Apss301 Form

What is the Apss301

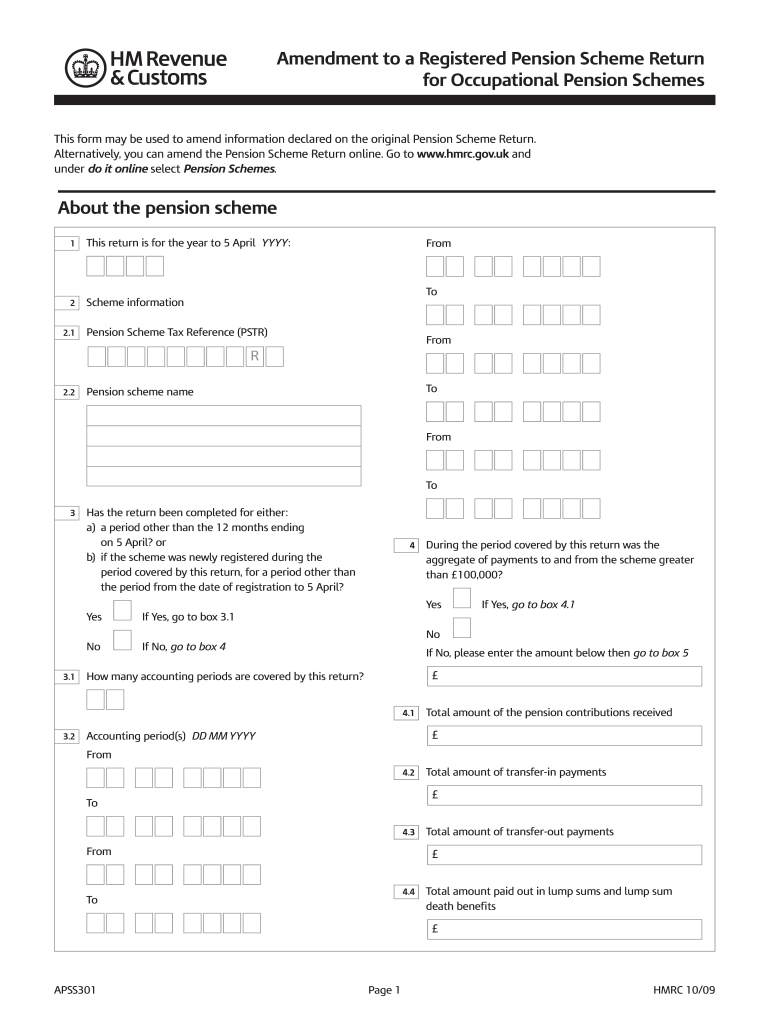

The Apss301 form, also known as the HMRC Apss301, is a critical document used for reporting pension scheme returns in the United States. This form is essential for pension scheme administrators to ensure compliance with regulatory requirements. It collects vital information about the pension scheme, including contributions, member details, and the overall financial status of the scheme. Accurate completion of the Apss301 is crucial for maintaining the legitimacy of the pension scheme and ensuring that all regulatory obligations are met.

How to use the Apss301

Utilizing the Apss301 form effectively involves several key steps. First, gather all necessary information regarding the pension scheme and its members. This includes personal details of the members, contribution amounts, and any relevant financial data. Next, access the Apss301 PDF, which can be filled out electronically for convenience. Ensure that all sections are completed accurately to avoid delays in processing. Once the form is filled out, it can be submitted according to the specified guidelines, either online or through traditional mail.

Steps to complete the Apss301

Completing the Apss301 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect all necessary data related to the pension scheme and its members.

- Access the Form: Obtain the Apss301 PDF from an official source.

- Fill Out the Form: Enter all required information in the designated fields, ensuring accuracy.

- Review: Double-check all entries for correctness and completeness.

- Submit: Send the completed form via the preferred submission method, either online or by mail.

Legal use of the Apss301

The legal use of the Apss301 is governed by specific regulations that ensure compliance with pension scheme reporting requirements. To be considered valid, the form must be filled out accurately and submitted within the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions for the pension scheme administrators. Utilizing reliable electronic tools, such as signNow, can enhance the legitimacy of the submission by providing a secure environment for e-signatures and maintaining compliance with relevant laws.

Required Documents

When preparing to complete the Apss301, certain documents are necessary to ensure all information is accurate and comprehensive. Required documents typically include:

- Pension scheme registration details

- Member contribution records

- Financial statements of the pension scheme

- Identification details of scheme members

Having these documents readily available will facilitate a smoother completion process and ensure that all required information is accurately reported.

Filing Deadlines / Important Dates

Adhering to filing deadlines for the Apss301 is essential to avoid penalties. Important dates include:

- Annual submission deadline for the pension scheme return

- Quarterly deadlines for reporting contributions

- Specific dates for amendments or corrections to previously submitted forms

Staying informed about these deadlines will help ensure compliance and avoid any potential issues with regulatory authorities.

Quick guide on how to complete apss301

Prepare Apss301 effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Apss301 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Apss301 without effort

- Locate Apss301 and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Apss301 and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the apss301

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'apss301' and how does it relate to airSlate SignNow?

'apss301' refers to an advanced feature set offered by airSlate SignNow. This includes tools for secure document signing and comprehensive eSignature solutions designed to streamline workflows for businesses. By utilizing 'apss301', users can ensure their document transactions are both efficient and compliant.

-

How much does airSlate SignNow cost with the 'apss301' feature?

The pricing for airSlate SignNow with the 'apss301' feature is competitive and varies based on the specific plan you select. Clients can choose from several pricing tiers that provide varied features to fit different business needs. It's best to check the pricing page for the latest offers and promotions regarding 'apss301'.

-

What are the key features included in the 'apss301' package?

The 'apss301' package includes features such as customizable templates, automated workflows, and advanced security measures. Businesses benefit from not only ease of use but also enhanced efficiency in sending and receiving documents for eSignature. Additionally, 'apss301' offers integration capabilities with various applications to foster seamless operations.

-

How can airSlate SignNow with 'apss301' improve my business operations?

Implementing airSlate SignNow with 'apss301' can signNowly enhance your business processes by reducing the time spent on document management. This feature allows for faster signing processes and quicker turnaround times overall. Furthermore, it promotes better organization and tracking of documents, leading to improved productivity.

-

Does airSlate SignNow support integrations with other software using 'apss301'?

Yes, airSlate SignNow with 'apss301' supports numerous integrations with popular software applications like CRM and project management tools. This functionality enables businesses to incorporate e-signatures easily into their existing workflows. Integrations help streamline operations while maintaining high efficiency.

-

Is airSlate SignNow compliant with legal regulations for eSignatures under 'apss301'?

Absolutely! airSlate SignNow complies with all major laws and regulations governing electronic signatures, including the ESIGN Act and UETA. The 'apss301' feature set ensures your electronic documents are legally binding and secure. So you can use it with confidence for critical business transactions.

-

Can I try the 'apss301' features before committing to a paid plan?

Yes, airSlate SignNow offers a free trial that allows you to explore the capabilities of the 'apss301' features. This trial period is an excellent opportunity for users to assess how the software can meet their business needs in document management. You can experience the platform without any financial commitment.

Get more for Apss301

Find out other Apss301

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free