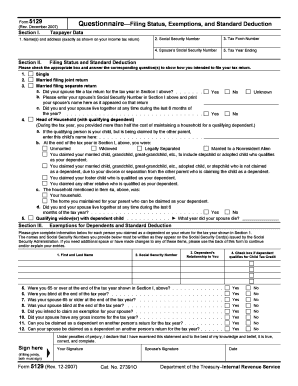

Irs Form 5129

What is the IRS Form 5129?

The IRS Form 5129 is a tax document utilized primarily for the purpose of reporting specific information related to certain tax obligations. This form is essential for individuals and entities who need to provide detailed financial data to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the IRS Form 5129 is crucial for compliance and accurate reporting.

How to Use the IRS Form 5129

Using the IRS Form 5129 involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website. Next, gather all necessary information, including financial records and any supporting documentation required for accurate completion. Fill out the form carefully, ensuring that all information is accurate and complete. Once filled, the form can be submitted according to IRS guidelines, either electronically or via mail.

Steps to Complete the IRS Form 5129

Completing the IRS Form 5129 requires careful attention to detail. Here are the steps to follow:

- Download the latest version of the IRS Form 5129 from the IRS website.

- Review the form instructions thoroughly to understand the required information.

- Gather all necessary documentation, including income statements and tax records.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the completed form electronically or by mail, as per IRS guidelines.

Legal Use of the IRS Form 5129

The IRS Form 5129 is legally binding when completed and submitted according to IRS regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The form must be signed and dated to validate its contents, and it is advisable to keep a copy for your records.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5129 can vary depending on the specific tax year and the taxpayer's situation. It is essential to be aware of these deadlines to avoid late penalties. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain circumstances, so checking the IRS guidelines for the current year is recommended.

Required Documents

When completing the IRS Form 5129, certain documents are required to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any relevant financial documents that pertain to the information being reported.

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete irs form 5129

Finalize Irs Form 5129 seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Irs Form 5129 on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and electronically sign Irs Form 5129 effortlessly

- Find Irs Form 5129 and click Obtain Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Finish button to preserve your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mishandled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs Form 5129 to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 5129

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 5129 form and why is it important?

The IRS 5129 form is a document used for specific tax purposes, and it is crucial for businesses to understand its requirements. Properly completing the IRS 5129 form ensures compliance with tax regulations, helping to avoid potential penalties. Using airSlate SignNow makes signing and submitting the IRS 5129 form quick and efficient.

-

How does airSlate SignNow facilitate the completion of the IRS 5129 form?

airSlate SignNow simplifies the process of completing the IRS 5129 form by providing an intuitive platform for document management and e-signatures. The tool allows you to fill out and send the form electronically, ensuring a seamless experience. This reduces the time spent on paperwork and enhances accuracy.

-

What are the pricing options for using airSlate SignNow to manage the IRS 5129 form?

airSlate SignNow offers a variety of pricing plans to cater to different business needs when managing documents like the IRS 5129 form. Each plan includes features that can enhance your document workflows, including unlimited e-signatures and integrations. You can choose the plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications while handling the IRS 5129 form?

Yes, airSlate SignNow supports integrations with a wide range of applications that can streamline the process of handling the IRS 5129 form. By connecting with tools like Google Drive, Dropbox, and CRMs, you can manage your documents more effectively. This helps in maintaining organized records and enhances your workflow efficiency.

-

What are the key benefits of using airSlate SignNow for the IRS 5129 form?

Using airSlate SignNow for your IRS 5129 form offers several benefits, including improved efficiency, enhanced security, and ease of use. The platform allows you to obtain e-signatures quickly and ensures that your submissions meet compliance requirements. This results in a hassle-free experience for both you and your clients.

-

Is airSlate SignNow secure for handling sensitive documents like the IRS 5129 form?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents, including the IRS 5129 form. With features such as encryption and secure storage, you can trust that your information remains safe and confidential throughout the signing and submission process.

-

How can airSlate SignNow improve the turnaround time for the IRS 5129 form?

airSlate SignNow enhances the turnaround time for the IRS 5129 form by allowing quick e-signature collection and streamlined document workflows. This means that you can send, sign, and manage your IRS 5129 form without the delays associated with traditional paper processes. Faster document handling contributes to overall business efficiency.

Get more for Irs Form 5129

- Addendum regarding lead based paint tar form

- Exide life insurance bank account updation form

- So1 form download 58848872

- Custodian evaluation form 79797913

- Bill nye measurement worksheet form

- Piggly wiggly job application pdf form

- Availability check and reservation of name form

- Nomination form katherine show society katherineshow org

Find out other Irs Form 5129

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile