PERSONAL FINANCIAL STATEMENT Westfield Bank Form

What is the personal financial statement?

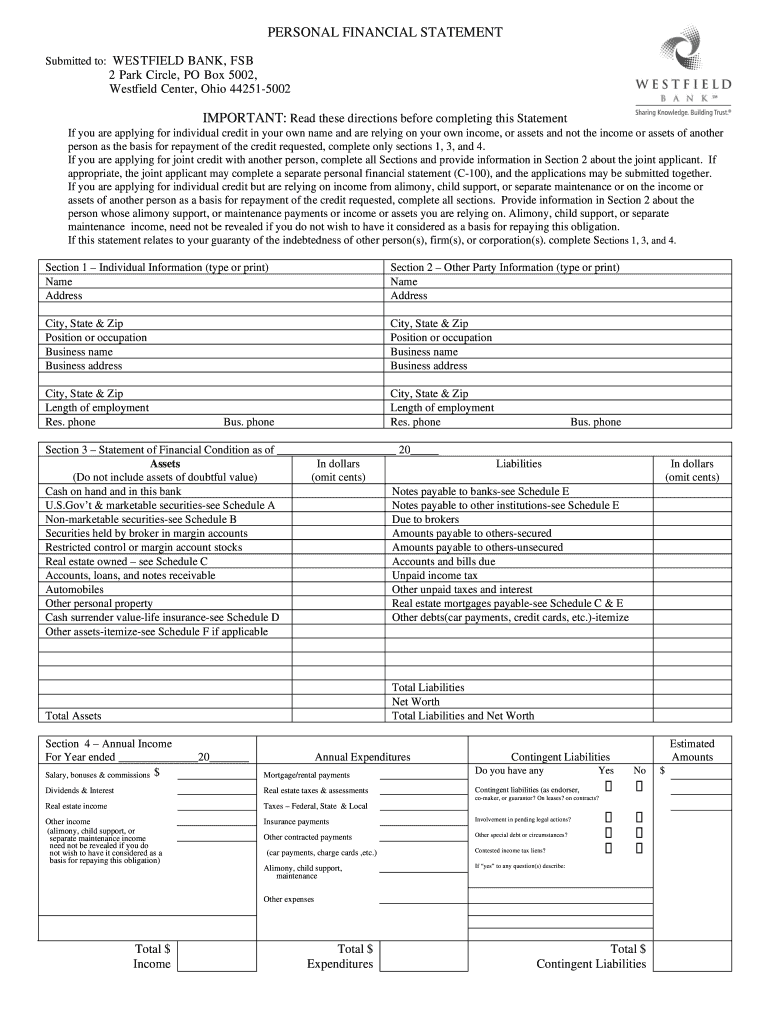

A personal financial statement is a document that provides a comprehensive overview of an individual's financial situation. It typically includes details about assets, liabilities, income, and expenses. This statement is often used by financial institutions, such as Westfield Bank, to assess an individual's creditworthiness when applying for loans or mortgages. By compiling this information, individuals can gain insights into their financial health and make informed decisions regarding their financial future.

Key elements of the personal financial statement

When preparing a personal financial statement, it is essential to include the following key elements:

- Assets: This section lists all valuable items owned, such as cash, real estate, investments, and personal property.

- Liabilities: Here, individuals should detail all debts and obligations, including mortgages, loans, and credit card balances.

- Income: This part outlines all sources of income, such as salary, bonuses, rental income, and dividends.

- Expenses: Individuals should record their monthly and annual expenses, covering categories like housing, transportation, and personal spending.

Steps to complete the personal financial statement

Completing a personal financial statement involves several steps to ensure accuracy and comprehensiveness:

- Gather financial documents, including bank statements, tax returns, and pay stubs.

- List all assets and their current values, ensuring to include both liquid and non-liquid assets.

- Detail all liabilities, including the total amount owed and the terms of each debt.

- Calculate total income from all sources, ensuring to account for any irregular income.

- Compile a list of monthly and annual expenses to provide a complete picture of financial obligations.

- Review the completed statement for accuracy and completeness before submission.

How to use the personal financial statement

The personal financial statement can serve various purposes, including:

- Applying for loans or mortgages, as lenders often require this document to evaluate financial stability.

- Assessing personal financial health, helping individuals identify areas for improvement.

- Planning for future financial goals, such as saving for retirement or purchasing a home.

Legal use of the personal financial statement

When used correctly, a personal financial statement is a legally binding document. It is crucial to ensure that all information provided is accurate and truthful, as discrepancies can lead to legal issues or denial of financial applications. Additionally, this document may be used in legal proceedings, such as divorce settlements or bankruptcy filings, making it essential to maintain its integrity.

Examples of using the personal financial statement

Individuals may use a personal financial statement in various scenarios, such as:

- When seeking a mortgage, lenders will review the statement to determine the applicant's ability to repay the loan.

- During financial planning sessions, individuals can analyze their financial statements to set realistic savings goals.

- In estate planning, a personal financial statement can help individuals outline their assets and liabilities for beneficiaries.

Quick guide on how to complete personal financial statement westfield bank

The simplest method to obtain and sign PERSONAL FINANCIAL STATEMENT Westfield Bank

Across the entirety of your organization, inefficient workflows involving paper approvals can consume a signNow amount of productive time. Executing documents such as PERSONAL FINANCIAL STATEMENT Westfield Bank is an inherent aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall productivity of the organization. With airSlate SignNow, signing your PERSONAL FINANCIAL STATEMENT Westfield Bank is as straightforward and rapid as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it immediately without the need to install external software on your device or print anything as physical copies.

Steps to obtain and sign your PERSONAL FINANCIAL STATEMENT Westfield Bank

- Navigate our library by category or use the search bar to find the document you require.

- View the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any required information using the toolbar.

- Once finished, click the Sign tool to sign your PERSONAL FINANCIAL STATEMENT Westfield Bank.

- Choose the signature method that suits you best: Draw, Create initials, or attach a picture of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your paperwork efficiently. You can find, complete, modify, and even share your PERSONAL FINANCIAL STATEMENT Westfield Bank within a single tab with no complications. Enhance your workflows with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

Create this form in 5 minutes!

How to create an eSignature for the personal financial statement westfield bank

How to generate an eSignature for your Personal Financial Statement Westfield Bank online

How to make an eSignature for your Personal Financial Statement Westfield Bank in Google Chrome

How to generate an eSignature for signing the Personal Financial Statement Westfield Bank in Gmail

How to generate an electronic signature for the Personal Financial Statement Westfield Bank straight from your smartphone

How to create an electronic signature for the Personal Financial Statement Westfield Bank on iOS

How to make an eSignature for the Personal Financial Statement Westfield Bank on Android devices

People also ask

-

What is a personal financial statement example?

A personal financial statement example is a document that outlines an individual's financial position at a specific point in time. It typically includes assets, liabilities, income, and expenses, making it essential for loan applications, budgeting, and financial planning.

-

How can airSlate SignNow help in creating a personal financial statement example?

airSlate SignNow allows users to easily create and customize templates for personal financial statements. By using our platform, you can ensure that your personal financial statement example is professionally formatted and ready for eSigning, enhancing efficiency in financial transactions.

-

What features does airSlate SignNow offer for managing personal financial statement examples?

With airSlate SignNow, you get features like document templates, collaboration tools, and secure eSigning to streamline the management of your personal financial statement example. These features not only save time but also improve accuracy and compliance in your financial documentation.

-

Is airSlate SignNow a cost-effective solution for creating personal financial statement examples?

Yes, airSlate SignNow is designed to be a budget-friendly option for individuals and businesses looking to create personal financial statement examples. Our pricing plans are transparent and offer great value, especially for those who need to handle multiple documents securely.

-

Can I integrate airSlate SignNow with other software for my personal financial statement example?

Absolutely! airSlate SignNow offers seamless integrations with many popular software programs, allowing you to enhance your workflow when creating and managing a personal financial statement example. This connectivity helps in pulling data from other platforms, streamlining the process.

-

What are the benefits of using airSlate SignNow for a personal financial statement example?

Using airSlate SignNow for your personal financial statement example ensures that you have a fast, secure, and user-friendly experience. The platform not only simplifies document creation but also enhances collaboration with stakeholders and reduces processing times signNowly.

-

How secure is my personal financial statement example when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and security measures to protect your personal financial statement example and any other documents you manage, giving you peace of mind while handling sensitive financial information.

Get more for PERSONAL FINANCIAL STATEMENT Westfield Bank

Find out other PERSONAL FINANCIAL STATEMENT Westfield Bank

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors