Form W 4 W 4 Nwcg

What is the Form W-4 NWCg

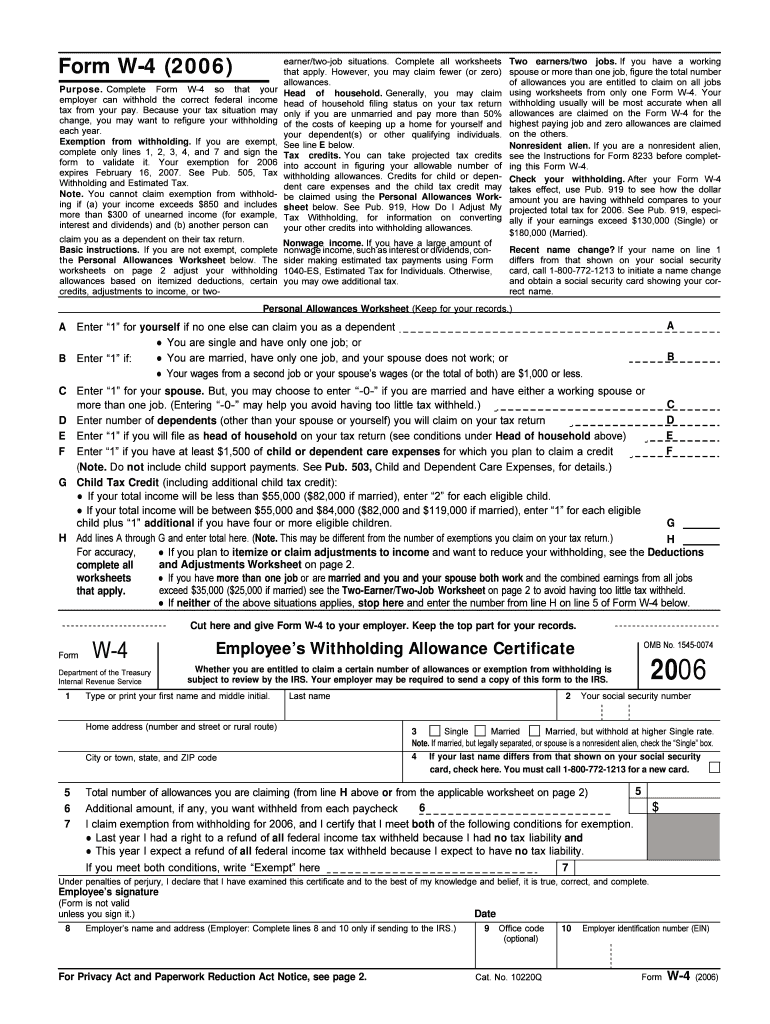

The Form W-4 NWCg, also known as the National Wildfire Coordinating Group W-4, is a tax form used by employees in the wildland firefighting sector. This form is essential for determining the amount of federal income tax withholding from an employee's paycheck. It is specifically tailored for those working in federal firefighting roles, ensuring that the unique income and tax situations of these employees are accurately addressed.

How to use the Form W-4 NWCg

The Form W-4 NWCg is utilized by employees to communicate their tax withholding preferences to their employer. By completing this form, employees can specify their filing status, number of allowances, and any additional amount they wish to have withheld from their paychecks. This information helps employers calculate the appropriate federal income tax withholding, ensuring that employees meet their tax obligations without overpaying or underpaying throughout the year.

Steps to complete the Form W-4 NWCg

Completing the Form W-4 NWCg involves several straightforward steps:

- Provide personal information, including your name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Indicate the number of allowances you are claiming based on your personal situation.

- If desired, specify any additional withholding amounts to be deducted from your paycheck.

- Sign and date the form to validate your submission.

Once completed, submit the form to your employer's payroll department for processing.

Legal use of the Form W-4 NWCg

The Form W-4 NWCg is legally recognized by the Internal Revenue Service (IRS) as a valid means for employees to communicate their tax withholding preferences. Employers are required to maintain accurate records of their employees' W-4 forms to ensure compliance with federal tax laws. Misuse or failure to submit the form can result in incorrect withholding, potentially leading to tax liabilities for the employee.

Filing Deadlines / Important Dates

There are no specific filing deadlines for submitting the Form W-4 NWCg; however, it is recommended that employees submit the form to their employer as soon as they start a new job or experience a significant life change, such as marriage or the birth of a child. This ensures that the correct amount of federal income tax is withheld from their paychecks right from the start of their employment.

Who Issues the Form

The Form W-4 NWCg is issued by the National Wildfire Coordinating Group, which is a collaborative organization that provides guidance and support for wildland firefighting efforts across the United States. This form is specifically designed for employees working in federal firefighting roles, ensuring that their unique tax situations are addressed appropriately.

Quick guide on how to complete form w 4 w 4 nwcg

Streamline Form W 4 W 4 Nwcg effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form W 4 W 4 Nwcg on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The simplest way to alter and eSign Form W 4 W 4 Nwcg with ease

- Locate Form W 4 W 4 Nwcg and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form: by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form W 4 W 4 Nwcg and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4 w 4 nwcg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 4 W 4 Nwcg and why is it important?

Form W 4 W 4 Nwcg is a tax form used by employees to indicate their tax withholding preferences. It is crucial for ensuring that the correct amount of federal income tax is withheld from your paycheck. Understanding this form helps employees manage their tax liabilities effectively.

-

How can airSlate SignNow help with Form W 4 W 4 Nwcg?

airSlate SignNow provides a seamless platform for businesses to send and eSign Form W 4 W 4 Nwcg electronically. This simplifies the process, reduces paperwork, and ensures that forms are completed accurately and stored securely. With our solution, you can streamline your HR processes and enhance compliance.

-

What are the pricing options for using airSlate SignNow for Form W 4 W 4 Nwcg?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that allow you to manage Form W 4 W 4 Nwcg efficiently, with options for monthly or annual subscriptions. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for Form W 4 W 4 Nwcg with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications to enhance your workflow for Form W 4 W 4 Nwcg. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a seamless document management experience. These integrations help streamline your processes and improve productivity.

-

What features does airSlate SignNow offer for managing Form W 4 W 4 Nwcg?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning for Form W 4 W 4 Nwcg. These tools help you create, send, and manage your forms efficiently while ensuring compliance with legal standards. Our user-friendly interface makes it easy for anyone to use.

-

How does airSlate SignNow ensure the security of Form W 4 W 4 Nwcg?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Form W 4 W 4 Nwcg and other sensitive documents. Our platform complies with industry standards to ensure that your data remains confidential and secure.

-

Can I track the status of my Form W 4 W 4 Nwcg with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your Form W 4 W 4 Nwcg. You can easily monitor when the document is sent, viewed, and signed, allowing you to stay informed throughout the process and ensuring timely completion.

Get more for Form W 4 W 4 Nwcg

Find out other Form W 4 W 4 Nwcg

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online