Maryland Form 202 Sales and Use Tax

What is the Maryland Form 202 Sales And Use Tax

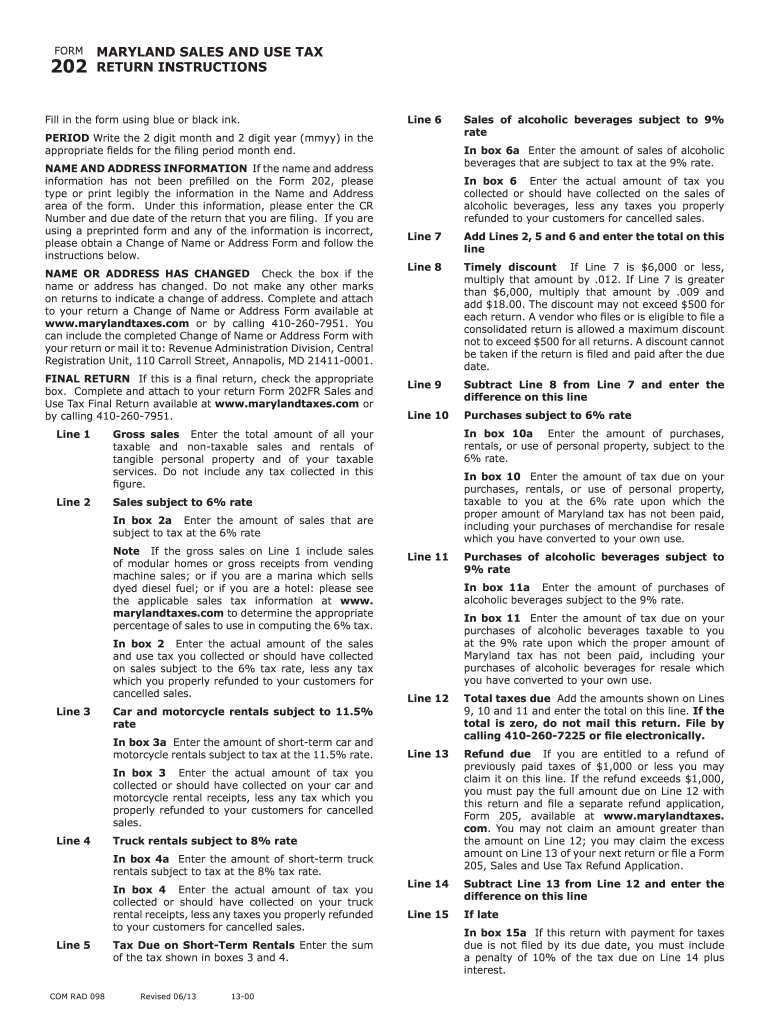

The Maryland Form 202 is a crucial document used for reporting sales and use tax in the state of Maryland. This form is essential for businesses that sell goods or services subject to sales tax, as well as for individuals who purchase taxable items for use in Maryland. The form helps ensure compliance with state tax laws and provides a structured way to report taxable sales, calculate tax owed, and remit payments to the state. Understanding the function and requirements of the Maryland sales and use tax form is vital for any business operating within the state.

Steps to Complete the Maryland Form 202 Sales And Use Tax

Completing the Maryland Form 202 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and purchase invoices. Next, follow these steps:

- Enter your business information, including name, address, and Maryland sales tax registration number.

- Report total sales for the period, distinguishing between taxable and non-taxable sales.

- Calculate the total sales tax due based on the applicable tax rate.

- Include any adjustments for prior periods, if necessary.

- Sign and date the form to certify its accuracy.

By following these steps, you can ensure that your Maryland Form 202 is completed correctly and submitted on time.

How to Obtain the Maryland Form 202 Sales And Use Tax

The Maryland Form 202 can be obtained through the official Maryland Comptroller's website or by visiting local tax offices. The form is available in both printable and fillable formats, making it accessible for businesses and individuals. To ensure you have the most current version, always check the state’s official resources. Additionally, many tax preparation software programs may include the Maryland Form 202, streamlining the process of filling it out and submitting it.

Legal Use of the Maryland Form 202 Sales And Use Tax

The Maryland Form 202 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be filled out accurately, with all required information provided. The form must also be signed by an authorized individual, which confirms the accuracy of the information reported. Compliance with Maryland's sales tax laws is critical, as failure to submit the form correctly can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 202 are typically set quarterly, with specific due dates for each period. Businesses must be aware of these deadlines to avoid late fees and penalties. Generally, the deadlines fall on the 20th of the month following the end of each quarter. For example, the due date for the first quarter (January to March) would be April 20. It is essential to stay informed about any changes to these dates, as they may vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Form 202 can be submitted through various methods to accommodate different preferences. Businesses have the option to file online using the Maryland Comptroller's e-services portal, which offers a convenient and efficient way to submit the form and make payments. Alternatively, the completed form can be mailed to the appropriate state office or delivered in person. Each submission method has specific guidelines, so it is important to follow the instructions provided by the Maryland Comptroller to ensure proper processing.

Quick guide on how to complete maryland form 202 sales and use tax

Complete Maryland Form 202 Sales And Use Tax effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, adjust, and eSign your documents quickly without delays. Handle Maryland Form 202 Sales And Use Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Maryland Form 202 Sales And Use Tax with ease

- Find Maryland Form 202 Sales And Use Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign Maryland Form 202 Sales And Use Tax while ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 202 sales and use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the md sales and use tax form?

The md sales and use tax form is a document used by businesses in Maryland to report and remit sales and use taxes to the state government. It's essential for compliance with state tax regulations. By using airSlate SignNow, you can easily manage and eSign this form, ensuring timely submission.

-

How do I fill out the md sales and use tax form using airSlate SignNow?

Filling out the md sales and use tax form with airSlate SignNow is straightforward. Simply upload the form, fill in the required fields with your sales data, and use our eSignature feature to sign it electronically. This streamlines the process, ensuring you don’t miss any critical details.

-

What are the benefits of using airSlate SignNow for the md sales and use tax form?

Using airSlate SignNow for your md sales and use tax form offers several advantages. It provides a user-friendly interface for easy navigation, secure document storage, and quick eSignature capabilities. This saves time and helps you maintain compliance with state tax laws.

-

Is there a cost associated with eSigning the md sales and use tax form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans based on your business needs. These plans are designed to be cost-effective and provide access to essential features, including the ability to eSign documents like the md sales and use tax form. You can choose the plan that best fits your usage.

-

Can airSlate SignNow integrate with other accounting software for md sales and use tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your md sales and use tax form alongside your other financial documents. These integrations help ensure that your tax forms are accurate and up-to-date.

-

How secure is the information I submit on the md sales and use tax form via airSlate SignNow?

Security is a top priority at airSlate SignNow. All information submitted on the md sales and use tax form is encrypted and stored securely. This ensures that your sensitive data remains protected while you efficiently manage your tax documents.

-

Can I track the status of my md sales and use tax form submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your md sales and use tax form submission in real-time. You will receive notifications about document views and completions, enabling you to stay informed throughout the process.

Get more for Maryland Form 202 Sales And Use Tax

Find out other Maryland Form 202 Sales And Use Tax

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe