Irs Form 2159

What is the IRS Form 2159?

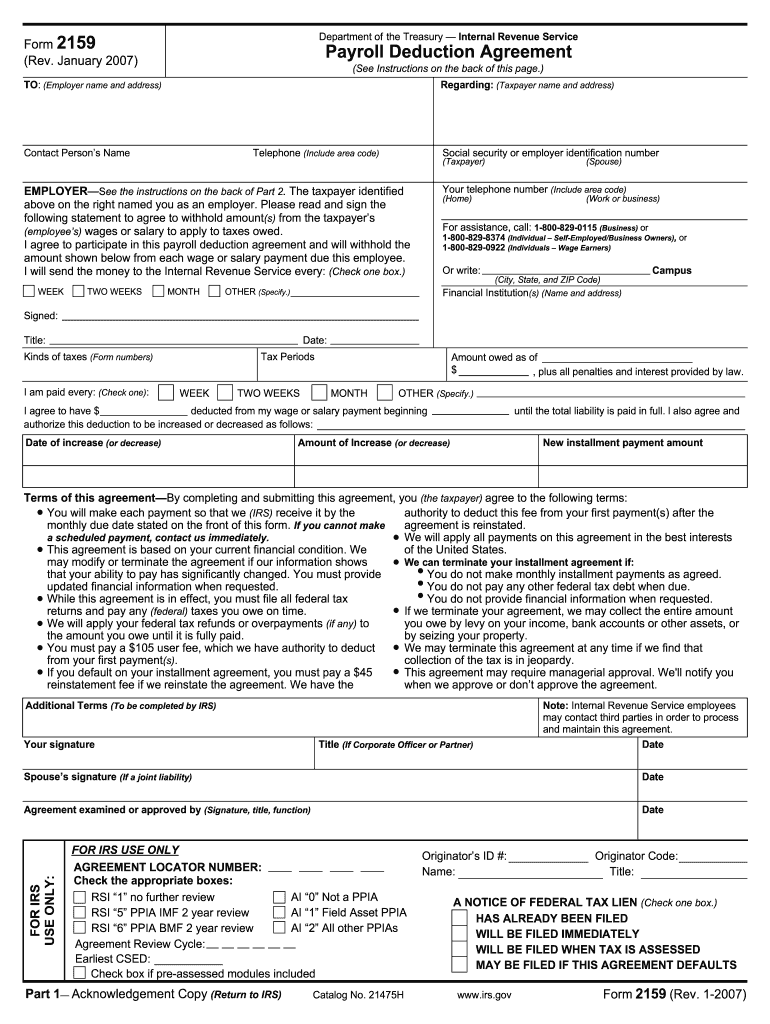

The IRS Form 2159, also known as the "Agreement to Terminate Employment," is a document used by employers and employees to formally agree on the terms of terminating employment. This form is particularly relevant in situations where an employee is resigning or being laid off, ensuring that both parties understand their rights and obligations. The completion of this form helps clarify the final pay, benefits, and any severance arrangements that may be applicable.

How to Use the IRS Form 2159

Using the IRS Form 2159 involves several steps to ensure that all necessary information is accurately captured. Initially, the employer should provide the form to the employee, who will then fill in their personal details and the specifics of their employment termination. Both parties must review the form together to confirm that all terms are understood. Once completed, the form should be signed by both the employer and the employee, making it a legally binding document.

Steps to Complete the IRS Form 2159

Completing the IRS Form 2159 requires careful attention to detail. Here are the essential steps:

- Obtain the form from the IRS website or through your employer.

- Fill in personal information, including the employee's name, address, and Social Security number.

- Specify the date of termination and the reason for leaving.

- Detail any severance pay or benefits that will be provided.

- Review the completed form with the employer to ensure accuracy.

- Both parties should sign and date the form to validate the agreement.

Legal Use of the IRS Form 2159

The IRS Form 2159 serves an important legal function by documenting the terms of employment termination. For the form to be legally binding, it must be completed accurately and signed by both parties. This documentation can protect both the employer and employee in case of disputes regarding final pay or benefits. Adhering to state and federal employment laws is crucial when using this form to ensure compliance and safeguard rights.

Key Elements of the IRS Form 2159

Several key elements must be included in the IRS Form 2159 to ensure its effectiveness:

- Employee Information: Full name, address, and Social Security number.

- Termination Details: Date of termination and reason for leaving.

- Severance and Benefits: Any severance pay or benefits being offered.

- Signatures: Signatures of both the employer and employee, along with the date.

Filing Deadlines / Important Dates

While the IRS Form 2159 itself does not have specific filing deadlines, it is important for both parties to complete and sign the form promptly after the decision to terminate employment has been made. Timely completion helps ensure that all final payments and benefits are processed without delay. Additionally, employers should be aware of any state-specific regulations regarding termination documentation that may impose their own deadlines.

Quick guide on how to complete irs form 2159

Prepare Irs Form 2159 easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, as you can readily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 2159 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Irs Form 2159 without hassle

- Obtain Irs Form 2159 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within just a few clicks from any device you choose. Alter and electronically sign Irs Form 2159 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 2159

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2159 and how can airSlate SignNow help with it?

Form 2159 is a crucial document for many businesses that need to streamline their signing processes. airSlate SignNow offers an easy-to-use platform for sending, signing, and managing Form 2159 electronically, ensuring you save time and improve productivity.

-

Is airSlate SignNow compliant with electronic signature laws for Form 2159?

Yes, airSlate SignNow complies with all electronic signature laws, including the ESIGN Act and UETA. This means that your Form 2159 can be securely signed electronically, giving you peace of mind regarding its legal validity.

-

What pricing plans does airSlate SignNow offer for managing Form 2159?

airSlate SignNow offers several pricing plans to cater to different business needs. Each plan provides access to features that simplify the handling of Form 2159, allowing you to choose the best option for your budget and requirements.

-

What features does airSlate SignNow provide for Form 2159?

AirSlate SignNow offers features like templates, automated reminders, and secure storage specifically designed for Form 2159. These tools help you streamline the signing process and reduce the time it takes to gather necessary signatures.

-

Can I integrate airSlate SignNow with other software tools for handling Form 2159?

Absolutely! airSlate SignNow supports integrations with various software tools, making it easy to manage Form 2159 alongside your existing systems. This seamless integration ensures a smooth workflow and enhances productivity.

-

How can airSlate SignNow enhance the efficiency of my Form 2159 signing process?

Using airSlate SignNow for your Form 2159 can signNowly enhance efficiency by automating manual tasks and reducing paperwork. The platform's intuitive interface allows users to easily send and sign documents from anywhere, leading to quicker turnaround times.

-

Is there a mobile app for airSlate SignNow to manage Form 2159 on the go?

Yes, airSlate SignNow has a mobile app that enables you to manage Form 2159 from anywhere. This means you can send, sign, and track your documents in real-time, which is perfect for busy professionals on the move.

Get more for Irs Form 2159

- Volleyball rally scoring scoresheet mac coaches maccoaches misd form

- List of bonded accountable public officers form

- M5 cashback claim 15974077 form

- Athene beneficiary change form

- One america beneficiary change form

- Kappa alpha psi scroller manual pdf form

- 1490s form 6457170

- Vdg merkblatt r 80 gie ereikoks bdg bdguss form

Find out other Irs Form 2159

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application