Bruttoerkl Rung 2001-2026

What is the Bruttoerklärung?

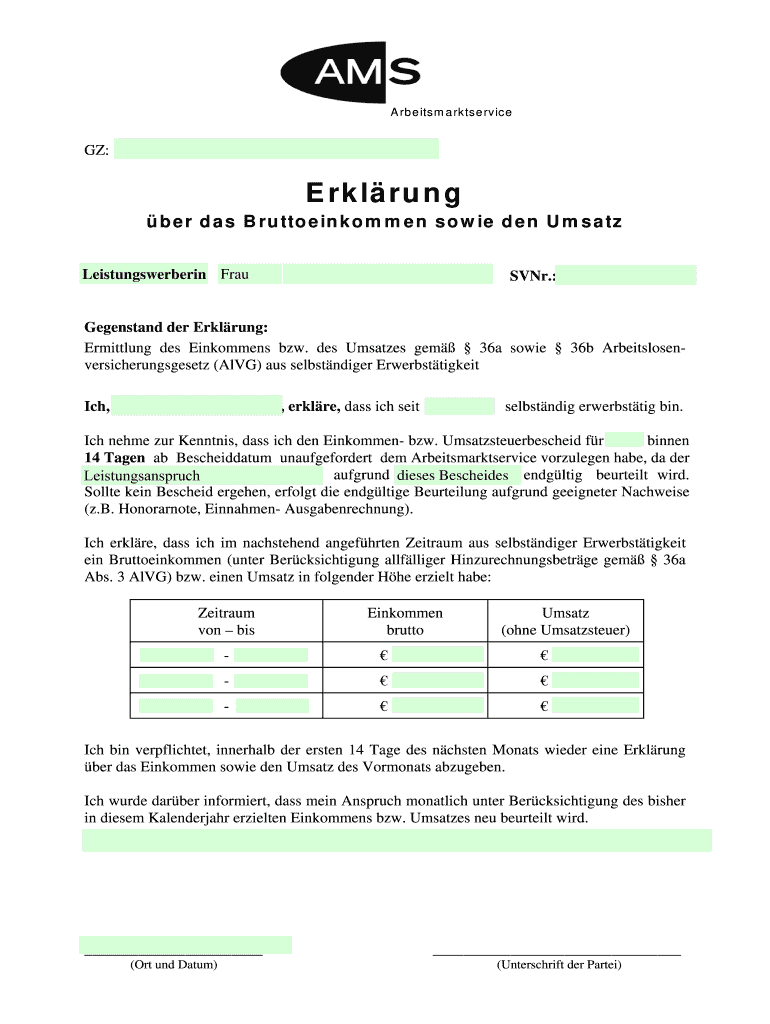

The Bruttoerklärung, or "ams erklärung über das bruttoeinkommen," is a formal declaration of gross income required in various financial contexts. This document is essential for individuals and businesses to report their total earnings before any deductions, such as taxes or other expenses. It serves as a foundational element in financial assessments, tax filings, and eligibility determinations for various programs or benefits.

Steps to Complete the Bruttoerklärung

Completing the Bruttoerklärung involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements, pay stubs, and any other records that reflect your gross earnings. Next, fill out the form with precise information, ensuring that all figures are accurate and reflect your total income. After completing the form, review it for any errors or omissions. Finally, submit the Bruttoerklärung through the appropriate channels, whether online, by mail, or in person, depending on the requirements set forth by the issuing authority.

Legal Use of the Bruttoerklärung

The Bruttoerklärung holds legal significance in various contexts, particularly in tax compliance and financial reporting. It must be filled out truthfully and accurately, as providing false information can lead to penalties or legal repercussions. Understanding the legal framework surrounding this document is crucial, as it ensures that individuals and businesses remain compliant with state and federal regulations. Additionally, the Bruttoerklärung may be used in legal proceedings to verify income claims or assess financial responsibilities.

Required Documents

To complete the Bruttoerklärung, specific documents are necessary to substantiate your income claims. These typically include:

- Recent pay stubs or salary statements

- Tax returns from previous years

- Documentation of any additional income sources, such as freelance work or investments

- Records of any deductions or expenses that may affect your gross income

Having these documents on hand will facilitate a smoother completion process and ensure that your declaration is accurate.

Form Submission Methods

The Bruttoerklärung can be submitted using various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission through designated government portals

- Mailing the completed form to the appropriate office

- In-person submission at local offices or designated locations

Each method may have specific guidelines and deadlines, so it is essential to review the instructions carefully to ensure timely and proper submission.

Penalties for Non-Compliance

Failure to submit the Bruttoerklärung accurately and on time can result in significant penalties. These may include fines, interest on unpaid taxes, or legal actions. It is crucial to understand the implications of non-compliance, as it can adversely affect your financial standing and eligibility for certain benefits or programs. Staying informed about submission deadlines and maintaining accurate records can help mitigate these risks.

Quick guide on how to complete bruttoerklrung

Prepare Bruttoerkl rung seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed materials, allowing you to find the right document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Handle Bruttoerkl rung on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Bruttoerkl rung effortlessly

- Find Bruttoerkl rung and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your document, through email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Bruttoerkl rung and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bruttoerklrung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the ams erklärung über das bruttoeinkommen?

The ams erklärung über das bruttoeinkommen is crucial for workers in Austria as it outlines their gross income for compliance with tax regulations. Understanding this document ensures individuals are informed about their earnings, helping with budgeting and financial planning. Using airSlate SignNow can streamline the process of sending and signing these important declarations.

-

How can airSlate SignNow help with the ams erklärung über das bruttoeinkommen?

airSlate SignNow provides an efficient platform to create, send, and eSign the ams erklärung über das bruttoeinkommen. Our intuitive solution allows users to customize templates, track the signing process, and ensure timely submissions. This enhances accuracy and compliance, saving time and reducing stress.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing tiers designed to cater to businesses of all sizes. From individual plans to comprehensive team solutions, you can choose based on your needs for managing documents like the ams erklärung über das bruttoeinkommen. Each plan provides access to essential features at competitive rates.

-

Are there any integration options available with airSlate SignNow?

Yes, airSlate SignNow integrates with a wide variety of applications, making it easy to incorporate into your existing workflows. Whether integrating with CRM systems, storage solutions, or accounting software, you can efficiently manage documents including the ams erklärung über das bruttoeinkommen. This flexibility enhances productivity and collaboration across teams.

-

What features does airSlate SignNow offer?

airSlate SignNow boasts numerous features, including customizable document templates, real-time tracking, and secure eSigning options. These capabilities support the efficient handling of important documents such as the ams erklärung über das bruttoeinkommen. Moreover, our user-friendly interface ensures that anyone can navigate and use the platform with ease.

-

What benefits can users expect from using airSlate SignNow?

By using airSlate SignNow, users can expect improved efficiency in document handling, reduced paper usage, and enhanced security. The platform enables quick processing of documents like the ams erklärung über das bruttoeinkommen without the hassle of physical signatures. This leads to faster transactions and happier clients.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is particularly beneficial for small businesses looking to streamline their document management processes. The flexibility in pricing and features allows small enterprises to manage legal documents like the ams erklärung über das bruttoeinkommen effectively without overwhelming costs. Our platform scales with your business.

Get more for Bruttoerkl rung

- Iq academy certificate image form

- Png medical board registration form

- Bir 0619 e form download

- Mauritius police force recruitment form

- Bmw r1150rt manual form

- Sample reason for delayed registration of marriage 51693757 form

- Agent release authorization form goindustry dovebid

- J1 general inspection of property addresspurch form

Find out other Bruttoerkl rung

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free