3939a Form

What is the 3939a Form

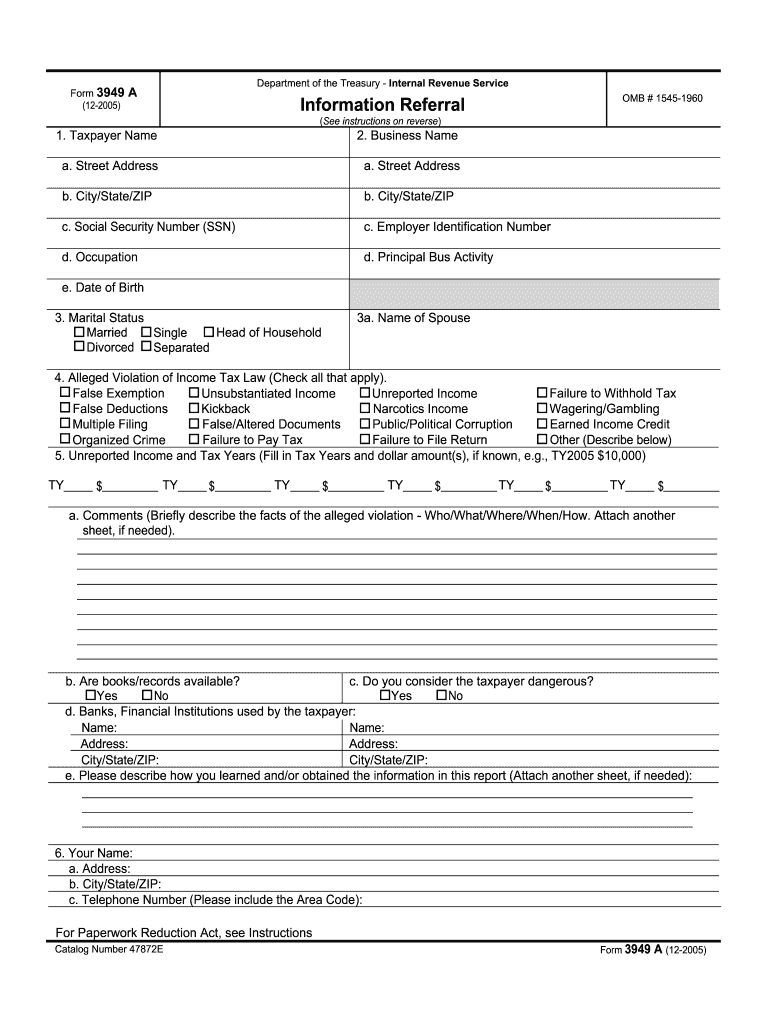

The 3939a form is a document used by individuals to report certain types of information to the IRS. It serves as a means for taxpayers to disclose specific details regarding their financial activities, ensuring compliance with federal tax regulations. Understanding the purpose of this form is crucial for accurate reporting and fulfilling legal obligations.

How to use the 3939a Form

Using the 3939a form involves several straightforward steps. First, gather all necessary financial information that pertains to the reporting requirements. Next, fill out the form accurately, ensuring that all sections are completed as required. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the taxpayer and the guidelines set by the IRS.

Steps to complete the 3939a Form

Completing the 3939a form requires careful attention to detail. Here are the essential steps:

- Review the instructions provided by the IRS for the 3939a form.

- Gather all relevant financial documents, such as income statements and expense records.

- Fill in the required information, ensuring accuracy in each section.

- Double-check the form for any errors or omissions.

- Submit the form according to the preferred method, whether online or by mail.

Legal use of the 3939a Form

The legal use of the 3939a form is governed by IRS regulations. It is essential for taxpayers to ensure that the information reported is truthful and complete. Failure to comply with the legal requirements associated with this form can lead to penalties or further scrutiny from tax authorities. Understanding the legal implications of using the 3939a form is vital for maintaining compliance.

Key elements of the 3939a Form

The 3939a form comprises several key elements that must be accurately filled out. These include personal identification information, financial details, and specific disclosures that the IRS requires. Each section is designed to capture important data that can affect a taxpayer's obligations and rights under federal law. Familiarity with these elements ensures that users can navigate the form effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 3939a form are critical to avoid penalties. Typically, the form must be submitted by a specific date each tax year, which aligns with the overall tax filing deadline. It is essential for taxpayers to stay informed about these dates to ensure timely submission and compliance with IRS regulations.

Quick guide on how to complete 3939a form

Complete 3939a Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle 3939a Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The optimal method to modify and eSign 3939a Form with ease

- Obtain 3939a Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign 3939a Form and ensure smooth communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3939a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3939a form and why is it important?

The 3939a form is a crucial document for businesses to manage their electronic signatures and streamline document workflows. It is essential for ensuring compliance and enhancing the speed of transactions, which is directly supported by airSlate SignNow's features.

-

How does airSlate SignNow help with filling out the 3939a form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the 3939a form. Users can easily upload the document, add necessary fields, and send it for eSignature, ensuring a smooth and efficient experience.

-

What are the pricing options for using airSlate SignNow for the 3939a form?

AirSlate SignNow offers various pricing plans tailored to different business needs, including those who require processing the 3939a form. Customers can choose from monthly or annual subscriptions that provide full access to all features at competitive prices.

-

Are there any advanced features for managing the 3939a form with airSlate SignNow?

Yes, airSlate SignNow includes advanced features like templates, automated workflows, and integration with popular apps, making it easier to manage the 3939a form. These tools enhance productivity and ensure that your documents are always compliant and professionally handled.

-

Can airSlate SignNow integrate with other software for processing the 3939a form?

Absolutely! airSlate SignNow offers seamless integrations with various software like CRM and ERP systems, facilitating efficient processing of the 3939a form. This ensures that your document management workflows are interconnected and streamlined.

-

Is airSlate SignNow secure for handling the 3939a form?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance standards, ensuring that your 3939a form is protected throughout the signing process. Your data integrity and confidentiality are always maintained.

-

What benefits does airSlate SignNow offer for businesses using the 3939a form?

By using airSlate SignNow for the 3939a form, businesses can experience faster turnaround times, reduced paperwork, and improved accuracy in transaction processing. This leads to enhanced customer satisfaction and efficiency in operations.

Get more for 3939a Form

Find out other 3939a Form

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document