Deed of Donation Sample Form

What is the deed of donation sample?

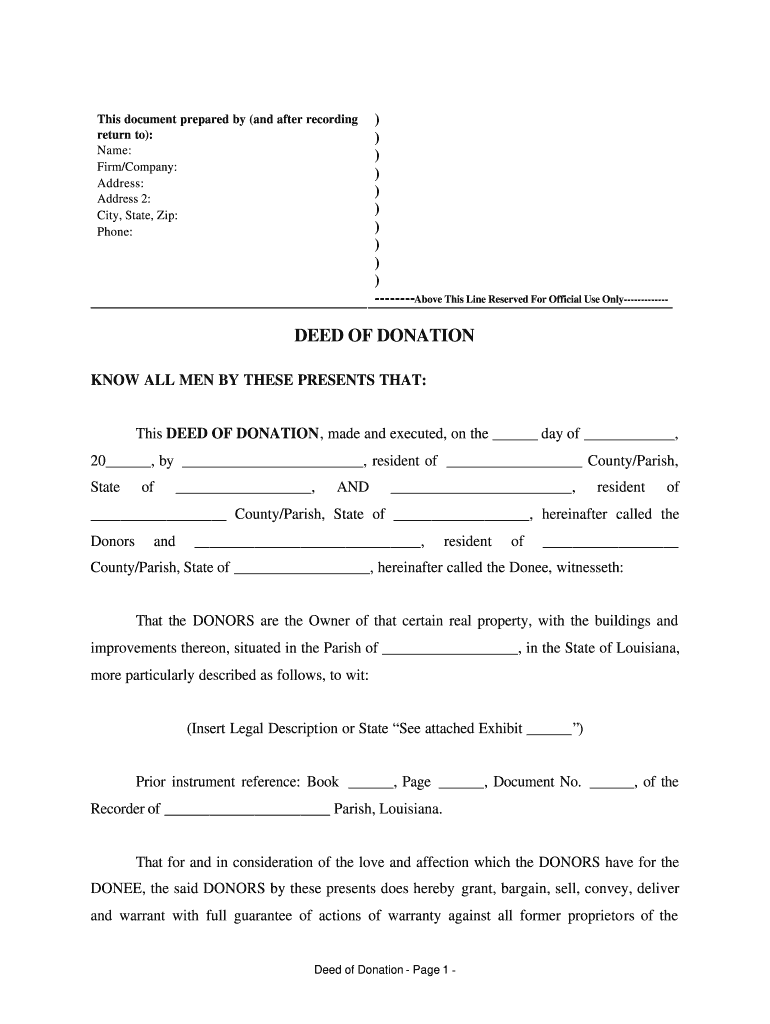

The deed of donation sample is a legal document that outlines the terms under which a donor voluntarily transfers ownership of property or assets to a recipient without expecting anything in return. This document serves as proof of the donation and can include various types of property, such as real estate, personal belongings, or financial assets. It is essential for ensuring that both parties understand the terms of the donation and that the transfer complies with applicable laws.

Key elements of the deed of donation sample

A well-structured deed of donation sample typically includes several key elements to ensure its validity and clarity:

- Donor and recipient information: Full names, addresses, and contact details of both parties.

- Description of the donated property: A clear and detailed description of the assets being donated, including any relevant identifiers.

- Statement of intent: A declaration that the donor intends to make the donation voluntarily and without compensation.

- Signatures: Signatures of both the donor and recipient, along with the date of signing.

- Witnesses or notarization: Depending on state laws, the presence of witnesses or a notary public may be required for the document to be legally binding.

Steps to complete the deed of donation sample

Completing a deed of donation sample involves several straightforward steps:

- Gather information: Collect the necessary details about the donor, recipient, and the property being donated.

- Draft the document: Use a template or create a deed of donation that includes all required elements.

- Review the document: Ensure that all information is accurate and that the terms are clear.

- Sign the document: Both parties should sign the deed in the presence of a witness or notary, if required.

- Distribute copies: Provide copies of the signed deed to both the donor and recipient for their records.

Legal use of the deed of donation sample

The deed of donation sample is legally recognized in the United States, provided it adheres to state-specific regulations. It is important to understand that the validity of the deed may depend on the proper execution of the document, including the necessary signatures and any required witnessing or notarization. This legal framework helps protect both the donor and recipient, ensuring that the transfer of ownership is acknowledged and enforceable.

State-specific rules for the deed of donation sample

Each state in the U.S. may have unique requirements regarding the deed of donation sample. These rules can include specific language that must be included, the necessity for notarization, and any filing requirements with local authorities. It is advisable to consult state laws or seek legal advice to ensure compliance with local regulations when preparing a deed of donation.

Examples of using the deed of donation sample

The deed of donation sample can be used in various scenarios, such as:

- Transferring ownership of a family property to a relative.

- Donating personal belongings to a charitable organization.

- Giving financial assets to a friend or family member as a gift.

In each case, the deed serves as a formal record of the transaction, providing clarity and legal protection for both parties involved.

Quick guide on how to complete deed of donation sample

Complete Deed Of Donation Sample effortlessly on any gadget

Online document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without any holdups. Handle Deed Of Donation Sample on any system with airSlate SignNow Android or iOS apps and enhance any document-centered workflow today.

How to alter and eSign Deed Of Donation Sample with ease

- Obtain Deed Of Donation Sample and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Edit and eSign Deed Of Donation Sample and guarantee outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deed of donation sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a deed of donation form?

A deed of donation form is a legal document used to transfer ownership of property or assets from one party to another as a gift. It outlines the details of the donation, including the donor's and recipient's information, and must be executed properly to be legally binding.

-

How can airSlate SignNow help with my deed of donation form?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign your deed of donation form efficiently. With customizable templates and an intuitive interface, you can streamline the donation process and ensure that your document is legally compliant.

-

Are there any costs associated with using airSlate SignNow for my deed of donation form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different needs. Depending on the features you require for managing your deed of donation form, you can choose a plan that best fits your budget while benefiting from our cost-effective solution.

-

Can I customize my deed of donation form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your deed of donation form by adding specific fields, logos, and text to meet your unique requirements. This flexibility ensures that your document reflects your brand and fulfills legal standards.

-

Is the deed of donation form secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Your deed of donation form and other documents are protected with advanced encryption and compliance with industry standards, ensuring that your information remains confidential and secure.

-

Does airSlate SignNow integrate with other software for managing my deed of donation form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your deed of donation form alongside your existing tools. This integration enhances workflow efficiency and ensures that your donation process is smooth and organized.

-

What are the benefits of using airSlate SignNow for my deed of donation form?

Using airSlate SignNow for your deed of donation form offers numerous benefits, including fast and easy eSigning, reduced paperwork, and improved collaboration. Additionally, our platform enhances accessibility, allowing you to manage forms from anywhere, at any time.

Get more for Deed Of Donation Sample

Find out other Deed Of Donation Sample

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter