Equity Bank Joint Account Requirements Form

What are the requirements for an Equity Bank joint account?

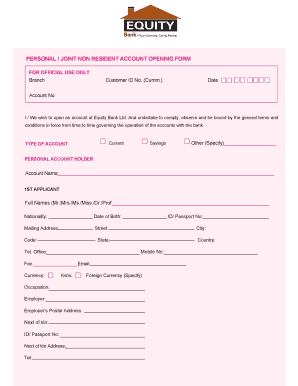

To open a joint account with Equity Bank, specific requirements must be met. Both account holders need to provide valid identification, such as a national ID or passport. Additionally, you will need to provide proof of residence, which can include a utility bill or a bank statement. Both parties must also complete the Equity Bank account opening form, which includes personal details and signatures. It is important to ensure that both individuals are present during the application process to facilitate the signing of necessary documents.

Steps to complete the Equity Bank joint account application

Completing the application for a joint account at Equity Bank involves several straightforward steps:

- Gather required documents: Ensure both account holders have their identification and proof of residence ready.

- Visit an Equity Bank branch: Both parties must go to a local branch to initiate the application process.

- Fill out the account opening form: Complete the form accurately, providing all necessary information.

- Sign the documents: Both account holders must sign the application and any additional required documents.

- Deposit initial funds: Make the initial deposit as required by the bank.

Required documents for an Equity Bank joint account

When applying for a joint account at Equity Bank, certain documents are essential. Both account holders must provide:

- Valid identification (national ID or passport)

- Proof of residence (utility bill or bank statement)

- Completed Equity Bank account opening form

Having these documents ready will streamline the application process and help avoid delays.

Legal considerations for Equity Bank joint accounts

Joint accounts at Equity Bank are subject to legal regulations that govern banking practices. Both account holders have equal rights to the funds in the account, and any transactions require the consent of both parties unless otherwise specified. It is crucial to understand that in the event of a dispute, the bank may require both parties to resolve issues collaboratively. Additionally, any legal actions, such as garnishments, may affect the joint account as a whole, impacting both account holders.

Eligibility criteria for opening a joint account

To qualify for a joint account at Equity Bank, both individuals must meet specific eligibility criteria. Each account holder must:

- Be at least eighteen years old

- Provide valid identification and proof of residence

- Be a resident or citizen of Kenya

Meeting these criteria ensures that both parties can legally manage the account and access its features.

Quick guide on how to complete equity bank joint account requirements

Prepare Equity Bank Joint Account Requirements effortlessly on any device

Digital document management has become a favored choice for businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Equity Bank Joint Account Requirements on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to adjust and eSign Equity Bank Joint Account Requirements with ease

- Find Equity Bank Joint Account Requirements and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Equity Bank Joint Account Requirements and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the equity bank joint account requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the joint account requirements in Kenya?

In Kenya, the joint account requirements typically include identification documents for all parties, such as national IDs or passports, proof of address, and the completion of a joint account application form. Each bank may have specific requirements, so it's essential to check with your chosen financial institution. airSlate SignNow helps streamline the document signing process once you have all the necessary paperwork.

-

How can airSlate SignNow help with managing joint account documentation in Kenya?

airSlate SignNow simplifies the management of joint account documentation in Kenya by allowing users to easily send and eSign required forms electronically. This eliminates the hassle of physical paperwork and speeds up the setup process for joint accounts. With user-friendly features, you can manage your documents from anywhere.

-

Are there any fees associated with opening a joint account in Kenya?

Many banks in Kenya may charge maintenance fees for joint accounts, while others may offer free options. It is crucial to inquire about these fees while meeting the joint account requirements in Kenya. airSlate SignNow can provide users with an overview of any documents that may outline these fees clearly for better financial planning.

-

What are the benefits of a joint account in Kenya?

A joint account in Kenya can provide several benefits, including shared access to funds for expenses, enhanced financial management for couples or business partners, and simplified record-keeping for tax purposes. It fosters transparency and collaboration in financial matters. Using airSlate SignNow makes it easy to manage and sign documents related to your joint account.

-

Can I access my joint account documents online?

Yes, you can access your joint account documents online, making it easy to manage your finances anytime, anywhere. Many banks offer online banking services where you can view transactions and account statements. With airSlate SignNow, you can also securely store and eSign important documents related to your joint account digitally.

-

What integrations does airSlate SignNow offer for managing joint account needs?

airSlate SignNow offers integrations with several platforms, including CRM systems and financial management tools, to ensure seamless document management for your joint account needs. These integrations make it possible to automate workflows and enhance productivity. Explore how these features can help you manage your joint account requirements in Kenya more effectively.

-

Is there a mobile app for airSlate SignNow to manage joint account documents?

Yes, airSlate SignNow offers a mobile app that allows users to manage joint account documents on the go. You can easily send and eSign documents directly from your smartphone or tablet, ensuring convenience and accessibility. This is particularly beneficial for users managing joint account requirements in Kenya, as it provides flexibility in document handling.

Get more for Equity Bank Joint Account Requirements

Find out other Equity Bank Joint Account Requirements

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document