Form 10b in Word Format

What is the Form 10b In Word Format

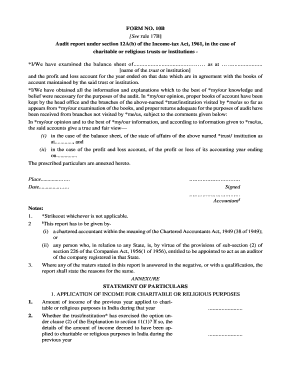

The Form 10b is a document utilized primarily for tax purposes, specifically related to income tax filings in the United States. This form is designed to collect essential information regarding the taxpayer's income, deductions, and other relevant financial data. The Word format of the Form 10b allows for easy editing and filling out, making it accessible for users who prefer digital documentation. It is important to ensure that the form is completed accurately to comply with IRS regulations.

How to use the Form 10b In Word Format

Using the Form 10b in Word format involves several straightforward steps. First, download the form from a reliable source. Once downloaded, open the document in a compatible word processor. Fill in the required fields, ensuring that all information is accurate and complete. After filling out the form, it is advisable to save a copy for your records. If necessary, you can print the completed form for submission to the relevant tax authorities.

Steps to complete the Form 10b In Word Format

Completing the Form 10b in Word format requires careful attention to detail. Follow these steps for a successful submission:

- Download the Form 10b in Word format from a trusted source.

- Open the document in a word processing application.

- Enter your personal information, including name, address, and Social Security number.

- Fill in the income details, including any applicable deductions.

- Review all entries for accuracy.

- Save the completed form and print it if necessary.

Legal use of the Form 10b In Word Format

The Form 10b is legally recognized when filled out correctly and submitted according to IRS guidelines. Digital versions of the form, such as the Word format, maintain the same legal standing as paper versions, provided they meet the necessary compliance requirements. It is crucial to ensure that the form is signed and dated appropriately, as this validates the information provided and fulfills legal obligations.

Key elements of the Form 10b In Word Format

Several key elements must be included when filling out the Form 10b. These include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Total income earned during the tax year.

- Deductions: Any applicable deductions that can reduce taxable income.

- Signature: A signature is required to validate the form.

- Date: The date of completion must be included.

Form Submission Methods (Online / Mail / In-Person)

The completed Form 10b can be submitted through various methods. Taxpayers can choose to file electronically using IRS-approved software, which often simplifies the process and ensures accuracy. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submission is also an option at designated IRS locations. Each method has its own advantages, so it is advisable to choose one that best suits your needs.

Quick guide on how to complete 10b format

Effortlessly Prepare 10b format on Any Device

The management of documents online has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Manage 10b form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign form 10b with Ease

- Obtain signnow com fill and sign pdf form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize signNow portions of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to apply your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and mistakes requiring the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and electronically sign 10b download to ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 10b download pdf

Create this form in 5 minutes!

How to create an eSignature for the it 10b form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask what is 10 b form

-

What is the new form 10b in word format?

The new form 10b in word format refers to a specific document template used for various business and legal requirements. This editable format allows users to fill in necessary details and customize the document as needed, ensuring compliance and accuracy in submissions.

-

How can I access the new form 10b in word format?

You can easily access the new form 10b in word format through airSlate SignNow's document template library. Simply search for the form within our platform, and you can download it or start editing it directly online.

-

What features does airSlate SignNow offer for editing the new form 10b in word format?

airSlate SignNow provides a user-friendly interface to edit the new form 10b in word format. Features include text editing, document signing, and integration with other tools, allowing users to streamline their document management process efficiently.

-

Is there a cost associated with using the new form 10b in word format on airSlate SignNow?

While the new form 10b in word format is free to access, airSlate SignNow offers subscription plans that include additional features such as advanced editing tools and unlimited signing capabilities. Pricing varies based on the features you need, ensuring flexibility for all users.

-

Can I integrate the new form 10b in word format with other applications?

Yes, airSlate SignNow allows seamless integration of the new form 10b in word format with various applications, such as Google Drive, Dropbox, and CRMs. This enhances efficiency by enabling users to pull or save documents directly from their preferred platforms.

-

What are the benefits of using the new form 10b in word format with airSlate SignNow?

Using the new form 10b in word format with airSlate SignNow streamlines your document workflow, reduces paper usage, and enhances collaboration. It empowers teams to eSign documents quickly, improving turnaround times and ensuring compliance in their operations.

-

Is the new form 10b in word format compliant with legal standards?

Yes, the new form 10b in word format available through airSlate SignNow is designed to meet legal standards for electronic signatures and documentation. Our platform ensures compliance with regulations, providing peace of mind when sending and signing sensitive documents.

Get more for new form 10b in excel format

Find out other it 10b

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free