. Ultimately, this contributes to improved productivity and better customer satisfaction.

-

Can the DR 225 solution integrate with other applications?

Yes, the DR 225 solution offers integration capabilities with numerous applications including CRM systems, cloud storage, and productivity tools. This ensures that users can incorporate airSlate SignNow into their existing workflows effortlessly. Integrations are designed to enhance overall efficiency and data interoperability.

-

Is there a mobile app available for the DR 225 service?

Absolutely! The DR 225 plan comes with a mobile app that allows users to manage and sign documents while on the go. This convenient feature ensures that you can stay productive from anywhere, making it easier to handle important tasks anytime, anywhere.

-

What security measures are in place for the DR 225 documents?

The DR 225 plan prioritizes the security of your documents with advanced encryption and compliance with industry standards. User authentication and access controls ensure that only authorized individuals can view or edit sensitive information. This commitment to security helps protect your business's data integrity.

-

How user-friendly is the DR 225 platform for new users?

The DR 225 platform is designed with user-friendliness in mind, making it accessible for individuals with varying levels of technical expertise. With an intuitive interface and guided tutorials, users can quickly become proficient in sending and signing documents. Our customer support team is also available to assist with any questions or concerns.

Get more for FL DoR DR 225 Form

- For ward older than 18 years of age form

- Summary process eviction complaint termination of lease by lapse of time form

- A guide to understanding the americans with disabilities act form

- Www courts state hi us form

- Summons miami dade form

- Florida supreme court approved family law form 12 970c waiver of service of process and consent for temporary custody by

- Form 17a case conference briefgeneral ontario

- Journal of trauma ampamp orthopaedics vol 4 iss 1 by british form

Find out other FL DoR DR 225 Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation