M1W, Minnesota Income Tax Withheld Form

What is the M1W, Minnesota Income Tax Withheld

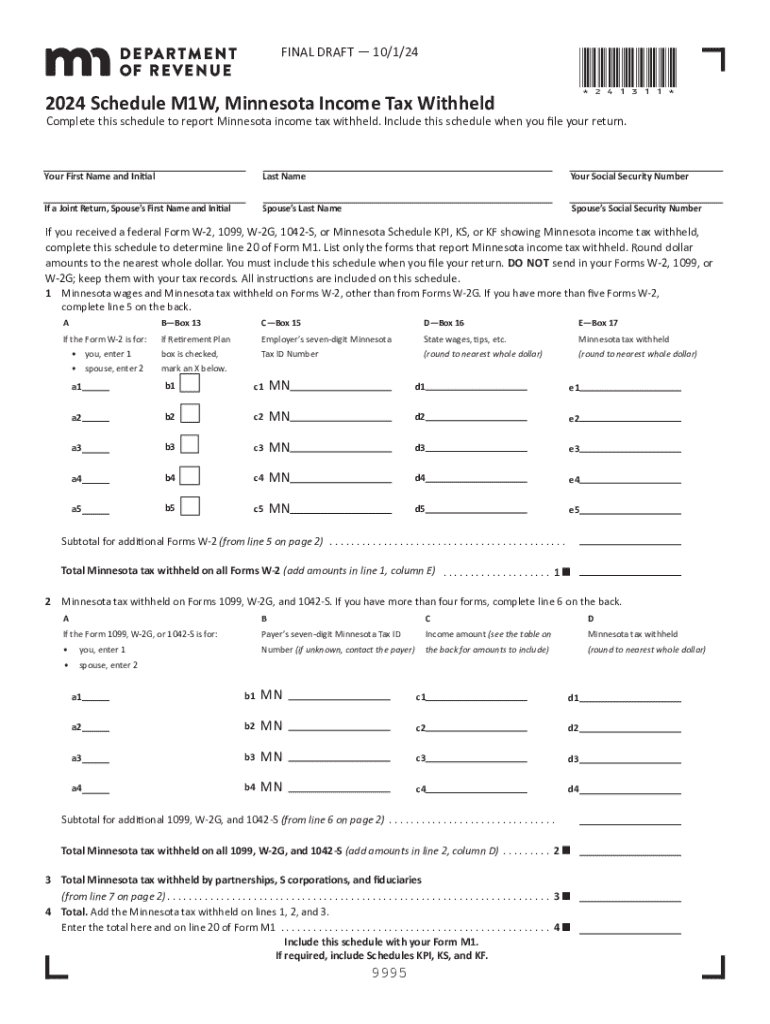

The M1W form is the Minnesota Income Tax Withheld form, which is used to report income tax that has been withheld from an employee's wages or other compensation. This form is essential for employers who need to submit the withheld amounts to the Minnesota Department of Revenue. The M1W helps ensure that employees receive proper credit for the taxes withheld when they file their annual income tax returns. Understanding the M1W is crucial for both employers and employees to maintain compliance with state tax regulations.

How to use the M1W, Minnesota Income Tax Withheld

To use the M1W form, employers must first complete the form accurately, detailing the total amount of income tax withheld from their employees. This includes wages, bonuses, and any other taxable income. Once completed, the M1W must be submitted to the Minnesota Department of Revenue along with the payment of the withheld taxes. Employers should keep copies of the submitted M1W for their records and provide employees with a copy for their personal tax filings. This ensures transparency and helps employees verify their withholding amounts during tax season.

Steps to complete the M1W, Minnesota Income Tax Withheld

Completing the M1W form involves several key steps:

- Gather all necessary payroll records for the reporting period.

- Calculate the total amount of Minnesota income tax withheld from each employee's paycheck.

- Fill out the M1W form, ensuring all information is accurate and complete.

- Submit the form along with the total payment of withheld taxes to the Minnesota Department of Revenue.

- Retain a copy of the completed M1W for your records and provide copies to employees as needed.

Filing Deadlines / Important Dates

Filing deadlines for the M1W form are critical for compliance. Typically, employers must submit the M1W by the end of the month following the end of the quarter in which the taxes were withheld. For example, if taxes were withheld in the first quarter, the M1W should be filed by April 30. It is important to stay updated on any changes to these deadlines, as they can vary from year to year. Missing a deadline may result in penalties or interest on unpaid taxes.

Required Documents

When completing the M1W form, employers should have the following documents ready:

- Payroll records detailing wages and tax withholdings for each employee.

- Previous M1W forms, if applicable, for reference.

- Any correspondence from the Minnesota Department of Revenue regarding tax obligations.

Having these documents organized will streamline the process of completing and submitting the M1W.

Who Issues the Form

The M1W form is issued by the Minnesota Department of Revenue. This state agency is responsible for managing tax collection and ensuring compliance with state tax laws. Employers can obtain the M1W form directly from the Minnesota Department of Revenue's official website or through their tax professional. It is important for employers to use the most current version of the form to ensure compliance with any new regulations or changes in tax law.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1w minnesota income tax withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2024 Minnesota tax changes for businesses?

The 2024 Minnesota tax changes can signNowly impact businesses by altering tax rates and regulations. Understanding these changes is crucial for compliance and financial planning. airSlate SignNow can help streamline document management related to tax filings, ensuring you stay updated with the latest requirements.

-

How can airSlate SignNow assist with 2024 Minnesota tax documentation?

airSlate SignNow simplifies the process of preparing and signing tax documents for the 2024 Minnesota tax season. Our platform allows you to easily create, send, and eSign necessary forms, ensuring that your documentation is accurate and submitted on time. This efficiency can save you valuable time and reduce the risk of errors.

-

What features does airSlate SignNow offer for managing 2024 Minnesota tax forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically designed for tax forms. These tools help you manage your 2024 Minnesota tax documents efficiently, ensuring that you can focus on your business while we handle the paperwork. Our platform is user-friendly and designed for all skill levels.

-

Is airSlate SignNow cost-effective for handling 2024 Minnesota tax needs?

Yes, airSlate SignNow is a cost-effective solution for managing your 2024 Minnesota tax needs. Our pricing plans are designed to fit various business sizes and budgets, allowing you to choose the best option for your requirements. By reducing the time spent on paperwork, you can save money and allocate resources more effectively.

-

Can I integrate airSlate SignNow with my existing accounting software for 2024 Minnesota tax?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your 2024 Minnesota tax documents. This integration allows for automatic data transfer, reducing manual entry and minimizing errors. You can streamline your workflow and ensure that all your financial documents are in sync.

-

What benefits does airSlate SignNow provide for small businesses during the 2024 Minnesota tax season?

For small businesses, airSlate SignNow provides numerous benefits during the 2024 Minnesota tax season, including time savings and enhanced accuracy. Our platform allows for quick document preparation and eSigning, which can signNowly reduce the stress associated with tax filing. Additionally, our customer support is available to assist you with any questions you may have.

-

How secure is airSlate SignNow for handling sensitive 2024 Minnesota tax information?

Security is a top priority at airSlate SignNow, especially when handling sensitive 2024 Minnesota tax information. Our platform employs advanced encryption and security protocols to protect your data. You can confidently manage your tax documents, knowing that your information is safe and compliant with industry standards.

Get more for M1W, Minnesota Income Tax Withheld

- Roofing contract for contractor utah form

- Electrical contract for contractor utah form

- Sheetrock drywall contract for contractor utah form

- Flooring contract for contractor utah form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract utah form

- Notice of intent to enforce forfeiture provisions of contact for deed utah form

- Final notice of forfeiture and request to vacate property under contract for deed utah form

- Buyers request for accounting from seller under contract for deed utah form

Find out other M1W, Minnesota Income Tax Withheld

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure