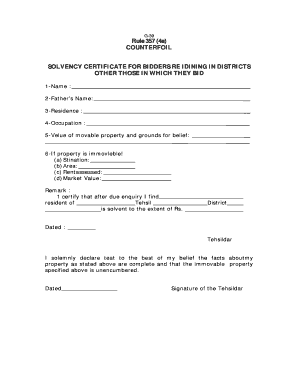

Solvency Certificate Form

What is the solvency certificate?

A solvency certificate is a formal document issued by a financial institution, such as a bank, that verifies an individual's or a company's financial stability and ability to meet its debts. This certificate serves as proof of solvency, indicating that the entity has sufficient assets to cover its liabilities. It is often required for various business transactions, loan applications, and legal purposes.

How to obtain the solvency certificate

To obtain a bank solvency certificate, follow these steps:

- Contact your bank or financial institution to inquire about their specific requirements for issuing a solvency certificate.

- Gather necessary documents, which may include financial statements, tax returns, and identification proof.

- Submit a formal request along with the required documents to the bank.

- Wait for the bank to process your request, which may take a few days to a couple of weeks.

- Once approved, collect the solvency certificate from the bank or receive it via email or postal service.

Key elements of the solvency certificate

A typical bank solvency certificate includes several key elements:

- Issuing Bank Details: Name and address of the bank providing the certificate.

- Client Information: Name, address, and account details of the individual or entity requesting the certificate.

- Statement of Solvency: A clear declaration stating that the client is solvent and able to meet financial obligations.

- Date of Issuance: The date when the certificate is issued.

- Signature and Seal: Authorized signature and bank seal to validate the document.

Steps to complete the solvency certificate

Completing a solvency certificate involves several important steps:

- Ensure you have all required information and documents ready.

- Fill out the solvency certificate format accurately, providing all necessary details.

- Review the completed document for any errors or omissions.

- Submit the completed certificate to the relevant authority or institution as required.

Legal use of the solvency certificate

The solvency certificate is legally recognized and can be used in various contexts, including:

- Loan applications to demonstrate financial stability.

- Business transactions where proof of solvency is required.

- Legal proceedings to establish the financial status of an individual or entity.

Examples of using the solvency certificate

Here are some common scenarios where a solvency certificate may be required:

- Applying for a business loan from a bank.

- Participating in government tenders or contracts that require proof of financial capability.

- Engaging in real estate transactions where financial verification is necessary.

Quick guide on how to complete solvency certificate

Prepare Solvency Certificate seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without complications. Handle Solvency Certificate on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to alter and eSign Solvency Certificate effortlessly

- Obtain Solvency Certificate and click on Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or by using an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Solvency Certificate and ensure outstanding communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the solvency certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank solvency certificate?

A bank solvency certificate is an official document issued by a bank that confirms the financial stability and reliability of an individual or business. It is often required for loans, visa applications, and other financial transactions to prove that the individual or entity can meet its financial obligations.

-

How can airSlate SignNow help in obtaining a bank solvency certificate?

With airSlate SignNow, you can streamline the process of requesting a bank solvency certificate by electronically signing and sending required documents. Our platform simplifies document management, ensuring you can efficiently create and submit applications while keeping track of all necessary paperwork.

-

What are the key features of using airSlate SignNow for a bank solvency certificate?

AirSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage which are essential for the quick processing of a bank solvency certificate. You can customize your documents, track their status, and ensure compliance seamlessly through our user-friendly interface.

-

Is airSlate SignNow cost-effective for businesses needing a bank solvency certificate?

Yes, airSlate SignNow provides a cost-effective solution for businesses seeking a bank solvency certificate. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document signing and management needs without compromising on quality.

-

What are the benefits of using airSlate SignNow for obtaining a bank solvency certificate?

Using airSlate SignNow for your bank solvency certificate needs provides efficiency, speed, and convenience. You can save time by eliminating the need for physical paperwork, reduce errors with digital documents, and ensure a quicker turnaround time for your certificate requests.

-

Can airSlate SignNow integrate with other software for managing bank solvency certificates?

Absolutely! AirSlate SignNow offers integrations with popular software applications, ensuring smooth workflows when managing your bank solvency certificate processes. Whether you use CRM systems, project management tools, or other applications, our integrations enhance productivity and connectivity.

-

What documents do I need to provide to obtain a bank solvency certificate through airSlate SignNow?

To obtain a bank solvency certificate through airSlate SignNow, you typically need to provide identification documents, bank statements, and any specific forms required by your banking institution. Our platform allows you to easily upload and manage all necessary documents online.

Get more for Solvency Certificate

Find out other Solvency Certificate

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement