Form 880

What is the Form 880

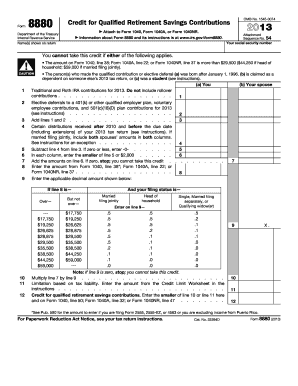

The Form 880, officially known as the IRS Form 880, is a tax document used primarily for claiming the Credit for Qualified Retirement Savings Contributions. This form is essential for individuals who have made contributions to eligible retirement plans and wish to receive a tax credit. Understanding its purpose is crucial for maximizing potential tax benefits while ensuring compliance with IRS regulations.

How to use the Form 880

Using the Form 880 involves several steps to ensure accurate completion. Taxpayers must first determine their eligibility based on income and filing status. Once eligibility is confirmed, the next step is to gather necessary documentation, such as proof of retirement contributions. After that, taxpayers can fill out the form, providing required information about their contributions and personal details. Finally, the completed form should be submitted along with the tax return to the IRS.

Steps to complete the Form 880

Completing the Form 880 requires careful attention to detail. Here are the key steps:

- Review eligibility criteria based on income and retirement contributions.

- Gather documentation, including W-2 forms and records of retirement account contributions.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about the retirement contributions made during the tax year.

- Calculate the credit amount based on IRS guidelines.

- Sign and date the form before submission.

Legal use of the Form 880

The legal use of the Form 880 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Additionally, all information provided must be truthful and supported by documentation. Misuse of the form, such as falsifying contributions or income, can lead to penalties and legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form 880 align with the general tax filing schedule. Typically, the form must be submitted by April 15 of the tax year. However, if taxpayers file for an extension, they may have until October 15 to submit their forms. It is essential to keep track of these dates to avoid late penalties and ensure timely processing of tax credits.

Required Documents

To complete the Form 880 successfully, several documents are required:

- W-2 forms from employers to verify income.

- Records of contributions made to eligible retirement accounts.

- Any additional documentation that supports claims for the credit.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Quick guide on how to complete form 880

Complete Form 880 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option compared to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the features required to create, modify, and eSign your documents quickly without delays. Manage Form 880 on any device with airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

The easiest way to modify and eSign Form 880 without breaking a sweat

- Obtain Form 880 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Select key sections of your documents or conceal sensitive information with tools that airSlate SignNow provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from a device of your selection. Modify and eSign Form 880 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 880

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 880 and how is it used?

Form 880 is a document used by businesses to report specific tax information to the IRS. It is essential for organizations seeking to maintain compliance with tax regulations. Understanding how to accurately complete Form 880 can help streamline your business's reporting process.

-

How can airSlate SignNow assist with completing Form 880?

airSlate SignNow offers an easy-to-use platform to electronically sign and manage Form 880. With features like templates and workflows, you can simplify the completion process and ensure that your document is securely signed by all necessary parties. This reduces the risk of errors and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for Form 880?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different businesses. Depending on the features you require for managing Form 880 and other documents, you can select a plan that fits your budget while maximizing productivity and efficiency.

-

What features does airSlate SignNow provide for Form 880 document management?

With airSlate SignNow, you have access to features like electronic signatures, customizable templates, and real-time tracking for Form 880. These features make it easier to fill out, sign, and manage your Form 880, ensuring a streamlined and organized process for document handling.

-

Can I integrate airSlate SignNow with other tools for handling Form 880?

Absolutely! airSlate SignNow offers a wide range of integrations with popular tools such as Salesforce, Google Drive, and others. This allows you to efficiently manage your Form 880 alongside your other business processes, enhancing collaboration and productivity.

-

How secure is my information when using airSlate SignNow for Form 880?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect your data and Form 880 documents. You can confidently handle sensitive information knowing that your documents are secure and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for managing Form 880?

Using airSlate SignNow for Form 880 provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced collaboration among team members. Additionally, the user-friendly interface helps minimize errors and ensures that your document is completed correctly and on time.

Get more for Form 880

- Medicare request for employment information form

- Speech therapy case history form

- Oklahoma legal last will and testament form for divorced and remarried person with mine yours and ours children

- Speed credit pte ltd form

- Vps sample logic form

- Mo cfc form

- Club bylaws for aktion club pdf kiwanis international form

- Magician contract template form

Find out other Form 880

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile