Uniform Real Estate Contract

What is the Uniform Real Estate Contract

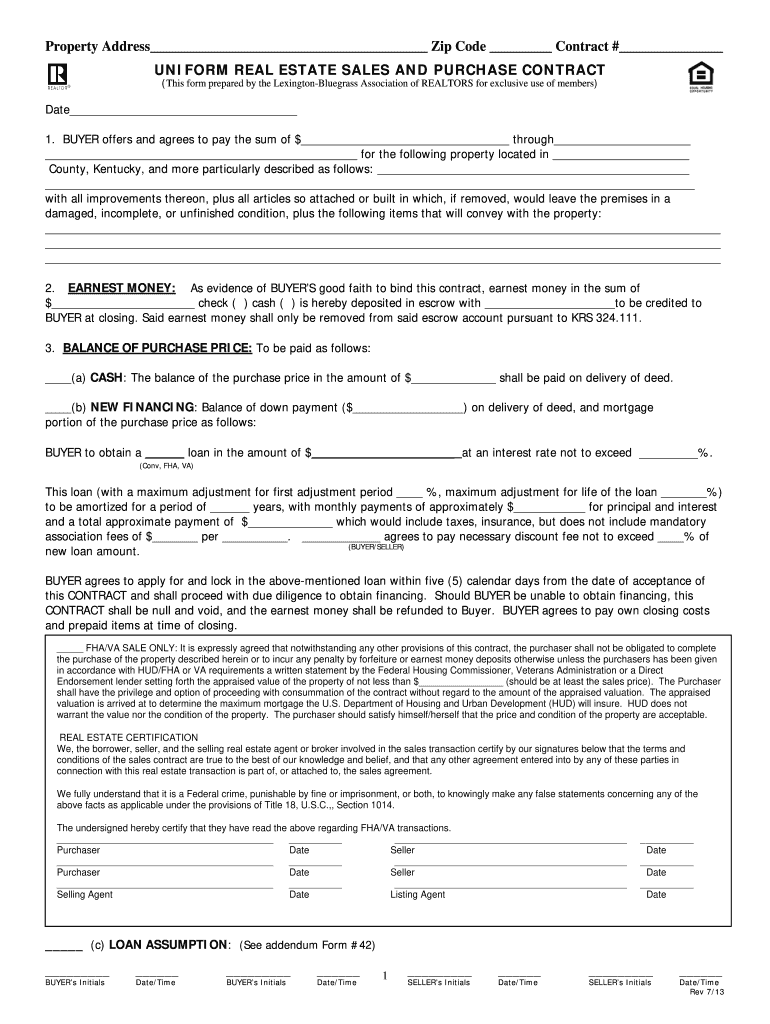

The uniform real estate contract is a standardized agreement used primarily in real estate transactions across the United States. This contract outlines the terms and conditions under which a property is bought or sold. It includes essential details such as the purchase price, property description, and the responsibilities of both the buyer and seller. By using a uniform real estate contract, parties can ensure that they adhere to common legal standards, making the process smoother and more efficient.

Key Elements of the Uniform Real Estate Contract

Understanding the key elements of a uniform real estate contract is crucial for both buyers and sellers. The contract typically includes:

- Property Description: A detailed description of the property being sold, including its address and any included fixtures.

- Purchase Price: The agreed-upon amount for the property, including any deposits or financing arrangements.

- Contingencies: Conditions that must be met for the contract to be valid, such as financing approval or home inspections.

- Closing Date: The date on which the transaction will be finalized and ownership transferred.

- Signatures: Signatures of both parties, which are necessary to execute the agreement legally.

Steps to Complete the Uniform Real Estate Contract

Completing a uniform real estate contract involves several important steps to ensure accuracy and compliance. Here are the recommended steps:

- Gather Information: Collect all relevant details about the property, including legal descriptions and any existing liens.

- Fill Out the Contract: Carefully enter the required information into the contract template, ensuring all sections are completed.

- Review Terms: Both parties should review the terms to confirm mutual understanding and agreement.

- Obtain Signatures: Ensure that both parties sign the document, either physically or electronically, to validate the agreement.

- Distribute Copies: Provide copies of the signed contract to all parties involved for their records.

Legal Use of the Uniform Real Estate Contract

The legal use of the uniform real estate contract is governed by state laws and regulations. For the contract to be enforceable, it must meet specific legal requirements, including:

- Written Form: Most states require that real estate contracts be in writing to be legally binding.

- Signatures: The contract must be signed by all parties involved to confirm their agreement.

- Compliance with Local Laws: Each state may have unique requirements that must be adhered to, such as disclosures or additional clauses.

How to Obtain the Uniform Real Estate Contract

Obtaining a uniform real estate contract can be done through various means. Here are some common methods:

- Real Estate Associations: Many local and state real estate associations provide standardized contract templates to their members.

- Online Resources: Numerous websites offer downloadable versions of the uniform real estate contract, often tailored to specific states.

- Legal Professionals: Consulting with a real estate attorney can ensure that you receive a contract that meets all legal requirements and is tailored to your situation.

State-Specific Rules for the Uniform Real Estate Contract

Each state in the U.S. may have specific rules governing the use of the uniform real estate contract. These rules can include:

- Disclosure Requirements: States may require sellers to disclose certain information about the property, such as known defects or environmental hazards.

- Cooling-Off Periods: Some states allow buyers a period during which they can cancel the contract without penalty.

- Specific Clauses: Certain states may mandate the inclusion of specific clauses that address local laws or customs in real estate transactions.

Quick guide on how to complete uniform real estate sales and purchase contract

Complete Uniform Real Estate Contract effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Uniform Real Estate Contract on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Uniform Real Estate Contract with ease

- Obtain Uniform Real Estate Contract and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes only moments and carries the same legal significance as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Uniform Real Estate Contract and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can I sue a homeowner or their real estate in a situation where both parties signed a purchase agreement then the buyer signed the contract, didn’t send it to me and eventually backed out?

Almost certainly no.There are certain things you must have to create a legal, enforceable contract:Legal intentCapacity of the partiesConsideration (something of value)Mutual agreementAdditionally, almost everything involving real estate falls under the Statute of Frauds. This comes from the English Common law, and says the contract must be in writing to be enforceable. It includes agreements to by or sell real estate and agreements made in consideration of marriage. (Just tossing that last in because its interesting)A real estate purchase contract starts with an offer in writing. The offeree (seller) may accept the offer as presented, reject it or make a counter-offer. Any change to the offer, no matter how minor, constitutes a counter-offer. The original offeror can do the same thing. There is no contract until and unless there is the meeting of the minds—complete agreement—and the agreement has been communicated to all parties.Once there is a meeting of minds, the document becomes an executory contract; that is, one which is in the process of being performed. Almost all real estate purchase agreements contain certain contingencies (we often call them “weasel clauses). Among these are typically loan, appraisal and inspection contingencies.The loan contingency states that the buyer must apply for and be approved for a loan within a certain period (typically 17–21 days). If the buyer does not get the loan for any reason, they get to walk, and they’ll get their earnest money deposit (the consideration) back.If the property appraises for less than the purchase, price, they can walk. If there is something on an inspection report they don’t like, they can walk.Once the buyer has removed all contingencies, they are obligated to perform—to complete the purchase. If they don’t, they are said to be in bsignNow—violating the contract—and may forfeit their deposit.Most real estate purchase contracts today are written by the various state Realtors’ Associations. They typically contain a “Liquidated Damages” clause to be initialed by the parties. This clause states in essence, “The parties agree that determining exact money damages in the event that the buyer does not perform is very difficult. Therefore, buyer and seller agree that the buyer’s earnest money deposit will be considered satisfaction for a bsignNow by the buyer.”In plain language the Liquidated Damages clause states that if a buyer decides not to proceed after having removed all contingencies, they may forfeit their earnest money deposit to the seller.Most contracts also contain an Arbitration Clause. By initialing this, both parties agree to go to binding arbitration rather than filing a lawsuit.If the buyer in your case did not deposit a check with escrow, you never had a contract. If there were contingencies which they did not remove, such as a loan contingency, they are completely free to walk. If you made a counter offer which they chose to ignore, you never had a contract. If your acceptance of their offer was not communicated to them (typically be delivering to them a fully-executed copy of the purchase agreement), you did not have a contract.Someone who “ghosts” and does not take the steps to proceed with a purchase for whatever reason almost invariably has plenty of legal “outs” if they don’t want to go forward. I believe your best bet is just to get on with your life and find another buyer.My standard disclaimer: While I am confident in the accuracy of my statements here, no one should construe a single word of it to be legal advice. I am not an attorney, although I know a whole lot of really fine legalish words. The best. They’re terrific. Anyone who needs legal advice should seek such advice from a duly licensed professional. Relying on “legal” advice on Quora could be an indication of a need for another kind of professional help.I hope this is helpful. Good luck.

-

How can I get out of a real estate contract when I priced the property too low and really feel it is a mistake to sell it?

Number one thing is to step back and think objectively talking to your listing agent. Hopefully, you did use an experienced Realtor to help you set the price. If a home is priced correctly, you should expect to have interest and offers early. You may have to wait a while before you get another similar offer. When a home first goes on the market, you get both the people who’ve been looking for possibly weeks or more plus new buyers just starting.If you truly want to get out of the contract talk to a real estate attorney. As a seller contracts really don’t give you much out unless a buyer defaults. If this your homesteaded home, you may be able to avoid being forced to sell but could be held liable for buyers costs and possibly damages. Your home may even be held up from being sold to someone else. If you have a listing agreement, you may be responsible for commissions.Think carefully, then talk to an attorney.

-

As a real estate professional I need a software other than signNow to easily fill in text, sign and send contracts. So which?

If you are looking for software that will allow you to complete details in contracts and request signatures from clients (even multiple parties) try FileInvite - File Requests, Document Collection on Autopilot!It’s a great way to manage the flow of documents and access to property files (titles, building inspections, LIM, HOA details etc) .We help thousands of companies and individuals to manage the collection of sensitive documents through our cloud based platform. You can choose to store them on Dropbox, Google Drive, Box, OneDrive or your own preferred storage platform.

-

Who makes the purchase and sale agreement, plus a contingency to buy a real estate property?

Who makes the purchase and sale agreement:A Purchase and Sale (P&S) understanding is an authoritative archive that has been arranged and consented to by lawyers speaking to the buyer and seller in a land exchange. In Massachusetts, it must be marked by a purchaser and dealer after both sides have gone to a concurrence on an offer on a bit of land. The P&S will incorporate the last deal cost and all terms of the buy, and it covers the weeks between when a property is removed the market and shutting; a few conditions stretch out past the end date.takes after is a rundown of normal possibilities that can be found in most home buy understandings.Contingency to buy a real estate property:Financing/Loan ContingencyAll home deal contracts will be dependent upon you, the Buyer, having the capacity to secure a credit or other wellspring of financing with which to buy the house. This possibility may put a day and age amongst marking and shutting in which the purchaser must secure this financing. For a first time purchaser, the a lot of cash included can appear to be very overwhelming, however remember this is quite normal. In the event that you can pay money in advance for the offer of the home, then you will have the capacity to discard this possibility.2. Home InspectionA typical possibility inside a home deal assention contract is one that gives the purchaser the privilege to no less than one home review before a specific date. This possibility ought to likewise give the purchaser the chance to escape the agreement, or request repairs, if the purchaser is not, in compliance with common decency, happy with the state of the house.3. ProtectionMost property holders will need to ensure that their new buy has home protection before moving in. Be that as it may, insurance agencies have turned out to be increasingly hesitant to protect properties and homes in specific parts of the nation.4. TitleThis can be a standout amongst the most imperative possibilities for you as the purchaser. This possibility will permit you to leave the agreement if the dealer of the home can't demonstrate that he or she has substantial legitimate title to the property that is available to be purchased.What to do nextSubsequent to considering what sorts of possibilities you need in your home deal understanding, set them in motion as a feature of your offer to purchase the house.

-

How do I get the capital or loans to invest in real estate and rent real estate out?

It depends whether you’re investing in commercial or residential real estate.The process to receive funding for a real estate investment differs on the type of property you’re looking to invest in, with the first and most important decision being between Residential real estate (homes and 2–4 unit Multifamily buildings), and Commercial real estate (buildings occupied by companies, or 5+ unit Multifamily properties).If you are looking to get started with Residential real estate investing and not sure where to start, there is a lot of great content on BiggerPockets: The Real Estate Investing Social Network - both guides and forums with other investors. The short answer is that funding will largely be based on your own credit score and finances.If you are looking to get involved in Commercial real estate, the process for receiving funding is a little bit different. Broadly, you can raise Equity (co-owners of your property), and generally you’ll supplement the total equity with Debt (an interest-bearing loan against the property).If you’re going commercial and have enough equity lined up, between yourself or an LLC with multiple investors including yourself, then next step is to find the property to invest in and create a great plan. Lenders in commercial real estate will evaluate the property itself and the plan, to determine metrics like the ratio of the property’s income to interest owed (Debt Service Coverage Ratio), the percent of the building value represented by the loan (Loan to Value), and some other measures of return and risk. These factors, plus your experience and financial strength, will determine the type of loan you qualify for. Banks, private lenders, and several other types of entities play in the commercial loan space.We’ve made it easy to find the best property-backed commercial lenders in the US by creating a platform that guides you through the loan application process, and instantly matches you with top lenders that are pre-selected for your deal scenario. Check out StackSource to learn more, or feel free to ask me other questions related to commercial real estate lending!

-

How do I evaluate real estate properties to reduce risk for purchase on a tax sale list? software or formula.

That would depend upon your financial position, access to the right professionals to do the repair/updates needed, legal assistance to straighten out any title or other legal challenges. You'll also need some feet on the ground to look at what the local municipality has on the property. Then you'll need to figure out any tenant issues. You'd be best advised to go to work for someone or some company that already does this and learn from them on their dime rather than yours. You'll learn valuable insight on local customs, laws, procedures etc. as well as contacts with the right people to work with to be profitable.

-

How likely is it for me to win a lawsuit where a seller wants to back out of a signed commercial real estate offer/contract?

Obligatory legalese: I’m not a lawyer and you should consult one for legal advice.Generally speaking, if you have performed as specified in the contract, including putting in deposit, removing any applicable contingencies, and informing seller of your intent to close, then I think you have a pretty good case.However, in practical terms, it’s not clear if you should go to court. Lawyers are expensive and, depending on the contract and the state you’re in, you may not be able to get back your expenses, even if you win. And any case, even a winning one, is going to take a long time to complete; is it really worth your time and aggravation?

-

In residential real estate wholesaling, where and how is the best way to learn about contracts?

This is not legal advice. Seek local counsel.This is just my take on what your objective is as wholesaler: find great deals off market for folks that want to flip houses. Therefore I am going to clue you into most of what you need to know about contacts:Offer plus acceptance supported by consideration ($10.00?)=ContractContracts for real estate must be in writing.Your welcome.Marketing, marketing and marketing is all you need to work on. Go to The Real Estate Investing Social Network for much more in-depth information from successful investors.

Create this form in 5 minutes!

How to create an eSignature for the uniform real estate sales and purchase contract

How to create an electronic signature for your Uniform Real Estate Sales And Purchase Contract in the online mode

How to create an eSignature for the Uniform Real Estate Sales And Purchase Contract in Google Chrome

How to create an electronic signature for putting it on the Uniform Real Estate Sales And Purchase Contract in Gmail

How to generate an electronic signature for the Uniform Real Estate Sales And Purchase Contract straight from your mobile device

How to create an electronic signature for the Uniform Real Estate Sales And Purchase Contract on iOS

How to generate an electronic signature for the Uniform Real Estate Sales And Purchase Contract on Android devices

People also ask

-

What is a uniform real estate contract?

A uniform real estate contract is a standardized legal document used in real estate transactions to outline the terms and conditions between buyers and sellers. It ensures that both parties have a clear understanding of their obligations, making the transaction more secure and efficient. Utilizing airSlate SignNow can simplify the process of managing these contracts.

-

How does airSlate SignNow enhance the use of a uniform real estate contract?

airSlate SignNow streamlines the process of creating, sending, and signing a uniform real estate contract electronically. Its user-friendly interface allows for quick adjustments and collaboration, ensuring that all necessary details are captured accurately. This not only speeds up the transaction but also reduces the risk of errors.

-

What pricing packages are available for using airSlate SignNow for uniform real estate contracts?

airSlate SignNow offers a range of pricing plans to fit different business needs when managing uniform real estate contracts. Whether you're an independent agent or a large brokerage, there are flexible options designed to provide the best value. You can choose between monthly or annual subscriptions to save on costs while enjoying premium features.

-

Are there any integrations available with airSlate SignNow for managing uniform real estate contracts?

Yes, airSlate SignNow integrates seamlessly with various real estate tools and CRM systems to manage uniform real estate contracts effectively. Popular integrations include CRM platforms, document storage services, and e-commerce solutions. This connectivity helps centralize your workflow and boosts productivity.

-

What are the benefits of using airSlate SignNow for uniform real estate contracts?

Using airSlate SignNow for uniform real estate contracts offers signNow benefits, including time savings, enhanced security, and improved compliance. The electronic signing features reduce the turnaround time for agreements, while advanced security measures protect sensitive information. Overall, it increases efficiency in real estate transactions.

-

Can I customize a uniform real estate contract using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize a uniform real estate contract to meet specific needs and requirements. Users can easily add clauses, modify terms, and include additional provisions as needed, ensuring that the contract accurately reflects the agreement between parties.

-

Is it easy to get started with airSlate SignNow for uniform real estate contracts?

Yes, getting started with airSlate SignNow for uniform real estate contracts is straightforward. The platform offers a simple onboarding process, along with user tutorials and customer support to assist you. Within minutes, you can create your first uniform real estate contract and begin sending it for signatures.

Get more for Uniform Real Estate Contract

- Agreement between owner and construction manager for services in overseeing a construction project form

- Advertising opportunity sample letter form

- Request production documents form

- Appointment resolution 497328650 form

- Company confidentiality form

- Nondisclosure agreement in connection with discussion of business plan form

- Unrestricted charitable contribution of cash form

- Contract portrait form

Find out other Uniform Real Estate Contract

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation