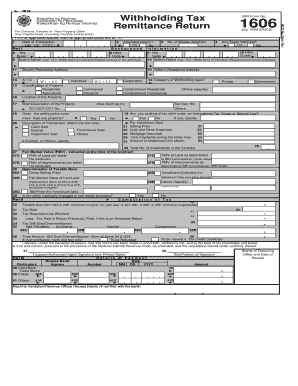

Bir Form 1606 Sample

What is the Bir Form 1606 Sample

The Bir Form 1606 is a document used for various tax-related purposes in the United States, particularly for reporting income and calculating tax obligations. This form is essential for individuals and businesses to ensure compliance with federal tax laws. The sample of the Bir Form 1606 provides a clear layout of the required fields and information needed to complete the form accurately. Understanding this sample helps taxpayers recognize the necessary components and how to fill them out properly.

How to Complete the Bir Form 1606 Sample

Completing the Bir Form 1606 requires careful attention to detail. Start by gathering all necessary information, including personal identification details, income sources, and any applicable deductions. Follow these steps for accurate completion:

- Fill in your name and contact information at the top of the form.

- Provide your Social Security Number or Employer Identification Number.

- Detail your income sources, including wages, interest, and dividends.

- Include any deductions or credits you are eligible for.

- Review the form for accuracy before submission.

Legal Use of the Bir Form 1606 Sample

The Bir Form 1606 holds legal significance as it is used to report income and calculate taxes owed to the government. To ensure its legal validity, the form must be completed accurately and submitted by the designated deadlines. Additionally, using an electronic signature solution can enhance the form's legitimacy. Adhering to the guidelines set forth by the IRS and local tax authorities is crucial for the form to be recognized as legally binding.

Filing Deadlines / Important Dates

Timely submission of the Bir Form 1606 is critical to avoid penalties. Key deadlines typically include:

- Annual filing deadline: April 15 for individual taxpayers.

- Quarterly estimated tax payments: April 15, June 15, September 15, and January 15 of the following year.

Staying aware of these dates ensures compliance and helps prevent unnecessary fines or interest charges.

Who Issues the Form

The Bir Form 1606 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and updates regarding the form, ensuring that taxpayers have access to the most current information required for accurate filing.

Examples of Using the Bir Form 1606 Sample

Using the Bir Form 1606 can vary based on individual circumstances. Here are a few examples:

- A self-employed individual reporting business income and expenses.

- A retired person claiming pension income and social security benefits.

- A student working part-time and filing for tax credits.

Each scenario highlights the form's versatility in accommodating different taxpayer situations while ensuring compliance with tax regulations.

Quick guide on how to complete bir form 1606 sample

Complete Bir Form 1606 Sample effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly and without unnecessary delays. Manage Bir Form 1606 Sample on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Bir Form 1606 Sample without any hassle

- Locate Bir Form 1606 Sample and click Get Form to initiate the process.

- Make use of the features we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that reason.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to finalize your alterations.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from whichever device you prefer. Edit and eSign Bir Form 1606 Sample and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 1606 sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 1606 in the context of airSlate SignNow?

The number 1606 refers to our competitive pricing model at airSlate SignNow, designed to provide businesses with an affordable eSigning solution. With plans starting at $1606 per year, it ensures that you get excellent value for a feature-rich platform.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow includes features like customizable templates, advanced security options, and real-time tracking for signed documents. These features enhance your document management experience and are especially beneficial for businesses dealing with numerous signatories throughout the year, including solutions priced around 1606.

-

How can airSlate SignNow improve our business workflow?

By integrating airSlate SignNow into your current workflow, you streamline the document signing process, allowing for faster turnaround times. With features tailored to meet various business needs, airSlate SignNow focused on efficiency helps your team save time and resources, ultimately reducing processing costs such as those in transactions around 1606.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides signNow benefits such as improved document security, compliance with legal standards, and ease of access from any device. The platform effectively democratizes eSigning, making it accessible for all businesses looking to modernize their processes without high costs exceeding 1606.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial period for potential users to explore its features and capabilities. This trial allows you to assess the value of our solutions, which are competitively priced around 1606, ensuring you're making an informed decision whether to proceed.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports a wide range of integrations with popular software like Google Drive, Salesforce, and more. This functionality allows you to seamlessly incorporate eSigning into your existing workflows and systems, enhancing productivity for your teams dealing with documents associated with transactions around 1606.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and adhere to industry standards to protect your documents, ensuring that your eSigning transactions remain confidential and secure, even in contexts questioning costs around 1606.

Get more for Bir Form 1606 Sample

- Ignou assignment cover page pdf form

- Pogil activity the skeletal system answer key form

- Public forum debate template form

- Download borang pengekalan nama jururawat form

- Form 3311

- Senior medical benefit request ma form

- Courtroom equipment request form 10 adm849 pdf videoconverencing courtroom equipment

- Shower door installation order form fleurco

Find out other Bir Form 1606 Sample

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure