Missouri Revenue 2014

What is the Missouri Revenue

The Missouri Revenue refers to the financial resources collected by the state of Missouri, primarily through taxes and fees. This revenue is crucial for funding various public services, including education, infrastructure, and public safety. The Missouri Department of Revenue (Mo Dept of Revenue) oversees the collection and distribution of these funds, ensuring compliance with state laws and regulations.

Steps to complete the Missouri Revenue

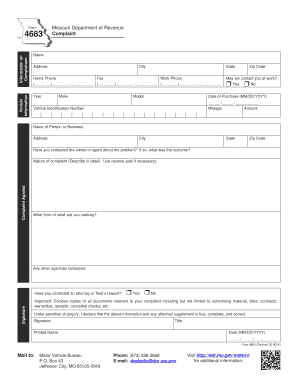

Completing the Missouri Revenue form, specifically the mo form 4683, involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and any relevant financial documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the submission methods available.

Legal use of the Missouri Revenue

The legal use of the Missouri Revenue is governed by state laws that dictate how revenue is collected and utilized. It is essential for individuals and businesses to understand their obligations under these laws to avoid penalties. The mo form 4683 must be filled out correctly to ensure that it meets legal standards, making it a binding document for revenue reporting and compliance.

Required Documents

When completing the mo form 4683, specific documents are necessary to support the information provided. These may include identification documents, proof of income, and any prior tax returns relevant to the current filing. Having these documents ready will facilitate a smoother completion process and help ensure that the form is filled out accurately.

Form Submission Methods

The mo form 4683 can be submitted through various methods, providing flexibility for users. Options typically include online submission via the Missouri Department of Revenue's website, mailing the completed form to the designated address, or delivering it in person at a local revenue office. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure timely processing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Missouri Revenue can result in significant penalties. These may include fines, interest on unpaid amounts, and potential legal action. It is crucial for individuals and businesses to understand their responsibilities regarding the mo form 4683 to avoid these consequences and maintain compliance with state regulations.

Quick guide on how to complete missouri revenue

Effortlessly Prepare Missouri Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Missouri Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Missouri Revenue with Ease

- Locate Missouri Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Missouri Revenue to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri revenue

Create this form in 5 minutes!

How to create an eSignature for the missouri revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO Form 4683, and why is it important?

The MO Form 4683 is a key document used for reporting income adjustments in Missouri. It is important because it helps taxpayers accurately report their financial changes, ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily fill, sign, and send the MO Form 4683 electronically.

-

How can airSlate SignNow help with the completion of the MO Form 4683?

airSlate SignNow simplifies the process of completing the MO Form 4683 by providing an intuitive platform for users to fill out the form electronically. With features like templates and auto-fill, you can save time and reduce errors when submitting your form. Additionally, you can securely eSign the document and share it instantly.

-

Is there a cost associated with using airSlate SignNow for the MO Form 4683?

Yes, there is a cost for using airSlate SignNow, but it offers flexible pricing plans to suit different business needs. You’ll find that the cost is a worthwhile investment considering the efficiencies gained in managing documents like the MO Form 4683. There are also trial options available to explore before committing.

-

What are the main features of airSlate SignNow for handling the MO Form 4683?

Key features of airSlate SignNow include document templates, eSignature capabilities, cloud storage, and audit trails. These features make it easy to manage the MO Form 4683 and other documents securely and efficiently. The platform is designed to streamline the signing and submission process.

-

Can I integrate airSlate SignNow with other applications for processing the MO Form 4683?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, enhancing its functionality for processing the MO Form 4683. Whether you use CRM, cloud storage, or productivity tools, you can connect them to create a seamless document workflow. This integration helps in maintaining consistency in document management.

-

What benefits does airSlate SignNow provide when filling out the MO Form 4683?

Using airSlate SignNow to fill out the MO Form 4683 offers several benefits, including time savings, increased accuracy, and improved collaboration. The platform ensures that users can complete forms quickly and avoids common errors found in manual entries. Moreover, documents can be accessed and shared in real-time.

-

Is airSlate SignNow secure for submitting the MO Form 4683?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to protect your data. When you submit the MO Form 4683 through their platform, it is encrypted and stored securely. Users also benefit from features like password protection and user authentication for added security.

Get more for Missouri Revenue

Find out other Missouri Revenue

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form