Kcb Joint Account Requirements Form

What are the kcb joint account requirements?

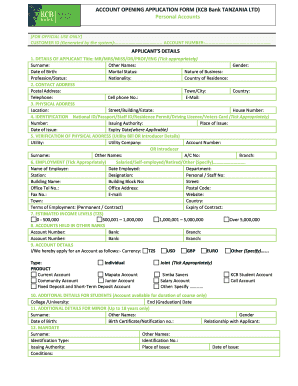

The kcb joint account requirements outline the necessary criteria for individuals looking to open a joint account with KCB Bank. To establish a joint account, both parties must provide valid identification, such as a government-issued ID or passport. Additionally, proof of residence, like a utility bill or lease agreement, is typically required. Both account holders must also be present during the application process to sign the necessary documentation. Understanding these requirements ensures a smoother account opening experience.

Steps to complete the kcb joint account requirements

To successfully complete the kcb joint account requirements, follow these steps:

- Gather necessary documents, including identification and proof of residence for both parties.

- Visit a KCB Bank branch together or access their online banking portal if available.

- Fill out the kcb joint account opening form, ensuring all information is accurate.

- Review the terms and conditions of the joint account with a bank representative.

- Both parties must sign the form and any additional paperwork required.

- Submit the completed form and documents to the bank for processing.

Required documents for the kcb joint account

When applying for a kcb joint account, specific documents are essential to meet the bank's requirements. Both applicants must provide:

- Valid government-issued identification, such as a driver's license or passport.

- Proof of residence, which can include a recent utility bill, bank statement, or lease agreement.

- Social Security numbers or Tax Identification Numbers (TIN) for both account holders.

Legal use of the kcb joint account requirements

Understanding the legal implications of kcb joint account requirements is crucial for both parties involved. A joint account allows both individuals to deposit, withdraw, and manage funds collectively. Legal ownership of the account is shared, meaning both parties have equal rights to the funds. It's important to be aware of any state-specific regulations that may affect joint account management, including liability for overdrafts and account fees.

Eligibility criteria for the kcb joint account

To qualify for a kcb joint account, applicants must meet certain eligibility criteria. Both parties should be at least eighteen years old and legally capable of entering into a contract. Additionally, both account holders must provide the required documentation and be residents of the United States. KCB Bank may also conduct a credit check to assess the financial history of both applicants, ensuring responsible account management.

Application process & approval time for the kcb joint account

The application process for a kcb joint account typically involves several steps. After gathering the necessary documents and completing the application form, both parties must submit their information to the bank. Approval times may vary, but applicants can generally expect a decision within a few business days. Factors such as the completeness of the application and any required background checks can influence the timeline.

Quick guide on how to complete kcb joint account requirements

Effortlessly Prepare Kcb Joint Account Requirements on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Kcb Joint Account Requirements on any platform using the airSlate SignNow apps available for Android or iOS and enhance any document-focused workflow today.

How to Revise and Electronically Sign Kcb Joint Account Requirements with Ease

- Find Kcb Joint Account Requirements and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to preserve your modifications.

- Select how you’d like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Kcb Joint Account Requirements to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kcb joint account requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a KCB joint account?

A KCB joint account is a bank account shared by two or more individuals, allowing them to manage funds collaboratively. This type of account simplifies financial transactions between partners, friends, or family members, and it is particularly beneficial for shared expenses.

-

How can I open a KCB joint account?

To open a KCB joint account, both parties must visit a KCB branch together and provide required identification documents. You will need to complete an application form with personal details and sign the agreement to open the account. It's a straightforward process designed to facilitate easy collaboration.

-

What are the fees associated with a KCB joint account?

Typically, KCB joint accounts have minimal maintenance fees, which may vary based on the type of account and balance requirements. It's advisable to consult the KCB fee schedule or speak with a bank representative to understand any applicable charges, ensuring that the account remains cost-effective.

-

What features does a KCB joint account offer?

A KCB joint account includes features such as shared access for both account holders, online banking capabilities, and easy funds management. Additionally, account holders can set up automatic payments and transfers, enhancing convenience for managing shared expenses.

-

What benefits does a KCB joint account provide?

The primary benefit of a KCB joint account is the ease of managing shared finances, making it suitable for couples, families, or business partners. It fosters transparency and collaborative financial management, reducing confusion over shared expenses and improving trust among account holders.

-

Can I link my KCB joint account to other financial services?

Yes, you can link your KCB joint account to various financial services, such as mobile payment applications and budgeting tools. This integration facilitates streamlined financial management and monitoring, allowing account holders to keep track of their spending effectively.

-

Is it necessary for both account holders to be present for transactions?

For most transactions, especially withdrawals and account changes, both account holders are typically required to authorize the action. However, there may be specific scenarios where one account holder can perform certain transactions independently, depending on the terms agreed upon when opening the KCB joint account.

Get more for Kcb Joint Account Requirements

Find out other Kcb Joint Account Requirements

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement