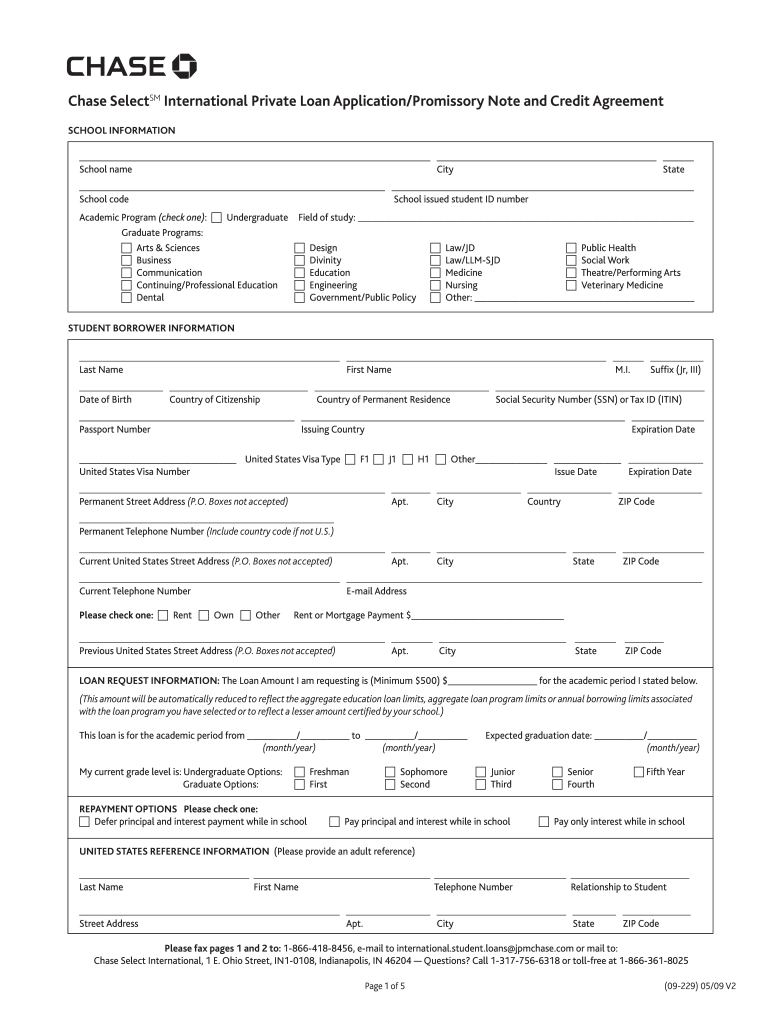

Chase Bank Loan Application Form

What is the Chase Bank Loan Application Form

The Chase Bank Loan Application Form is a document used by individuals seeking to apply for an auto loan through Chase Bank. This form collects essential information from applicants, including personal details, financial history, and vehicle information. Completing this application is a critical step in the loan approval process, as it allows the bank to assess the applicant's creditworthiness and determine the terms of the loan.

Steps to complete the Chase Bank Loan Application Form

Completing the Chase auto loan application involves several key steps to ensure accuracy and efficiency:

- Gather necessary documents, such as proof of income, identification, and information about the vehicle.

- Access the Chase auto loan application form online or obtain a printable version.

- Fill out the form with accurate personal and financial information, ensuring all fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application electronically or via mail, depending on the chosen method.

Legal use of the Chase Bank Loan Application Form

The Chase auto loan application form is legally binding when completed and submitted according to the regulations set forth by the bank and relevant legal frameworks. Ensuring that the form is filled out correctly and signed is crucial for the application to be considered valid. Electronic signatures, when used, must comply with the ESIGN Act and UETA, which govern the legality of digital signatures in the United States.

Required Documents

When applying for a Chase auto loan, certain documents are required to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Proof of income, which may include recent pay stubs or tax returns.

- Details of the vehicle you intend to purchase, including the make, model, and VIN.

- Credit history information, which may be accessed by Chase during the application process.

Form Submission Methods (Online / Mail / In-Person)

The Chase auto loan application can be submitted through various methods to accommodate applicants' preferences:

- Online: Complete and submit the application directly through the Chase website.

- Mail: Print the completed application and send it to the designated address provided by Chase.

- In-Person: Visit a local Chase branch to submit the application with assistance from a bank representative.

Eligibility Criteria

To qualify for a Chase auto loan, applicants must meet specific eligibility criteria. These may include:

- Minimum credit score requirements, which can vary based on the loan type.

- Proof of stable income and employment history.

- Age requirements, typically at least eighteen years old.

- Residency in the United States.

Quick guide on how to complete chase bank loan application form

Easily Prepare Chase Bank Loan Application Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Chase Bank Loan Application Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Chase Bank Loan Application Form Effortlessly

- Find Chase Bank Loan Application Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Chase Bank Loan Application Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase bank loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the chase auto loan application process?

The chase auto loan application process is designed to be simple and efficient. You can apply online, fill out your personal details, and submit necessary documents in just a few minutes. This streamlined process helps you get a quick response on your loan application status.

-

What are the requirements for a chase auto loan application?

To complete a chase auto loan application, you typically need to provide personal identification, proof of income, and details about the vehicle you wish to purchase. Ensuring you have all necessary information ready can help expedite the application process.

-

Are there any fees associated with the chase auto loan application?

Typically, there are no fees to apply for a chase auto loan application. However, it's important to review the terms carefully, as certain fees might apply if you proceed with financing or if you choose additional coverages for your auto loan.

-

How long does it take to get approval for a chase auto loan application?

Approval for a chase auto loan application can often be completed within a few hours to a couple of days. The quick turnaround provides you with the timeframe needed to make timely decisions about your vehicle purchase.

-

What are the advantages of using a chase auto loan application?

One major advantage of the chase auto loan application is its user-friendly online platform that saves time and simplifies the borrowing process. Additionally, competitive interest rates and flexible terms mean you can find a loan option that best fits your budget.

-

Can I track my chase auto loan application status?

Yes, you can easily track your chase auto loan application status through the online portal. This feature allows you to stay informed about every step of your application, providing peace of mind as you wait for approval.

-

Does the chase auto loan application offer refinancing options?

Absolutely, the chase auto loan application includes refinancing options. This can be beneficial if you find better rates or if your financial situation changes, allowing you to adjust your payments to fit your needs.

Get more for Chase Bank Loan Application Form

- Ssa 501 reasonable accommodation form

- Printable level of care passr form

- Mcgraw hill science grade 7 answer key pdf form

- Affidavit for marriage witness sample form

- Answer key pdf form

- Service request form maybank 14815179

- Instructions for form 720 rev december instructions for form 720 quarterly federal excise tax return

- Hs 01691 docx tennessee department of human services form

Find out other Chase Bank Loan Application Form

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document