Sbi Bank Loan Papper Form

Key elements of the loan application form

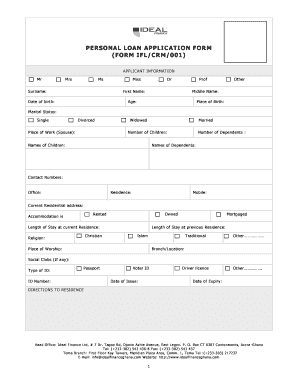

The loan application form is a crucial document that outlines the necessary information required by lenders to evaluate a borrower's eligibility for a loan. Understanding its key elements can help streamline the application process. Common components include:

- Personal Information: This section typically requests the applicant's full name, address, date of birth, and Social Security number.

- Employment Details: Applicants must provide details about their current employment, including job title, employer's name, and duration of employment.

- Financial Information: This includes income sources, monthly expenses, and existing debts, which help lenders assess the applicant's financial stability.

- Loan Details: Applicants specify the type of loan they are seeking, the amount required, and the intended use of the funds.

- Signature Section: A signature is necessary to authorize the lender to conduct a credit check and process the application.

Steps to complete the loan application form

Completing a loan application form involves several important steps to ensure accuracy and completeness. Following these steps can enhance the chances of approval:

- Gather Necessary Documents: Collect all required documentation, such as proof of income, identification, and credit history.

- Fill Out Personal Information: Carefully enter your personal details, ensuring all information is accurate and up-to-date.

- Provide Employment and Financial Information: Clearly outline your employment status and financial situation, including any liabilities.

- Specify Loan Details: Indicate the loan amount you wish to apply for and its intended purpose.

- Review and Sign: Double-check all entries for accuracy before signing the form, which confirms your consent for the lender to process your application.

Legal use of the loan application form

The legal use of the loan application form is governed by various laws and regulations that protect both the lender and the borrower. To ensure compliance:

- Adhere to Federal and State Laws: Understand the legal requirements that apply to loan applications in your state, as they can vary.

- Ensure Accurate Information: Providing false information on a loan application can lead to legal repercussions, including denial of the loan or fraud charges.

- Maintain Confidentiality: Protect sensitive personal and financial information to comply with privacy laws.

Required documents for the loan application form

When applying for a loan, specific documents are typically required to support your application. These documents help lenders verify your identity and financial status:

- Identification: A government-issued ID, such as a driver's license or passport, is often required.

- Proof of Income: Recent pay stubs, tax returns, or bank statements may be needed to demonstrate your income level.

- Credit History: Lenders may request permission to access your credit report to evaluate your creditworthiness.

- Employment Verification: A letter from your employer or recent employment contract can serve as proof of employment.

Form submission methods for the loan application form

Submitting a loan application form can be done through various methods, each with its own advantages. Understanding these options can help you choose the most convenient way:

- Online Submission: Many lenders offer the option to complete and submit the loan application form digitally, providing a quick and efficient process.

- Mail Submission: Applicants can print the completed form and send it via postal mail to the lender's address.

- In-Person Submission: Visiting a local branch allows applicants to submit their forms directly and ask any questions they may have.

Eligibility criteria for the loan application form

Eligibility criteria for a loan application form vary by lender and loan type. Understanding these criteria can help applicants prepare effectively:

- Credit Score: Most lenders require a minimum credit score to qualify for a loan, which reflects the applicant's creditworthiness.

- Income Level: A stable income that meets the lender's requirements is essential for approval.

- Debt-to-Income Ratio: Lenders assess the ratio of monthly debt payments to monthly income to evaluate financial stability.

- Employment History: A consistent employment history can enhance an applicant's chances of approval.

Quick guide on how to complete sbi bank loan papper

Accomplish Sbi Bank Loan Papper effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Sbi Bank Loan Papper on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and electronically sign Sbi Bank Loan Papper with ease

- Obtain Sbi Bank Loan Papper and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sbi Bank Loan Papper and guarantee smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi bank loan papper

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan application form and how does airSlate SignNow facilitate its creation?

A loan application form is a document used by lenders to collect essential information from borrowers. With airSlate SignNow, you can easily create, customize, and send your loan application form electronically, streamlining the process for both you and your clients.

-

What features does airSlate SignNow offer for managing loan application forms?

airSlate SignNow provides various features for managing loan application forms, including custom templates, eSignature capabilities, and document tracking. These features ensure that your forms are filled out correctly and returned promptly, enhancing the efficiency of your loan processing.

-

How does airSlate SignNow ensure the security of loan application forms?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and authentication measures to protect your loan application forms and sensitive information, ensuring that all data remains private and secure during transmission.

-

Can I integrate airSlate SignNow with my existing loan management software?

Yes, airSlate SignNow integrates seamlessly with various loan management systems. This means you can sync data efficiently, allowing for a cohesive workflow that enhances productivity while handling loan application forms.

-

What are the pricing options for using airSlate SignNow for loan application forms?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that provides the necessary features for managing your loan application forms cost-effectively.

-

How does eSigning a loan application form work with airSlate SignNow?

With airSlate SignNow, eSigning a loan application form is a simple process. Users can sign documents electronically on any device, and once signed, the form is securely stored and easy to access, speeding up the loan approval process.

-

What benefits does airSlate SignNow provide for processing loan application forms?

Using airSlate SignNow for processing loan application forms offers numerous benefits, such as reduced turnaround time, minimized paperwork, and improved accuracy. Ultimately, these advantages result in a streamlined experience for both lenders and borrowers.

Get more for Sbi Bank Loan Papper

Find out other Sbi Bank Loan Papper

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile