1702q Excel Format

What is the 1702q Excel Format

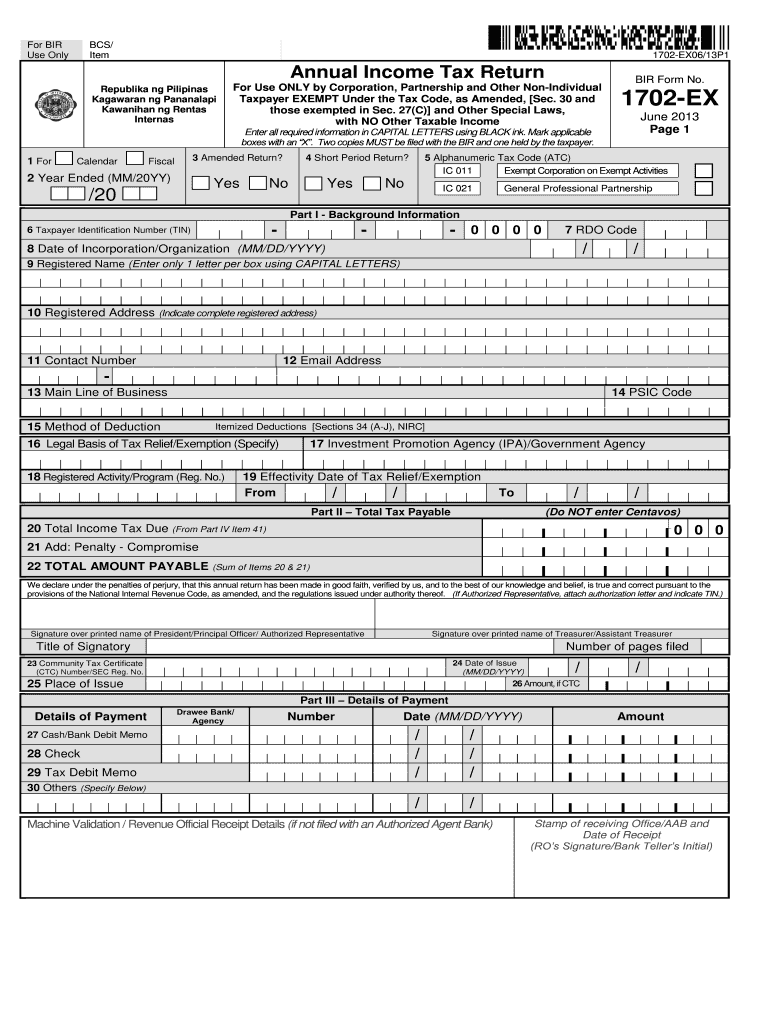

The 1702q Excel format is a specific tax form used in the Philippines for the declaration of income tax for corporations and partnerships. This form is essential for businesses to report their income and calculate their tax liabilities accurately. The Excel format allows for easier data entry and calculations, making it user-friendly for those who need to fill it out. It is particularly beneficial for individuals and organizations that prefer digital documentation, as it streamlines the process of filing taxes.

How to Use the 1702q Excel Format

To effectively use the 1702q Excel format, start by downloading the form from a reliable source. Once downloaded, open the file in Excel. You will find various fields that require input, including income details, deductions, and tax calculations. It is important to fill in all required fields accurately to ensure compliance with tax regulations. After completing the form, save it securely, and follow the submission guidelines for your jurisdiction, which may include online filing or printing and mailing the document.

Steps to Complete the 1702q Excel Format

Completing the 1702q Excel format involves several key steps:

- Download the form: Obtain the latest version of the 1702q Excel format from a trusted source.

- Open the form: Use Microsoft Excel or compatible software to open the downloaded file.

- Input data: Fill in the necessary information, including total income, allowable deductions, and any applicable tax credits.

- Review calculations: Ensure that all calculations are accurate and that the form reflects your financial situation correctly.

- Save your work: Keep a backup of the completed form for your records.

- Submit the form: Follow the guidelines for submission, which may include electronic filing or mailing the completed form to the appropriate tax authority.

Legal Use of the 1702q Excel Format

The 1702q Excel format is legally recognized as a valid method for filing tax returns, provided that it is completed accurately and submitted in accordance with the relevant tax laws. Electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other applicable regulations. It is crucial to ensure that all information is truthful and complete to avoid penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1702q form can vary based on the specific tax year and the type of business entity. Generally, corporations and partnerships must file their income tax returns annually, with specific deadlines set by the Internal Revenue Service (IRS). It is important to stay informed about these dates to ensure timely submission and avoid late fees or penalties. Checking the IRS website or consulting a tax professional can provide the most accurate information regarding deadlines.

Examples of Using the 1702q Excel Format

Examples of using the 1702q Excel format include:

- A corporation reporting its annual income and expenses for tax purposes.

- A partnership calculating its share of profits and losses to report to partners.

- Businesses utilizing the form to claim deductions for eligible expenses, such as operating costs and employee salaries.

These examples illustrate the versatility of the 1702q form in various business contexts, emphasizing its importance for accurate tax reporting.

Quick guide on how to complete 1702q excel format

Complete 1702q Excel Format effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed materials, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle 1702q Excel Format on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign 1702q Excel Format without hassle

- Find 1702q Excel Format and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign 1702q Excel Format and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1702q excel format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BIR Form 1702Q Excel download feature in airSlate SignNow?

The BIR Form 1702Q Excel download feature in airSlate SignNow allows users to easily access and download the form in an Excel format. This simplifies the form-filling process, enabling efficient data entry and quick submission to the BIR.

-

How much does it cost to use the BIR Form 1702Q Excel download feature?

Accessing the BIR Form 1702Q Excel download feature is part of airSlate SignNow's subscription plans, which offer competitive pricing based on your business needs. You can choose a plan that fits your budget and use the feature along with other benefits offered by the platform.

-

Are there any benefits to using airSlate SignNow for BIR Form 1702Q Excel download?

Yes, using airSlate SignNow for BIR Form 1702Q Excel download streamlines the filing process, enhances document security, and allows for electronic signatures. This not only saves time but also reduces the potential for errors while ensuring compliance with BIR requirements.

-

Can I integrate the BIR Form 1702Q Excel download with other software?

Absolutely! airSlate SignNow allows for seamless integrations with various software and applications. This means you can easily incorporate the BIR Form 1702Q Excel download feature into your existing workflow, enhancing overall productivity.

-

Is the BIR Form 1702Q Excel download compatible with mobile devices?

Yes, the BIR Form 1702Q Excel download feature is accessible on mobile devices through the airSlate SignNow application. This enables you to work on the go and manage your documentation needs anytime, anywhere.

-

How secure is my information when using the BIR Form 1702Q Excel download?

airSlate SignNow prioritizes your data security, implementing robust encryption and security measures during the BIR Form 1702Q Excel download process. Your information is protected, ensuring peace of mind as you handle sensitive documents.

-

What support options are available for questions about the BIR Form 1702Q Excel download?

Our support team is readily available to assist with any inquiries regarding the BIR Form 1702Q Excel download. You can contact us via chat, email, or phone for prompt assistance and guidance tailored to your needs.

Get more for 1702q Excel Format

Find out other 1702q Excel Format

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy