FINAL Refund General Instructions 02 23 07 DOC 2022-2026

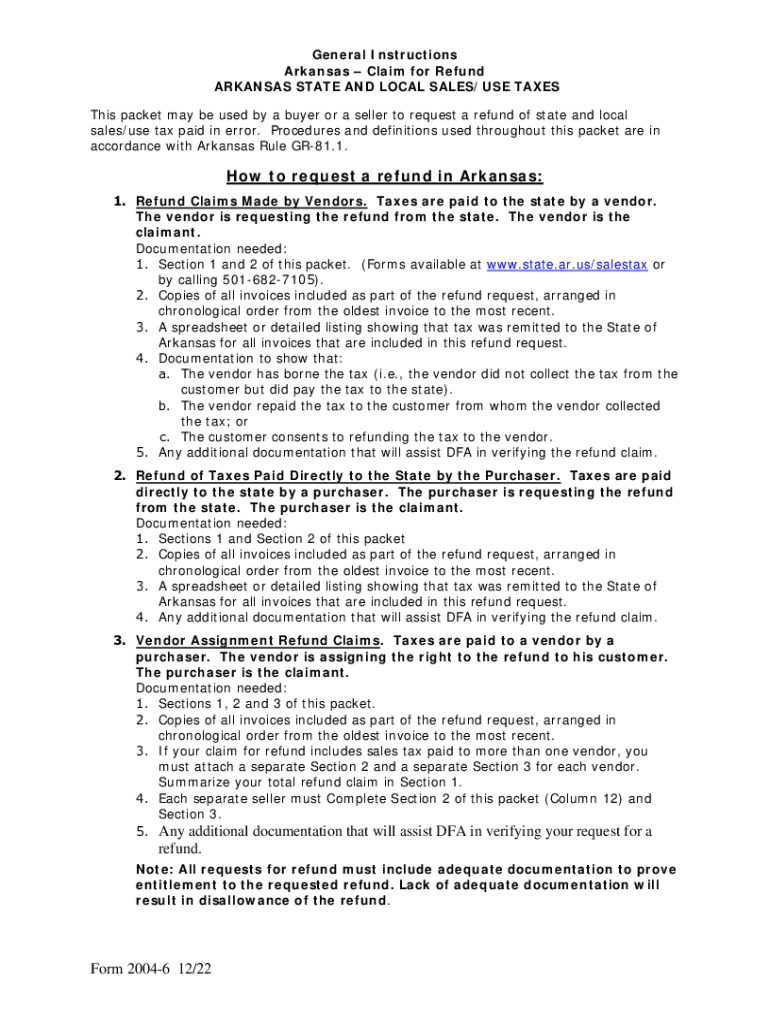

What is the FINAL Refund general Instructions?

The FINAL Refund general Instructions provide essential guidelines for individuals and businesses in Arkansas seeking to navigate the refund process. This document outlines the necessary steps, eligibility criteria, and required documentation for submitting a claim. Understanding these instructions is crucial to ensure compliance and to facilitate a smooth refund experience.

Steps to complete the FINAL Refund general Instructions

Completing the FINAL Refund general Instructions involves a series of straightforward steps:

- Review the eligibility criteria to confirm that you qualify for a refund.

- Gather all required documents, such as proof of payment and identification.

- Fill out the necessary forms accurately, ensuring all information is complete.

- Submit the completed forms either online or via mail, depending on your preference.

- Keep a copy of your submission for your records.

Required Documents

To successfully process your claim, certain documents are required. These typically include:

- Proof of payment, such as receipts or invoices.

- Identification documents, like a driver's license or Social Security number.

- Any additional forms specified in the FINAL Refund general Instructions.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the FINAL Refund. Missing these dates can result in delays or denial of your claim. Typically, the deadlines are outlined in the instructions and may vary based on the type of refund being requested.

Eligibility Criteria

Understanding the eligibility criteria is essential for a successful claim. Generally, applicants must meet specific conditions, such as:

- Being a resident of Arkansas or having conducted business within the state.

- Providing accurate and complete information on the refund request.

- Meeting any additional requirements specified in the FINAL Refund general Instructions.

Who Issues the Form

The FINAL Refund general Instructions are typically issued by the Arkansas Department of Finance and Administration. This agency is responsible for managing tax-related matters and ensuring that all refund claims are processed according to state regulations.

Quick guide on how to complete finalrefundgeneral instructions 02 23 07doc

Finish FINAL Refund general Instructions 02 23 07 doc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to prepare, modify, and electronic sign your documents swiftly with no delays. Handle FINAL Refund general Instructions 02 23 07 doc on any device using airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

The easiest way to edit and eSign FINAL Refund general Instructions 02 23 07 doc with minimal effort

- Obtain FINAL Refund general Instructions 02 23 07 doc and select Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your selected device. Modify and eSign FINAL Refund general Instructions 02 23 07 doc and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct finalrefundgeneral instructions 02 23 07doc

Create this form in 5 minutes!

How to create an eSignature for the finalrefundgeneral instructions 02 23 07doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to file an Arkansas claim refund?

To file an Arkansas claim refund, start by gathering your necessary documents to support your claim. You can then complete the official refund request form online or via mail. Ensure you provide accurate information to expedite the processing of your Arkansas claim refund.

-

How much does it cost to submit an Arkansas claim refund?

Submitting an Arkansas claim refund is free; however, you may incur additional costs if you require assistance or professional services to prepare your claim. Utilizing affordable solutions like airSlate SignNow can simplify document submissions, making it budget-friendly. Save time and effort while ensuring your Illinois claim refund is filed correctly.

-

What documents do I need for an Arkansas claim refund?

For an Arkansas claim refund, you typically need proof of payment, identification, and any relevant tax documents. It’s important to gather all necessary paperwork to ensure a smoother process. Using airSlate SignNow can help you manage and eSign these documents conveniently.

-

How long does it take to receive my Arkansas claim refund?

The processing time for an Arkansas claim refund can vary; generally, it takes about 4 to 6 weeks. Factors affecting this timeframe include the volume of claims and the accuracy of your submitted documents. By using airSlate SignNow, you can ensure your documents are well-organized to potentially speed up the refund process.

-

Can I track the status of my Arkansas claim refund?

Yes, you can track the status of your Arkansas claim refund through the Arkansas Department of Finance and Administration website. They offer online tools that allow you to check your claim’s progress. Keeping all related documents organized with airSlate SignNow can help you easily monitor your status.

-

Are there any penalties for filing an Arkansas claim refund incorrectly?

Filing an Arkansas claim refund incorrectly can lead to delays or denial of your refund request, but typically does not result in penalties. To avoid such issues, ensure that all your documents are accurate and complete. Using airSlate SignNow can help prevent errors by allowing you to review and edit documents easily.

-

What features can airSlate SignNow offer to aid in Arkansas claim refund submissions?

airSlate SignNow offers features such as easy document eSigning, templates for common forms, and secure document storage. These features can streamline the submission of your Arkansas claim refund, making the process hassle-free. Additionally, integration with other tools can enhance your productivity during the filing process.

Get more for FINAL Refund general Instructions 02 23 07 doc

Find out other FINAL Refund general Instructions 02 23 07 doc

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now