State Form 43709

What is the State Form 43709

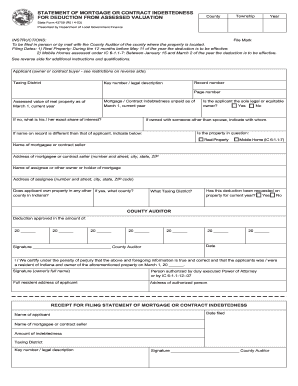

The State Form 43709, also known as the Indiana Mortgage Exemption State Form 43709, is a document used in Indiana to claim a mortgage exemption. This form is essential for homeowners who wish to report their mortgage or contract indebtedness to the state. By completing this form, individuals can potentially reduce their property tax obligations based on the amount of their mortgage. The form is specifically designed to ensure that the state has accurate information regarding the financial obligations of homeowners.

How to use the State Form 43709

Using the State Form 43709 involves a straightforward process. First, gather all necessary information, including details about your mortgage or contract indebtedness. This includes the lender's name, loan amount, and property details. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Once completed, the form must be submitted to the appropriate county office for processing. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the State Form 43709

Completing the State Form 43709 requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the form from the Indiana Department of Revenue or a local county office.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about your mortgage, including the lender's name and the loan amount.

- Indicate the property for which the exemption is being claimed.

- Review the form for accuracy and completeness before submission.

Key elements of the State Form 43709

The State Form 43709 includes several key elements that must be accurately reported. These elements are crucial for determining eligibility for the mortgage exemption. Key components include:

- Personal Information: Your name, address, and contact information.

- Lender Information: Name of the mortgage lender and loan details.

- Property Description: Information about the property associated with the mortgage.

- Loan Amount: The total amount of the mortgage or contract indebtedness.

Legal use of the State Form 43709

The legal use of the State Form 43709 is governed by Indiana state laws regarding property taxation and exemptions. Completing this form accurately is essential to ensure compliance with state regulations. The information provided on the form must be truthful and verifiable, as any discrepancies could lead to penalties or denial of the exemption. It is important for homeowners to understand their rights and responsibilities when submitting this form to avoid legal issues.

Form Submission Methods (Online / Mail / In-Person)

The State Form 43709 can be submitted through various methods, depending on the preferences of the filer and the requirements of the local county office. Common submission methods include:

- Online Submission: Some counties may allow electronic submission through their official websites.

- Mail: The completed form can be mailed to the appropriate county office address.

- In-Person: Homeowners can also submit the form in person at their local county office for immediate processing.

Quick guide on how to complete state form 43709 5476796

Complete State Form 43709 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage State Form 43709 on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related task today.

How to edit and eSign State Form 43709 effortlessly

- Obtain State Form 43709 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important parts of the documents or conceal sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign State Form 43709 and ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 43709 5476796

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 43709 Indiana and why do I need to fill it out?

Form 43709 Indiana is used for various state-specific applications, such as tax exemptions or regulatory compliance. Understanding how to fill out form 43709 Indiana correctly is essential to ensure that your application is processed efficiently and accurately.

-

How can airSlate SignNow help me fill out form 43709 Indiana?

airSlate SignNow simplifies the process of filling out form 43709 Indiana by providing user-friendly templates and guided instructions. With its electronic signing features, you can complete the form digitally, ensuring a hassle-free experience.

-

Are there any costs associated with using airSlate SignNow for form 43709 Indiana?

airSlate SignNow offers a cost-effective solution that includes various pricing plans to suit your business needs. Whether you're an individual or a larger organization, there are options available to help you efficiently manage how to fill out form 43709 Indiana without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for filling out form 43709 Indiana?

Yes, airSlate SignNow supports numerous integrations with popular applications, allowing you to streamline your workflow. This makes it easier to gather information required for how to fill out form 43709 Indiana and manage your documents effectively.

-

What are the key features of airSlate SignNow that assist with form 43709 Indiana?

Some key features of airSlate SignNow include template creation, electronic signatures, and real-time tracking. These tools not only aid in how to fill out form 43709 Indiana but also enhance the overall efficiency of your document management process.

-

Is it secure to use airSlate SignNow to fill out form 43709 Indiana?

Absolutely! airSlate SignNow takes data security seriously, employing advanced encryption and compliance measures. You can feel confident that your sensitive information while learning how to fill out form 43709 Indiana is protected.

-

What support options are available if I need help with form 43709 Indiana?

airSlate SignNow offers extensive customer support, including tutorials and a dedicated help center. If you're struggling with how to fill out form 43709 Indiana, you can signNow out to the support team for personalized assistance.

Get more for State Form 43709

Find out other State Form 43709

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement