Sbi Personal Loan Form Fill Up

Key elements of the SBI personal loan form fill up

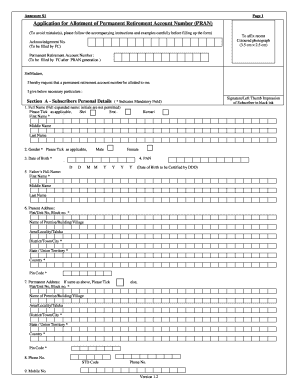

The SBI personal loan form is designed to gather essential information from applicants. Understanding its key elements ensures a smooth application process. Key components typically include:

- Personal Information: This section requires your full name, date of birth, and contact details.

- Employment Details: Applicants must provide information about their current employer, job title, and duration of employment.

- Financial Information: This includes income details, existing loans, and monthly expenses, which help the bank assess your repayment capacity.

- Loan Amount Requested: Specify the amount you wish to borrow, aligning it with your financial needs.

- Purpose of the Loan: Clearly state the reason for the loan, as this can influence approval.

Steps to complete the SBI personal loan form fill up

Filling out the SBI personal loan form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather Required Documents: Collect necessary documents such as proof of identity, income statements, and employment verification.

- Fill in Personal Information: Enter your details accurately, ensuring that all names and dates are correct.

- Provide Employment Details: Include your job title, employer’s name, and duration of employment.

- Detail Financial Information: List your income, existing loans, and monthly expenses to give a clear picture of your financial situation.

- Specify Loan Amount and Purpose: Clearly indicate how much you wish to borrow and the intended use of the funds.

- Review the Form: Double-check all entries for accuracy before submission.

Legal use of the SBI personal loan form fill up

Completing the SBI personal loan form correctly is crucial for legal compliance. The form serves as a binding document between the applicant and the bank. Ensure that:

- The information provided is truthful and accurate to avoid potential legal issues.

- You understand the terms and conditions associated with the loan, as these will be outlined in the form.

- All required signatures are included, as this validates the application.

Who issues the SBI personal loan form fill up

The SBI personal loan form is issued by the State Bank of India, one of the largest banks in the country. It is important to obtain the form directly from the bank's official channels to ensure you have the most current version. This can typically be done through:

- Visiting a local SBI branch.

- Accessing the bank’s official website for downloadable forms.

- Requesting the form through customer service channels.

Required documents for the SBI personal loan form fill up

To successfully complete the SBI personal loan form, specific documents are required. These documents help verify your identity, employment, and financial status. Commonly required documents include:

- Proof of Identity: A government-issued ID such as a driver’s license or passport.

- Proof of Address: Utility bills or lease agreements that confirm your current residence.

- Income Proof: Recent pay stubs, tax returns, or bank statements that demonstrate your income.

- Employment Verification: A letter from your employer or an employment contract.

Application process & approval time for the SBI personal loan form fill up

Understanding the application process and expected approval time can help manage your expectations. The process generally involves the following stages:

- Submission: Submit the completed loan application form along with all required documents to the bank.

- Verification: The bank will review your application and documents for accuracy and completeness.

- Approval: If everything is in order, the bank will approve your loan application, typically within a few days to a couple of weeks.

- Disbursement: Once approved, the loan amount will be disbursed to your account, allowing you to access the funds.

Quick guide on how to complete sbi personal loan form fill up

Complete Sbi Personal Loan Form Fill Up effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents rapidly without obstacles. Handle Sbi Personal Loan Form Fill Up on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Sbi Personal Loan Form Fill Up without stress

- Locate Sbi Personal Loan Form Fill Up and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Sbi Personal Loan Form Fill Up and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi personal loan form fill up

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan application form and why is it important?

A loan application form is a document used by lenders to collect information from borrowers when they apply for a loan. It is important because it provides the necessary data to evaluate the creditworthiness of an applicant and helps streamline the approval process.

-

How can airSlate SignNow help me with loan application forms?

airSlate SignNow helps you create, send, and eSign loan application forms efficiently. With its user-friendly interface, you can easily customize forms and collect responses faster, ensuring a smoother application process for both lenders and borrowers.

-

Is there a cost associated with using loan application forms on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can start with a free trial to explore features related to loan application forms, and choose a plan that best suits your requirements.

-

Can I integrate loan application forms with other applications?

Absolutely! airSlate SignNow allows you to integrate loan application forms with various applications such as CRMs and accounting software. This means you can automate workflows and improve efficiency across your business operations.

-

What features does airSlate SignNow provide for loan application forms?

airSlate SignNow offers features such as customizable templates, electronic signatures, and real-time tracking for loan application forms. These features help ensure compliance, enhance security, and improve the overall user experience.

-

How does using electronic signatures for loan application forms benefit me?

Using electronic signatures for loan application forms provides a legal and secure way to sign documents digitally. This not only speeds up the approval process but also reduces paper usage, making it a more environmentally friendly option.

-

Can I track the status of my loan application form once it's sent?

Yes, with airSlate SignNow, you can easily track the status of your loan application form in real time. You'll receive notifications when the form is viewed and once it's signed, allowing for better management and follow-up.

Get more for Sbi Personal Loan Form Fill Up

Find out other Sbi Personal Loan Form Fill Up

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document