Tax Declaration Form

What is the Tax Declaration Form

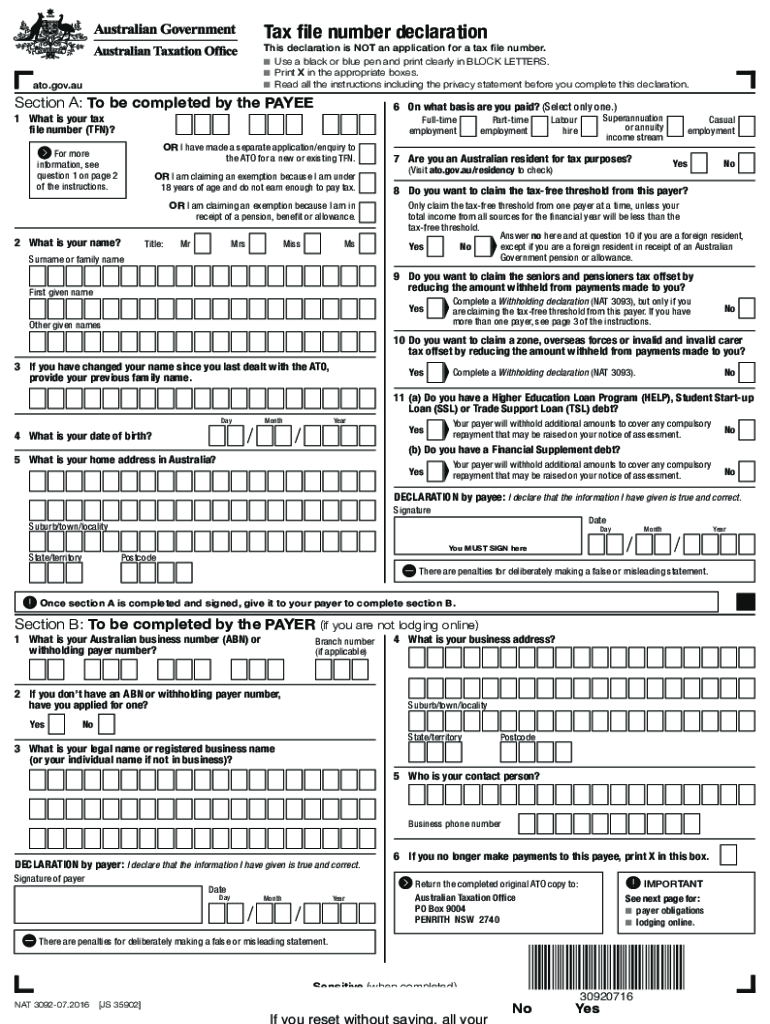

The tax declaration form is a crucial document used by individuals and businesses to report their income, expenses, and other financial information to the Internal Revenue Service (IRS). This form plays a vital role in determining tax liability and ensuring compliance with federal tax laws. It includes essential details such as income sources, deductions, and credits that may apply to the taxpayer. Understanding the purpose of this form is fundamental for accurate tax reporting and avoiding penalties.

Steps to Complete the Tax Declaration Form

Completing the tax declaration form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and records of deductions. Next, choose the appropriate form based on your filing status and income level, such as the 1040 or 1040-SR. Carefully fill out each section, ensuring that all information is accurate and complete. After completing the form, review it for errors and omissions before submitting it to the IRS. Consider using electronic filing options for a streamlined process.

Legal Use of the Tax Declaration Form

The tax declaration form must be completed and submitted in accordance with IRS regulations to be considered legally binding. This means that all information provided must be truthful and accurate, as any discrepancies can lead to audits or penalties. Additionally, electronic signatures are recognized as valid under the ESIGN Act, provided that the electronic filing meets specific criteria. It is essential to understand the legal implications of submitting this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the tax declaration form are critical to ensure compliance with IRS regulations. Generally, individual tax returns are due on April 15 of each year, although this date may vary slightly depending on weekends or holidays. Extensions may be available, but they must be requested by the original deadline. It is important to stay informed about any changes to deadlines, especially during tax season, to avoid late fees or penalties.

Required Documents

To accurately complete the tax declaration form, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income

- Documentation for deductions, such as mortgage interest statements and medical expenses

- Social Security numbers for all dependents

Having these documents on hand will facilitate a smoother and more efficient filing process.

Form Submission Methods (Online / Mail / In-Person)

The tax declaration form can be submitted through various methods, offering flexibility to taxpayers. The most common methods include:

- Online Filing: Using IRS-approved software or services to file electronically, which often results in faster processing times.

- Mail: Sending a paper copy of the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: Visiting local IRS offices for assistance with filing, although this option may require an appointment.

Each submission method has its advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete tax declaration form 102014885

Prepare Tax Declaration Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Tax Declaration Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Tax Declaration Form with ease

- Locate Tax Declaration Form and then click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Declaration Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax declaration form 102014885

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration form and why do I need it?

A tax declaration form is a document that individuals and businesses use to report their income and expenses to tax authorities. Completing this form accurately is essential for proper tax compliance and to avoid potential penalties. Using airSlate SignNow, you can easily eSign and send your tax declaration form, ensuring a streamlined process.

-

How does airSlate SignNow assist with filling out a tax declaration form?

airSlate SignNow offers intuitive tools that simplify the process of completing a tax declaration form. You can fill out the necessary fields, add electronic signatures, and securely send the document to relevant parties. This saves time and minimizes the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax declaration forms?

airSlate SignNow provides various pricing plans to accommodate different business needs, from individual freelancers to large organizations. You can choose a plan that fits your budget and requirements for managing your tax declaration form. The cost-effective solution ensures you get the best value for handling your documents.

-

Can I integrate airSlate SignNow with my accounting software for tax declaration forms?

Yes, airSlate SignNow allows seamless integration with popular accounting software, making it easier to manage your tax declaration form alongside your financial data. This integration helps streamline your workflow and organize your tax-related documentation efficiently.

-

What are the benefits of using airSlate SignNow for my tax declaration form?

Using airSlate SignNow for your tax declaration form offers numerous benefits, including enhanced accuracy, increased efficiency, and improved collaboration. The platform allows you to quickly gather signatures and securely share documents, ensuring compliance while saving time during tax season.

-

Is airSlate SignNow secure for submitting tax declaration forms?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure storage, to protect your tax declaration form and sensitive data. You can trust that your information is safe while using our platform.

-

Can multiple users collaborate on a tax declaration form with airSlate SignNow?

Yes, airSlate SignNow supports multi-user collaboration, allowing teams to work together on a tax declaration form in real-time. This feature enhances communication and ensures that all input is captured, making the filing process more efficient.

Get more for Tax Declaration Form

Find out other Tax Declaration Form

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe