Irs Form 13909 PDF 2023-2026

What is the IRS Form 13909 PDF?

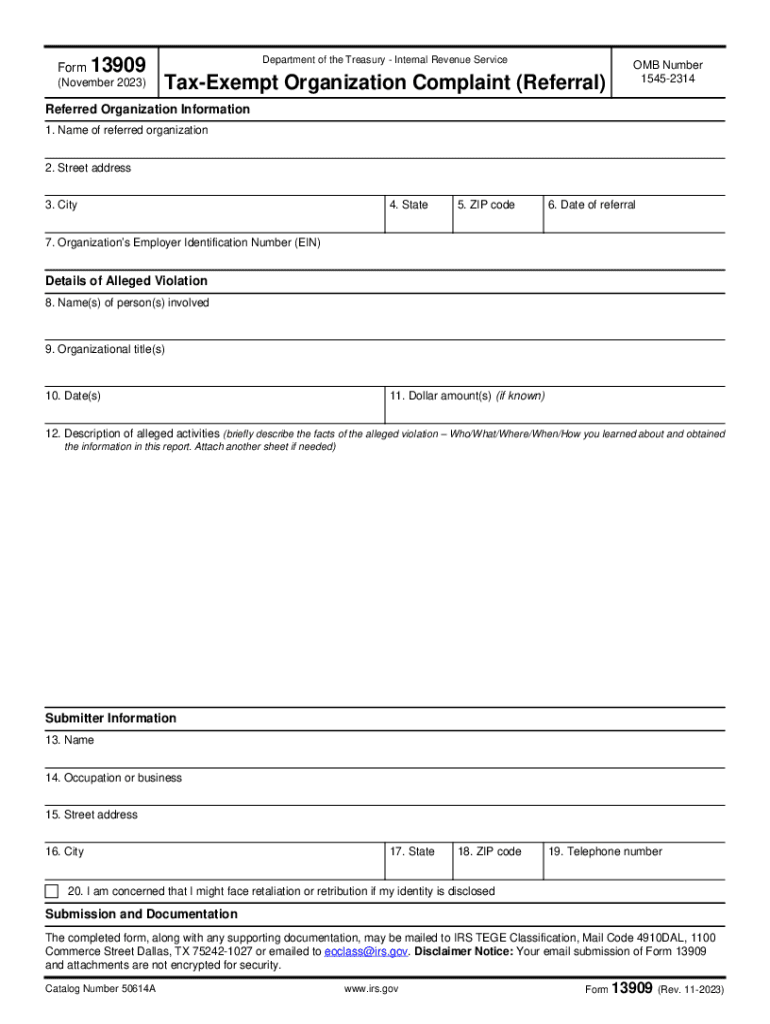

The IRS Form 13909 is a complaint form used to report potential violations by tax-exempt organizations, particularly those classified under section 501(c)(3) of the Internal Revenue Code. This form allows individuals to submit concerns regarding the activities of these organizations, especially if they believe the organization is not adhering to its tax-exempt status requirements. The form is available in a PDF format, making it easy to download, print, and fill out for submission to the IRS.

How to Use the IRS Form 13909 PDF

Using the IRS Form 13909 involves several key steps. First, download the PDF from the IRS website or another trusted source. Once you have the form, carefully read the instructions provided within the document. Fill out the required fields, providing detailed information about the organization in question and the nature of your complaint. After completing the form, you can submit it to the IRS either by mail or through designated submission methods outlined in the instructions.

Steps to Complete the IRS Form 13909 PDF

Completing the IRS Form 13909 requires attention to detail. Follow these steps for accurate submission:

- Download the IRS Form 13909 PDF from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Provide your contact information, including your name, address, and phone number.

- Detail the organization you are reporting, including its name, address, and EIN (Employer Identification Number) if available.

- Clearly describe the nature of your complaint, including specific violations or concerns.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 13909 PDF

The IRS Form 13909 is legally recognized as a formal method for reporting concerns about tax-exempt organizations. It is essential to understand that submitting this form does not guarantee an investigation or action by the IRS. However, it is a vital tool for individuals who believe that a nonprofit organization is operating outside of its legal parameters. It is important to provide truthful and accurate information to avoid any potential legal repercussions.

Required Documents for IRS Form 13909 Submission

When submitting the IRS Form 13909, no additional documents are required to accompany the form itself. However, it may be beneficial to include any supporting documentation that substantiates your claims. This could include copies of correspondence, financial records, or any other evidence relevant to your complaint. Ensure that any additional documents are clearly labeled and referenced in your complaint for clarity.

Form Submission Methods

The IRS Form 13909 can be submitted through various methods. The primary method is by mailing the completed form to the address specified in the form's instructions. Additionally, some individuals may have the option to submit the form electronically, depending on the IRS's current submission protocols. Always check for the latest submission guidelines to ensure compliance with IRS requirements.

Quick guide on how to complete irs form 13909 pdf

Effortlessly Prepare Irs Form 13909 Pdf on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle Irs Form 13909 Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Edit and Electronically Sign Irs Form 13909 Pdf

- Obtain Irs Form 13909 Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method to send your form, whether through email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Irs Form 13909 Pdf while ensuring excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13909 pdf

Create this form in 5 minutes!

How to create an eSignature for the irs form 13909 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax form 13909 form used for?

The tax form 13909 form is used for requesting a refund of overpaid taxes. It helps individuals and businesses facilitate the refund process efficiently by providing necessary details.

-

How can airSlate SignNow assist with the tax form 13909 form?

airSlate SignNow streamlines the completion and signing of the tax form 13909 form. With our solution, users can easily fill out the form electronically and get it signed quickly, reducing turnaround time.

-

Is there a cost associated with using airSlate SignNow for the tax form 13909 form?

Yes, airSlate SignNow offers flexible pricing plans to cater to various needs. You can choose a plan based on your use cases for the tax form 13909 form and enjoy cost-effective document management.

-

Can I track the status of my tax form 13909 form submission?

Absolutely! With airSlate SignNow, you can track the status of your tax form 13909 form submissions in real-time. This feature keeps you informed about the signing process and ensures nothing falls through the cracks.

-

Are there integrations available for managing the tax form 13909 form?

Yes, airSlate SignNow integrates seamlessly with various platforms, enhancing your ability to manage the tax form 13909 form alongside other business processes. This ensures a smooth workflow across applications.

-

What security measures are in place for the tax form 13909 form?

airSlate SignNow prioritizes security, implementing robust measures like encryption and secure access controls for handling the tax form 13909 form. Your sensitive information remains protected throughout the process.

-

Can I use airSlate SignNow on mobile devices for the tax form 13909 form?

Yes! airSlate SignNow is mobile-friendly, allowing users to access and manage the tax form 13909 form on their smartphones or tablets. This flexibility is perfect for working on-the-go.

Get more for Irs Form 13909 Pdf

- Interstate motor fuel user quarterly tax return schedule a detail of revenue louisiana form

- Eye clinic referral form the childrenamp39s hospital at westmead chw edu

- Domestic relations pretrial questionnaire 2d ed kansas judicial kscourts form

- Hollis f price form

- Licensing nebraska department of health ampamp human services form

- Motor vehicle fuel tax claim for refund by federal agency motor vehicle fuel tax claim for refund by federal agency form

- Unpaid internship agreement template form

- Unpaid intern agreement template form

Find out other Irs Form 13909 Pdf

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy