Sample Letter of Request to Waive Penalty Charges Due to Covid Form

Key elements of the sample letter to waive penalty charges

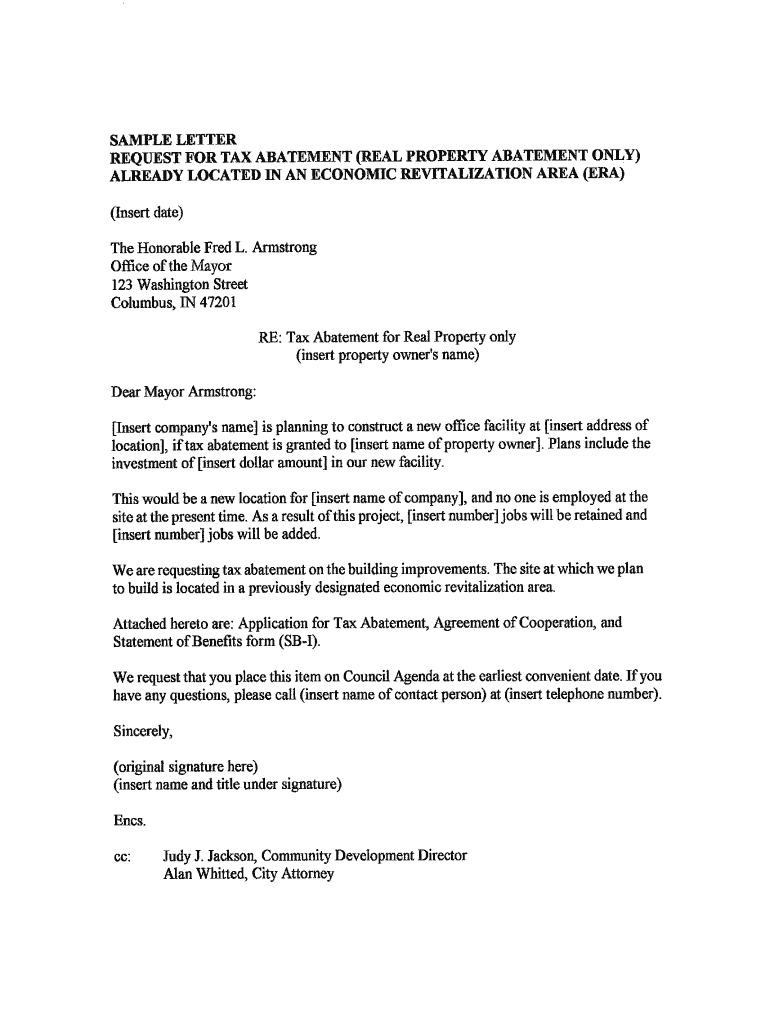

When drafting a sample letter to waive penalties, several key elements must be included to ensure its effectiveness. First, clearly state your intention to request a waiver of penalties. This should be done in the opening paragraph, specifying the type of penalties you are addressing. Next, provide your personal information, including your full name, address, and contact details, to ensure the recipient can easily identify you. Additionally, include your tax identification number, if applicable, to link your request to your tax records.

It is also important to explain the reason for your request. Detail any circumstances that led to the penalties, such as financial hardship, illness, or other extenuating factors. Supporting documentation, such as medical records or financial statements, can strengthen your case. Finally, conclude the letter with a polite request for consideration and provide your signature to validate the document.

Steps to complete the sample letter to waive penalty charges

Completing a sample letter to waive penalty charges involves several straightforward steps. Begin by selecting a template that suits your needs, ensuring it includes all necessary sections. Fill in your personal information accurately at the top of the letter. Next, clearly articulate the penalties you wish to waive and the reasons behind your request.

Gather any supporting documents that may enhance your case, such as proof of financial difficulties or relevant correspondence with the tax authority. Incorporate these details into your letter, referencing them where appropriate. After drafting the letter, review it for clarity and completeness. Finally, sign the document and prepare it for submission, whether electronically or by mail.

Legal use of the sample letter to waive penalty charges

The legal use of a sample letter to waive penalty charges hinges on its compliance with relevant laws and regulations. Ensure that your letter adheres to the guidelines set forth by the Internal Revenue Service (IRS) or your local tax authority. This includes providing accurate information and supporting documentation as required by law.

Additionally, the letter should be signed and dated to validate your request. It is advisable to retain a copy of the letter for your records, along with any correspondence related to your request. This documentation may be necessary if further clarification is needed by the tax authority.

IRS guidelines for penalty waivers

The IRS provides specific guidelines regarding penalty waivers that taxpayers should be aware of. Generally, the IRS may grant a penalty waiver under certain conditions, such as reasonable cause or first-time penalty abatement. Understanding these criteria is essential when crafting your sample letter to waive penalties.

Taxpayers should familiarize themselves with the IRS’s definitions of reasonable cause, which may include circumstances beyond their control, such as natural disasters or serious illness. Referencing these guidelines in your letter can strengthen your request. Additionally, be aware of any deadlines for submitting penalty waiver requests to ensure timely processing.

Required documents for the sample letter to waive penalty charges

When submitting a sample letter to waive penalty charges, certain documents may be required to support your request. Essential documents typically include your tax return for the relevant year, any notices received from the IRS regarding penalties, and evidence that substantiates your claim for a waiver.

For example, if you are requesting a waiver due to financial hardship, include documentation such as bank statements, pay stubs, or proof of unemployment. If illness is a factor, medical records or a doctor’s note may be necessary. Providing comprehensive documentation can enhance the likelihood of your request being approved.

Form submission methods for the sample letter to waive penalty charges

Submitting your sample letter to waive penalty charges can be done through various methods, depending on the requirements of the tax authority. Common submission methods include online submission through the tax authority’s website, mailing the letter to the appropriate address, or delivering it in person at a local office.

When submitting online, ensure that you follow all instructions carefully to avoid any delays. If mailing the letter, consider using certified mail to track its delivery. For in-person submissions, check the office hours and any specific protocols that may be in place. Each method has its own advantages, so choose the one that best suits your needs.

Quick guide on how to complete sample letter of request to waive penalty charges due to covid

Effortlessly Prepare Sample Letter Of Request To Waive Penalty Charges Due To Covid on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Manage Sample Letter Of Request To Waive Penalty Charges Due To Covid on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign Sample Letter Of Request To Waive Penalty Charges Due To Covid Stress-Free

- Access Sample Letter Of Request To Waive Penalty Charges Due To Covid and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive details using tools that airSlate SignNow has designed for such tasks.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Don't worry about lost or misplaced documents, tiring searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sample Letter Of Request To Waive Penalty Charges Due To Covid and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample letter of request to waive penalty charges due to covid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample letter to SARS to waive penalties?

A sample letter to SARS to waive penalties is a template document that individuals or businesses can use to formally request the South African Revenue Service to reconsider imposed penalties. It typically includes details about the taxpayer’s situation and reasons for the waiver. Using a well-crafted letter can increase the chances of a favorable response from SARS.

-

How can airSlate SignNow help me send a sample letter to SARS to waive penalties?

airSlate SignNow simplifies the process of sending a sample letter to SARS to waive penalties by allowing users to easily create, edit, and eSign documents. With our user-friendly interface, you can customize your letter to fit your needs and send it securely with just a few clicks. This streamlines your communications with SARS.

-

Is it costly to use airSlate SignNow for sending documents?

No, airSlate SignNow is a cost-effective solution for sending documents, including your sample letter to SARS to waive penalties. We offer various pricing plans to cater to different business needs, ensuring that you get the best value without compromising on features. Try our services and see how affordable document management can be.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for effective document management, including customizable templates, eSignature capabilities, and secure cloud storage. These functionalities allow you to manage your documents effortlessly and even prepare a sample letter to SARS to waive penalties efficiently. Our platform ensures that your documents are handled securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your workflow efficiency. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to streamline your processes. This means you can easily manage a sample letter to SARS to waive penalties alongside other business documents.

-

How secure is the information I send using airSlate SignNow?

The security of your information is a top priority at airSlate SignNow. We utilize advanced encryption and compliance with industry standards to safeguard all your documents, including any sample letter to SARS to waive penalties. Rest assured, your sensitive personal and business information remains protected during transmission.

-

What are the benefits of using airSlate SignNow for handling tax documents?

Using airSlate SignNow for handling tax documents offers numerous benefits such as increased efficiency, reduced paperwork, and easier collaboration. You can quickly prepare and eSign your sample letter to SARS to waive penalties, ensuring timely submissions. Our platform helps you stay organized and focused on meeting tax obligations with ease.

Get more for Sample Letter Of Request To Waive Penalty Charges Due To Covid

Find out other Sample Letter Of Request To Waive Penalty Charges Due To Covid

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple