Go Online to File This Information

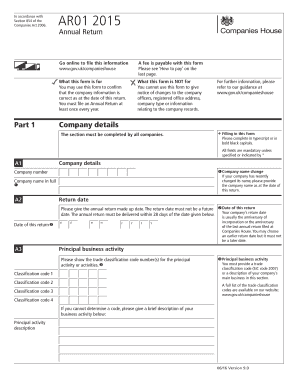

What is the companies house ar01 form?

The companies house ar01 form is a crucial document used by companies in the United Kingdom to notify Companies House of changes to their registered office address. This form is essential for maintaining accurate records and ensuring compliance with legal requirements. It serves as an official notification mechanism, allowing businesses to update their information promptly and correctly.

Key elements of the companies house ar01 form

The companies house ar01 form includes several key elements that must be completed accurately. These elements typically consist of:

- Company Name: The official name of the company as registered with Companies House.

- Company Number: The unique registration number assigned to the company.

- New Address: The updated registered office address that the company wishes to use.

- Effective Date: The date on which the new address will take effect.

- Signature: The signature of an authorized representative of the company, confirming the accuracy of the information provided.

Steps to complete the companies house ar01 form

Completing the companies house ar01 form involves several straightforward steps:

- Gather the necessary information, including the current and new registered office addresses.

- Access the companies house ar01 form through the official Companies House website or other authorized platforms.

- Fill out the form with the required details, ensuring accuracy in the company name, number, and address.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, as per the preferred submission method.

Form Submission Methods

The companies house ar01 form can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online Submission: Companies can file the form electronically through the Companies House online service, which is often the fastest option.

- Mail Submission: Alternatively, the completed form can be printed and sent via postal service to the relevant Companies House address.

- In-Person Submission: In some cases, companies may choose to submit the form in person at a local Companies House office.

Penalties for Non-Compliance

Failure to submit the companies house ar01 form or to provide accurate information can result in penalties. Companies may face fines or legal repercussions for non-compliance, which can affect their standing and operations. It is essential for businesses to adhere to the filing requirements to avoid these consequences.

Legal use of the companies house ar01 form

The companies house ar01 form serves a legal purpose, ensuring that the information on file with Companies House is up to date. This legal requirement helps maintain transparency and accountability within the corporate structure. By using this form correctly, companies fulfill their obligations under the law, protecting their interests and those of their stakeholders.

Quick guide on how to complete go online to file this information

Complete Go Online To File This Information seamlessly on any device

Digital document administration has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly without unnecessary delays. Handle Go Online To File This Information on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Go Online To File This Information with ease

- Locate Go Online To File This Information and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Go Online To File This Information and ensure clear communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the go online to file this information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the companies house ar01 form?

The companies house ar01 form is a document used by UK companies to notify Companies House of changes to their registered office address or to update their company details. This form is essential for maintaining accurate company records and ensuring compliance with UK regulations.

-

How can airSlate SignNow help with the companies house ar01 form?

airSlate SignNow simplifies the process of completing and submitting the companies house ar01 form by providing an intuitive eSigning platform. Users can easily fill out the form, sign it electronically, and send it directly to Companies House, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow for the companies house ar01 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that facilitate the completion and submission of the companies house ar01 form, ensuring a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the companies house ar01 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the companies house ar01 form. These features enhance efficiency and ensure that all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other tools for the companies house ar01 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to connect their workflow seamlessly. This means you can easily manage the companies house ar01 form alongside other business processes, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the companies house ar01 form?

Using airSlate SignNow for the companies house ar01 form provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are handled efficiently and securely, allowing you to focus on your business.

-

Is airSlate SignNow user-friendly for completing the companies house ar01 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the companies house ar01 form. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate it effortlessly.

Get more for Go Online To File This Information

- Attachment no 2 non collusion certificate bformb 512

- Bunker delivery note amsa gov form

- Adhs incident report form

- Dbt diary card recovery technology recoverytechnology form

- Carefully read below the program requirements before deciding if mercy general hospital volunteer form

- Patient registration form afc urgent care beverly

- Edu1 form

- Client intake form stenzel clinical services

Find out other Go Online To File This Information

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement