R38 Form PDF

What is the R38 Form PDF

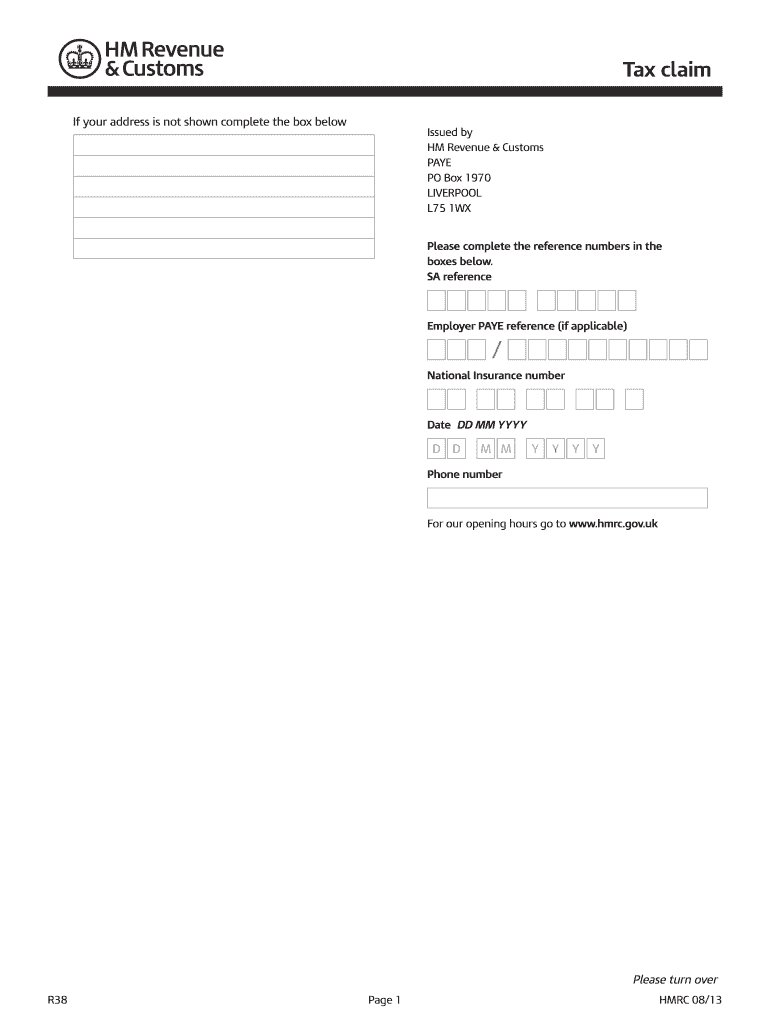

The R38 form, also known as the R38 tax claim form, is a document used in the United States for individuals seeking a tax refund from the Internal Revenue Service (IRS). This form allows taxpayers to claim a refund for overpaid taxes or to request a refund for specific tax credits. The R38 form PDF is a standardized version that can be easily downloaded and filled out electronically, ensuring a more efficient process for taxpayers. Understanding the purpose and function of the R38 form is essential for anyone looking to navigate their tax obligations effectively.

How to Use the R38 Form PDF

Using the R38 form PDF involves several steps to ensure accurate completion and submission. First, download the form from a reliable source. Once you have the form, read through the instructions carefully to understand the information required. Fill out the form with your personal details, including your name, address, and Social Security number. Be sure to provide accurate financial information related to your tax situation. After completing the form, review it for any errors before submitting it to the IRS or the relevant tax authority.

Steps to Complete the R38 Form PDF

Completing the R38 form PDF requires attention to detail. Follow these steps for a smooth process:

- Download the R38 form PDF from a trusted source.

- Read the instructions provided with the form to understand its requirements.

- Enter your personal information accurately in the designated fields.

- Provide details about your tax situation, including any overpayments or credits.

- Review the completed form for accuracy and completeness.

- Sign and date the form where required.

- Submit the form electronically or by mail, following the submission guidelines.

Legal Use of the R38 Form PDF

The R38 form PDF is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it must be signed by the taxpayer or an authorized representative. Compliance with the IRS guidelines regarding the form's completion and submission is crucial. Additionally, using a reliable electronic signature solution can enhance the form's validity and security, ensuring that it meets all legal requirements.

Key Elements of the R38 Form PDF

The R38 form PDF includes several key elements that are essential for its proper completion. These elements typically consist of:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Tax Year: The specific tax year for which the refund is being claimed.

- Claim Details: Information regarding the amount of overpayment or credits being claimed.

- Signature: A space for the taxpayer's signature, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the R38 form PDF are crucial for taxpayers to keep in mind. Generally, the form must be submitted by the tax filing deadline for the year in which the overpayment occurred. For most taxpayers, this deadline falls on April fifteenth of the following year. It is important to stay informed about any changes to these dates, as they can vary based on specific circumstances or IRS announcements.

Quick guide on how to complete r38 form pdf

Complete R38 Form Pdf effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage R38 Form Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign R38 Form Pdf effortlessly

- Obtain R38 Form Pdf and click on Get Form to begin.

- Use the tools we offer to finalize your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign R38 Form Pdf and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r38 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form r38 and how can airSlate SignNow help with it?

Form r38 is a specific document often used in various business transactions. airSlate SignNow allows users to easily create, send, and eSign form r38 efficiently, ensuring that your documents are securely managed and legally binding.

-

Is airSlate SignNow a cost-effective solution for managing form r38?

Yes, airSlate SignNow is known for being a cost-effective solution for document management, including form r38. With flexible pricing plans, businesses can choose a package that best suits their needs without compromising on features or efficiency.

-

What features does airSlate SignNow offer for handling form r38?

airSlate SignNow provides a variety of features for managing form r38, including customizable templates, real-time tracking, and multiple eSigning options. These features streamline the process of preparing and signing documents, making it even easier to handle your form r38.

-

How can I integrate form r38 into my existing workflow with airSlate SignNow?

Integrating form r38 into your existing workflow with airSlate SignNow is simple and seamless. The platform offers integrations with popular applications and services that allow you to automate the process of sending and signing form r38, improving overall efficiency.

-

What are the benefits of eSigning form r38 with airSlate SignNow?

The benefits of eSigning form r38 with airSlate SignNow include enhanced security, faster turnaround times, and improved accessibility. By utilizing eSigning, you can ensure that your form r38 is signed quickly, from anywhere, without the need for physical paperwork.

-

Can I customize form r38 templates using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize form r38 templates to fit your specific business needs. You can add your branding, include specific fields, and tailor the document to ensure it meets compliance and operational requirements.

-

What type of support does airSlate SignNow provide for users of form r38?

airSlate SignNow offers comprehensive support for users of form r38, including tutorials, FAQs, and dedicated customer service teams. Whether you're new to the platform or need help with specific features, assistance is readily available.

Get more for R38 Form Pdf

Find out other R38 Form Pdf

- Edit Sign Form Android

- Edit Sign Form iPad

- How To Submit Sign Word

- Submit Sign PDF Secure

- How To Submit Sign Form

- Submit Sign Form Online

- How Do I Submit Sign Form

- How To Submit Sign Document

- Submit Sign PPT Myself

- Submit Sign Presentation Myself

- Convert Sign PDF Online

- Convert Sign PDF Now

- Convert Sign PDF Free

- Convert Sign PDF Mac

- Convert Sign Word Online

- How To Convert Sign Word

- Help Me With Convert Sign Word

- Convert Sign Word Now

- Convert Sign Word Later

- How To Convert Sign PDF