10 40 Form

What is the 10 40

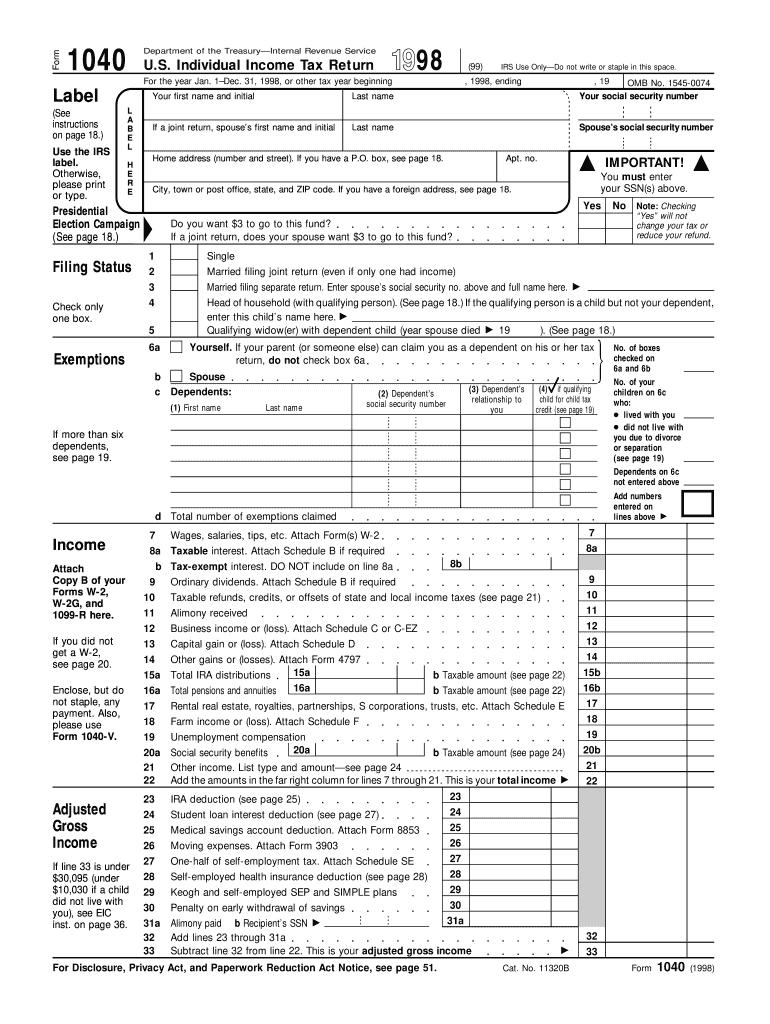

The IRS 10 40, commonly referred to as the 10 40 tax form, is a crucial document for individual taxpayers in the United States. It serves as the standard federal income tax return form used to report income, calculate taxes owed, and determine eligibility for various tax credits and deductions. The 10 40 form is designed for individuals and married couples filing jointly, allowing them to declare their earnings, claim dependents, and report other financial information. Understanding the purpose and structure of the 10 40 is essential for accurate tax reporting.

Steps to complete the 10 40

Completing the 10 40 tax form involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the essential steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, such as single, married filing jointly, or head of household.

- Report all sources of income on the form, including wages, dividends, and interest.

- Claim eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability using the IRS tax tables or tax software.

- Review the completed form for accuracy before submitting it to the IRS.

Legal use of the 10 40

The legal use of the 10 40 tax form is governed by IRS regulations. To be considered valid, the form must be accurately filled out and submitted by the tax filing deadline. E-signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other applicable laws. Using a reliable e-signature solution ensures that the form is legally binding and secure. It is essential to maintain documentation and records related to the 10 40 for potential audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 10 40 tax form are critical for compliance. Typically, the deadline for submitting your 10 40 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties. Staying informed about these dates is vital for timely filing and avoiding unnecessary fees.

Required Documents

To accurately complete the 10 40 tax form, certain documents are required. These typically include:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including medical, educational, and charitable contributions.

- Statements for any investment income or capital gains.

Having these documents ready can streamline the process of filling out the 10 40 and ensure that all income and deductions are accurately reported.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 10 40 tax form can be done through various methods, providing flexibility for taxpayers. Options include:

- Online filing through IRS-approved software, which often simplifies the process and provides instant confirmation.

- Mailing a paper form to the appropriate IRS address based on your state of residence.

- In-person submission at designated IRS offices, though this option may require an appointment.

Choosing the right submission method can affect processing times and the overall experience of filing your taxes.

Quick guide on how to complete 10 40

Complete 10 40 effortlessly on any device

Web-based document management has become increasingly favored by both organizations and individuals. It serves as a superb eco-friendly alternative to conventional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage 10 40 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign 10 40 with ease

- Find 10 40 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign 10 40 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 10 40

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 10 40 and how is it used?

The IRS 10 40 is a federal tax form used by individuals to file their annual income tax returns. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. Properly completing the IRS 10 40 is crucial for accurate tax reporting.

-

How can airSlate SignNow help with IRS 10 40 filing?

airSlate SignNow streamlines the process of signing and sending tax-related documents, including the IRS 10 40. Our platform ensures that your forms are securely eSigned and easily accessible, simplifying the paperwork required for tax filing. With airSlate SignNow, you can complete your form quickly and efficiently.

-

What features does airSlate SignNow offer for IRS 10 40 forms?

AirSlate SignNow offers several features tailored for IRS 10 40 forms, including user-friendly templates and document management tools. You can collect eSignatures, track document status, and store completed forms securely in the cloud. These features enhance your tax filing process and ensure compliance with IRS requirements.

-

Is airSlate SignNow affordable for small businesses handling IRS 10 40 forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses dealing with IRS 10 40 forms. Our pricing plans are competitive and designed to accommodate various business sizes and needs. Additionally, the time saved in document processing can lead to cost savings and increased productivity.

-

Can I integrate airSlate SignNow with accounting software for IRS 10 40 management?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your IRS 10 40 documents. This connectivity ensures that your tax forms are seamlessly incorporated into your accounting workflow, reducing the risk of errors and boosting efficiency.

-

What are the benefits of using airSlate SignNow for IRS 10 40 document signing?

The primary benefits of using airSlate SignNow for IRS 10 40 document signing include enhanced security, ease of use, and time efficiency. Our platform provides a secure method for eSigning sensitive tax documents, and the intuitive interface allows users to complete forms without hassle. Moreover, the automated tracking system simplifies document management.

-

How secure is airSlate SignNow for submitting IRS 10 40 forms?

Security is a top priority for airSlate SignNow, especially when it comes to submitting IRS 10 40 forms. We use advanced encryption protocols to safeguard your documents and ensure that only authorized users have access. This robust security framework helps protect your sensitive tax information during transmission and storage.

Get more for 10 40

- Common app mid year report pdf form

- Notice of intention to defend template south africa form

- Puzzle words form

- Regular passport application form minor philippine embassy in

- Application for night out with the guys form

- Emdr case conceptualization example form

- Hdfc ergo general insurance claim form pdf

- Pos040 form

Find out other 10 40

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement