Money Transfer Slip 2019

What is the Money Transfer Slip

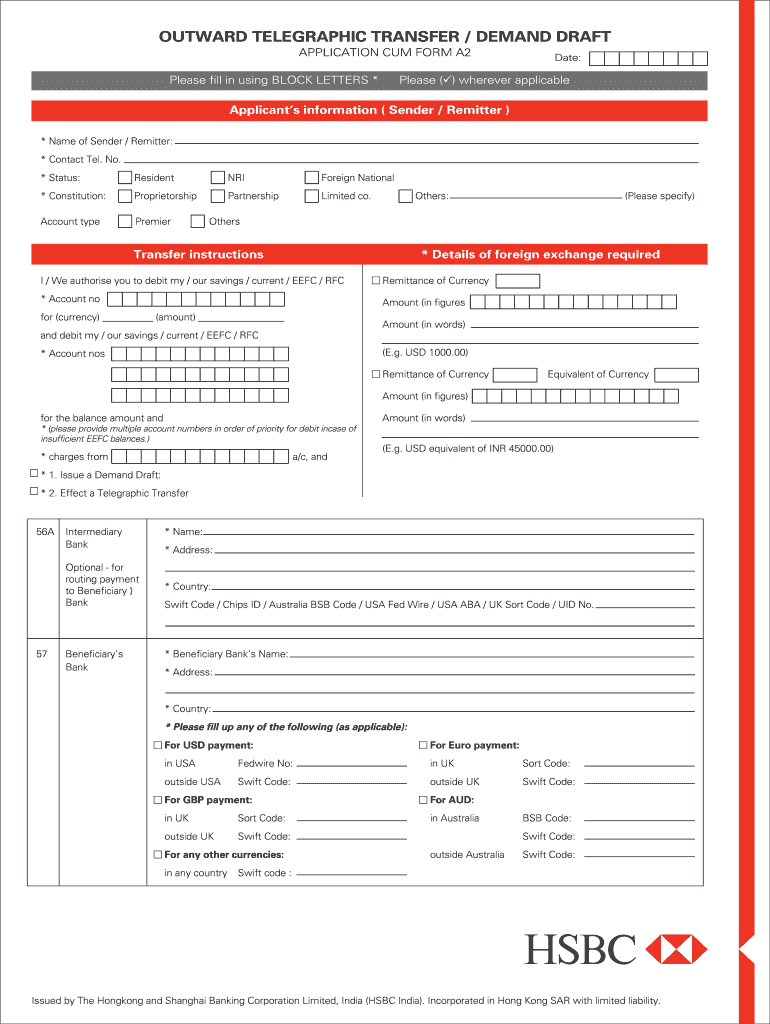

The money transfer slip, commonly known as the HSBC paying in slip, is a document used to facilitate the transfer of funds between accounts. This slip serves as a formal request to process a transaction, allowing individuals and businesses to deposit money into their accounts or transfer funds to another entity. The slip typically includes essential information such as the sender's and recipient's names, account numbers, and the amount being transferred. Understanding this document is crucial for anyone engaging in banking transactions, as it ensures accuracy and compliance with banking regulations.

How to use the Money Transfer Slip

Using the HSBC paying in slip involves several straightforward steps. First, ensure you have the correct slip, which can often be obtained from your local HSBC branch or downloaded online. Next, fill in the required details, including your account information, the amount to be transferred, and any necessary references. Once completed, submit the slip either in person at a bank branch or through an ATM that accepts deposits. Digital options may also be available, allowing you to complete the process online, streamlining your banking experience.

Steps to complete the Money Transfer Slip

Completing the HSBC paying in slip requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the correct money transfer slip from HSBC.

- Fill in your personal information, including your name and account number.

- Provide the recipient's details, ensuring the account number is accurate.

- Enter the amount you wish to transfer, double-checking for errors.

- Add any reference information if required, which can help in tracking the transaction.

- Sign the slip to authorize the transaction.

Legal use of the Money Transfer Slip

The legal use of the HSBC paying in slip is governed by banking regulations and eSignature laws. For the slip to be considered valid, it must be completed accurately and signed by the account holder. Digital versions of the slip must comply with laws such as the ESIGN Act and UETA, which recognize electronic signatures as legally binding. Ensuring compliance with these regulations protects both the sender and recipient during the transaction process.

Key elements of the Money Transfer Slip

Several key elements make up the HSBC paying in slip, which are vital for successful transactions. These include:

- Account Holder Information: Name and account number of the sender.

- Recipient Details: Name and account number of the recipient.

- Transaction Amount: The total funds being transferred.

- Date: The date of the transaction.

- Signature: The authorization from the sender to process the transaction.

Examples of using the Money Transfer Slip

There are various scenarios in which the HSBC paying in slip can be utilized effectively. For instance, individuals may use it to deposit cash into their savings accounts or to transfer funds to family members. Businesses often rely on this slip for payroll deposits or vendor payments. Each example highlights the versatility of the slip in managing financial transactions securely and efficiently.

Quick guide on how to complete money transfer slip

Effortlessly Prepare Money Transfer Slip on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct template and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Handle Money Transfer Slip across any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The easiest method to modify and electronically sign Money Transfer Slip with ease

- Locate Money Transfer Slip and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with the specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Money Transfer Slip and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the money transfer slip

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSBC paying in slip?

An HSBC paying in slip is a document used by account holders to deposit funds into their HSBC bank accounts. This slip facilitates various deposits, including cash and cheques, ensuring a seamless banking experience. Utilizing an HSBC paying in slip helps maintain proper records of transactions.

-

How can airSlate SignNow streamline the process of handling HSBC paying in slips?

airSlate SignNow offers a digital platform to easily create, sign, and manage HSBC paying in slips electronically. By utilizing electronic signatures, businesses can eliminate the need for physical paperwork, speeding up the deposition process. This efficiency can signNowly improve cash flow management.

-

Are there any fees associated with using airSlate SignNow for HSBC paying in slips?

airSlate SignNow provides flexible pricing plans that can accommodate various business needs, ensuring you get the best value for managing HSBC paying in slips. While fees may apply depending on the chosen plan, the cost-effectiveness of airSlate SignNow generally offsets these expenses. Businesses save both time and resources, making it a smart investment.

-

What features does airSlate SignNow offer for managing HSBC paying in slips?

airSlate SignNow includes features such as customizable templates, automated workflows, and tracking tools, making it easier to manage HSBC paying in slips. These features enhance productivity by simplifying the documentation process. Additionally, users can easily integrate these features with existing software for a smoother experience.

-

Can I integrate airSlate SignNow with my existing banking software for HSBC paying in slips?

Yes, airSlate SignNow offers seamless integrations with various banking software platforms, allowing you to efficiently manage HSBC paying in slips. This compatibility ensures a streamlined workflow between your banking solutions and electronic signature processes. Easily connect your tools for enhanced productivity.

-

What are the benefits of using airSlate SignNow for HSBC paying in slips over paper methods?

Using airSlate SignNow for HSBC paying in slips signNowly reduces paperwork and enhances the overall efficiency of banking transactions. The electronic process provides fast access to documents and reduces errors associated with manual entries. Additionally, it offers a secure way to store and retrieve your transaction records.

-

How does airSlate SignNow ensure the security of my HSBC paying in slips?

airSlate SignNow employs industry-leading security measures to ensure the safety of your HSBC paying in slips, including encryption and secure access controls. This commitment to security means that your sensitive banking information remains protected. Businesses can confidently handle electronic transactions without worrying about unauthorized access.

Get more for Money Transfer Slip

Find out other Money Transfer Slip

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple