Income Tax Practitioner Exam Question PDF Form

Eligibility Criteria for Income Tax Practitioner Registration

To register as an income tax practitioner, individuals must meet specific eligibility criteria. Generally, candidates should possess a relevant educational background, such as a degree in accounting, finance, or a related field. Additionally, they may need to demonstrate a certain level of professional experience in tax preparation or related services. It is essential to check state-specific requirements, as some jurisdictions may have additional prerequisites, including certification or licensing.

Required Documents for Registration

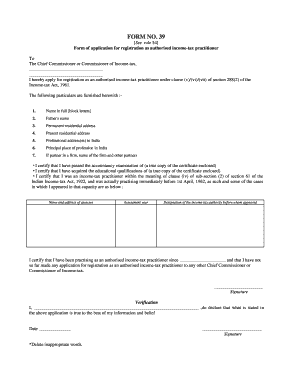

The registration process for income tax practitioners typically involves submitting several key documents. Applicants usually need to provide proof of educational qualifications, such as diplomas or transcripts. A resume detailing relevant work experience may also be required. Furthermore, individuals might need to submit a completed application form, which could be designated as Form No 39 or a similar document, depending on the state. Additional identification, such as a driver's license or Social Security number, may also be necessary.

Application Process & Approval Time

The application process for income tax practitioner registration generally follows a structured path. Candidates must complete the registration form, ensuring all required information is accurate and up to date. After submission, the application will undergo a review process by the relevant authority. Approval times can vary significantly, ranging from a few weeks to several months, depending on the volume of applications and the specific requirements of the state. It is advisable to check for any updates during the review period.

Form Submission Methods

Submitting the income tax practitioner registration form can typically be done through various methods. Many states offer an online submission option, allowing applicants to fill out and submit Form No 39 electronically. Alternatively, individuals may choose to mail the completed form to the appropriate tax authority or deliver it in person. Each method has its advantages, with online submissions often providing faster processing times and immediate confirmation of receipt.

IRS Guidelines for Income Tax Practitioners

Income tax practitioners must adhere to specific IRS guidelines to ensure compliance and maintain their professional standing. These guidelines outline the ethical standards and responsibilities practitioners must uphold while preparing tax returns and advising clients. Practitioners should stay informed about any changes in tax laws and regulations to provide accurate and reliable services. Regular training and continuing education are often recommended to keep skills and knowledge current.

Penalties for Non-Compliance

Failure to comply with registration requirements or IRS guidelines can result in significant penalties for income tax practitioners. These penalties may include fines, suspension of practice privileges, or even criminal charges in severe cases. Practitioners must ensure they maintain accurate records and adhere to all regulations to avoid potential repercussions. Understanding the implications of non-compliance is crucial for anyone considering a career in this field.

Quick guide on how to complete income tax practitioner exam question pdf

Complete Income Tax Practitioner Exam Question Pdf seamlessly on any gadget

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it on the web. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Manage Income Tax Practitioner Exam Question Pdf on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Income Tax Practitioner Exam Question Pdf without effort

- Find Income Tax Practitioner Exam Question Pdf and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any gadget you prefer. Modify and eSign Income Tax Practitioner Exam Question Pdf and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax practitioner exam question pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the income tax practitioner registration procedure?

The income tax practitioner registration procedure refers to the steps an individual must follow to become a registered practitioner with the tax authorities. This process usually involves submitting an application, providing necessary documentation, and meeting specific eligibility criteria set by the government or relevant tax authority.

-

What documents are required for the income tax practitioner registration procedure?

To complete the income tax practitioner registration procedure, you typically need to provide identification documents, proof of qualifications, and any professional memberships. Additional forms may include proof of practice experience and a completed application form specific to the tax authority's requirements.

-

How long does the income tax practitioner registration procedure take?

The income tax practitioner registration procedure duration can vary depending on the jurisdiction and the completeness of your application. Generally, expect the process to take anywhere from a few weeks to several months post-submission, particularly if additional documentation or verification is required.

-

What are the benefits of completing the income tax practitioner registration procedure?

Completing the income tax practitioner registration procedure offers multiple benefits, including legal recognition as a qualified practitioner, eligibility to represent clients before tax authorities, and access to exclusive resources and continuing education opportunities. This registration can signNowly enhance your professional credibility and client trust.

-

Are there any fees associated with the income tax practitioner registration procedure?

Yes, there are typically fees associated with the income tax practitioner registration procedure. These fees can vary depending on the governing body and may include application fees, registration fees, or annual renewal fees. It’s advisable to check with your specific tax authority for detailed fee structures.

-

Can airSlate SignNow assist with the income tax practitioner registration procedure?

While airSlate SignNow does not directly assist with the income tax practitioner registration procedure, it provides an efficient platform for managing documents and eSigning necessary forms. Using airSlate SignNow can streamline your workflow by allowing you to quickly gather signatures on your application and related documentation.

-

Is there a way to track my application during the income tax practitioner registration procedure?

Most tax authorities provide a system to track the status of your application after submission as part of the income tax practitioner registration procedure. You can usually check this status online using a unique reference number or by contacting the appropriate agency directly for updates.

Get more for Income Tax Practitioner Exam Question Pdf

- Patient registration form vecinos denver harbor family clinic

- Lien statementcorporation or llc form

- Name and address of assignee form

- Request for satisfaction form

- Deed of trust formsus legal forms

- State of ohio advance directives health care power of attorney form

- Editable washington state home warranty fill print ampamp download form

- Psychology board form change of principal supervisor

Find out other Income Tax Practitioner Exam Question Pdf

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy