Income Tax Clearance Certificate by Ca Format

What is the Income Tax Clearance Certificate By Ca Format

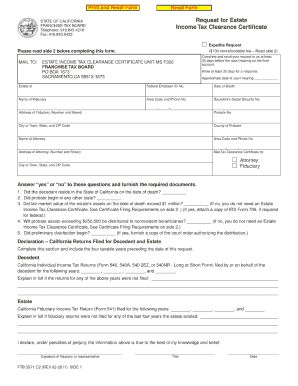

The Income Tax Clearance Certificate by CA format is a formal document that certifies an individual or business has complied with all tax obligations as per California tax laws. This certificate is essential for various financial transactions, including loan applications, property sales, and business registrations. It confirms that the taxpayer has no outstanding tax liabilities or issues with the California Franchise Tax Board. The format typically includes the taxpayer's name, identification number, and a statement of compliance with tax regulations.

How to obtain the Income Tax Clearance Certificate By Ca Format

To obtain the Income Tax Clearance Certificate in California, taxpayers must follow a specific process. First, ensure all tax returns are filed and any outstanding taxes are paid. Next, submit a request to the California Franchise Tax Board, either online or via mail. The request should include relevant personal information, such as the taxpayer's identification number and contact details. Upon review, the board will issue the certificate if all requirements are met. It is advisable to keep a copy of all submitted documents for reference.

Steps to complete the Income Tax Clearance Certificate By Ca Format

Completing the Income Tax Clearance Certificate by CA format involves several key steps:

- Gather necessary documents, including tax returns and payment receipts.

- Fill out the certificate format accurately, ensuring all details are correct.

- Submit the completed certificate to the California Franchise Tax Board.

- Wait for confirmation of compliance from the board.

- Receive the certificate once all requirements are satisfied.

Key elements of the Income Tax Clearance Certificate By Ca Format

The key elements of the Income Tax Clearance Certificate by CA format include:

- Taxpayer Information: Name, address, and identification number.

- Compliance Statement: Confirmation of no outstanding tax liabilities.

- Issuing Authority: California Franchise Tax Board details.

- Date of Issue: The date the certificate is issued.

- Signature: Authorized signature from the issuing authority.

Legal use of the Income Tax Clearance Certificate By Ca Format

The Income Tax Clearance Certificate by CA format serves as a legal document that verifies a taxpayer's compliance with California tax laws. It is often required in legal and financial transactions, such as securing loans, transferring property, or applying for business licenses. The certificate assures third parties that the taxpayer has fulfilled all tax obligations, thereby minimizing the risk of legal disputes related to tax liabilities.

Who Issues the Form

The Income Tax Clearance Certificate is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring compliance among taxpayers. The FTB reviews requests for clearance certificates and verifies that all tax obligations have been met before issuing the document.

Quick guide on how to complete income tax clearance certificate by ca format

Effortlessly Prepare Income Tax Clearance Certificate By Ca Format on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without hindrances. Manage Income Tax Clearance Certificate By Ca Format on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Income Tax Clearance Certificate By Ca Format with Ease

- Find Income Tax Clearance Certificate By Ca Format and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, a process that takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Income Tax Clearance Certificate By Ca Format and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax clearance certificate by ca format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax clearance certificate California?

A tax clearance certificate California is an official document issued by the state, confirming that a business or individual has fulfilled all tax obligations. Obtaining this certificate is essential for various transactions, including business licenses and permits.

-

How can airSlate SignNow help with obtaining a tax clearance certificate California?

airSlate SignNow simplifies the process of obtaining a tax clearance certificate California by allowing you to electronically sign and manage all necessary documentation. This streamlines the process, reducing the time it takes to secure your certificate.

-

What are the costs associated with getting a tax clearance certificate California?

The fees for a tax clearance certificate California can vary based on the issuing agency and complexity of your tax situation. Using airSlate SignNow can help you save money on document management and expedite the submission process, potentially minimizing costs.

-

Is airSlate SignNow compatible with tax software for obtaining a tax clearance certificate California?

Yes, airSlate SignNow integrates seamlessly with various tax and financial software solutions. This compatibility allows for easy management of documents required to secure your tax clearance certificate California.

-

What documents do I need to provide to get a tax clearance certificate California?

Typically, to obtain a tax clearance certificate California, you need to provide documentation proving your current tax status, including prior tax returns and payment confirmations. airSlate SignNow makes it easy to gather and send these documents securely.

-

How long does it take to receive a tax clearance certificate California?

The time to receive a tax clearance certificate California can vary, typically ranging from a few days to a couple of weeks, depending on the agency's processing times. Using airSlate SignNow can expedite your document submission, potentially speeding up the entire process.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents provides a secure, efficient, and legally compliant way to finalize important paperwork, including your tax clearance certificate California. The platform's user-friendly interface ensures a smooth experience for all users.

Get more for Income Tax Clearance Certificate By Ca Format

- Tire kingdom credit card form

- Ctvt form

- Ihsaa skin form

- 2 for each box rate enjoyment and mastery sense of achievement from 0 not at all to 10 a lot form

- Idfc mutual fund minor to major form

- X xxockm form

- Civil rights evaluation tool form

- Registration form for security engineering planning assistance training sepat security engineering planning assistance training

Find out other Income Tax Clearance Certificate By Ca Format

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later