G4 Form

What is the G4 Form

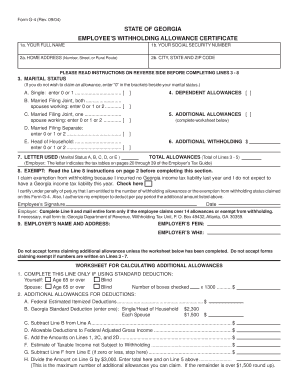

The G4 form, officially known as the Georgia Employee's Withholding Allowance Certificate, is a crucial document for employees in the state of Georgia. This form is used to determine the amount of state income tax to withhold from an employee's paycheck. By accurately completing the G4 form, employees can ensure that the correct amount is withheld based on their personal and financial circumstances, thereby avoiding overpayment or underpayment of taxes.

How to use the G4 Form

Using the G4 form involves a straightforward process. Employees must fill out the form with their personal information, including their name, address, and Social Security number. Additionally, they need to indicate their filing status and the number of allowances they wish to claim. The number of allowances can affect the amount of tax withheld; more allowances typically result in less tax being withheld. Once completed, the form should be submitted to the employer's payroll department.

Steps to complete the G4 Form

Completing the G4 form requires careful attention to detail. Here are the steps to follow:

- Obtain the G4 form from your employer or download it from the Georgia Department of Revenue website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Choose your filing status: single, married, or head of household.

- Decide on the number of allowances you want to claim based on your financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer.

Legal use of the G4 Form

The G4 form is legally recognized in Georgia and serves as an essential document for tax withholding purposes. Employers are required to maintain accurate records of the forms submitted by their employees to ensure compliance with state tax laws. The information provided on the G4 form must be truthful and accurate, as any discrepancies can lead to penalties or legal issues for both the employee and employer.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines related to the G4 form. Employees should submit their G4 form to their employer as soon as they start a new job or experience a change in their financial situation that affects their withholding allowances. Employers are responsible for ensuring that the correct withholding is applied in a timely manner, which can impact employees' tax obligations at the end of the year.

Who Issues the Form

The G4 form is issued by the Georgia Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and employees in Georgia. The form can typically be obtained through the employer or directly from the Georgia Department of Revenue's website.

Quick guide on how to complete g4 form 5601431

Effortlessly Prepare G4 Form on Any Gadget

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and e-sign your documents quickly and without delays. Manage G4 Form on any gadget using the airSlate SignNow applications for Android or iOS and enhance any process reliant on documents today.

The Easiest Method to Modify and eSign G4 Form with Ease

- Find G4 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign G4 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g4 form 5601431

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are g4 forms, and how can they be used?

G4 forms are customizable templates that streamline the process of collecting information and signatures electronically. With airSlate SignNow, businesses can create, send, and eSign g4 forms, making document management efficient and hassle-free.

-

How much does it cost to use g4 forms with airSlate SignNow?

Pricing for g4 forms within airSlate SignNow is competitive and varies based on the plan chosen. You can opt for monthly or annual subscriptions, and all plans include access to essential features for managing g4 forms effectively.

-

What features are included with g4 forms in airSlate SignNow?

When using g4 forms, airSlate SignNow offers features like drag-and-drop form creation, easy integration with existing systems, and secure eSigning capabilities. These features help enhance workflow and improve user experience.

-

Can g4 forms be integrated with other software solutions?

Yes, airSlate SignNow allows seamless integration of g4 forms with various third-party applications such as CRM and project management tools. This ensures that your business can maintain a unified workflow and manage documents alongside existing software.

-

What are the benefits of using g4 forms for my business?

Using g4 forms can signNowly reduce paperwork, save time, and enhance efficiency in document management. Additionally, airSlate SignNow's g4 forms provide a secure and cost-effective solution that fosters collaboration and improves overall productivity.

-

Is it easy to get started with g4 forms in airSlate SignNow?

Absolutely! Getting started with g4 forms in airSlate SignNow is user-friendly and intuitive. Once you sign up, you can access various templates and tools to create, send, and manage your g4 forms with ease.

-

Are g4 forms secure and compliant with regulations?

Yes, airSlate SignNow ensures that all g4 forms are secure and comply with industry standards and regulations, such as GDPR and HIPAA. Your data will be protected through encryption and other security measures, making our platform a reliable choice.

Get more for G4 Form

Find out other G4 Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document