Dividend Warrant Format

What is the dividend warrant format?

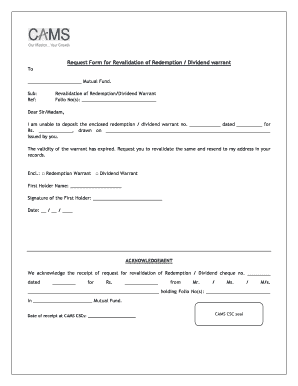

The dividend warrant format is a formal document issued by a company to its shareholders, representing a payment of dividends. It serves as a negotiable instrument, allowing shareholders to receive their dividend payments in a structured manner. The format typically includes essential information such as the name of the shareholder, the amount of dividend due, the date of issue, and the signature of an authorized company representative. Understanding this format is crucial for both companies and shareholders to ensure proper processing and compliance with relevant banking laws.

Key elements of the dividend warrant format

The dividend warrant format consists of several key elements that must be included for it to be valid. These elements typically include:

- Company Name: The legal name of the issuing company.

- Shareholder Information: Name and address of the shareholder entitled to the dividend.

- Dividend Amount: The total amount of dividend payable to the shareholder.

- Date of Issue: The date when the dividend warrant is issued.

- Authorized Signature: Signature of an authorized representative of the company, confirming the legitimacy of the warrant.

Including these elements ensures that the dividend warrant is legally binding and can be processed by financial institutions.

How to use the dividend warrant format

Using the dividend warrant format involves several straightforward steps. First, ensure that the warrant is properly filled out with accurate information regarding the shareholder and the dividend amount. Next, the authorized representative of the company must sign the document to validate it. Once completed, the dividend warrant can be distributed to shareholders, who can then present it to their bank for payment. It is essential to retain copies of issued warrants for record-keeping and compliance purposes.

Steps to complete the dividend warrant format

Completing the dividend warrant format requires careful attention to detail. Follow these steps:

- Gather the necessary information about the shareholder, including their name and address.

- Determine the dividend amount to be issued.

- Fill in the dividend warrant format with the collected information.

- Have an authorized company representative sign the warrant.

- Distribute the completed dividend warrants to the respective shareholders.

By following these steps, companies can ensure that they issue valid and effective dividend warrants.

Legal use of the dividend warrant format

The legal use of the dividend warrant format is governed by various banking laws and regulations. In the United States, it is important for companies to comply with the Uniform Commercial Code (UCC) and other relevant statutes when issuing dividend warrants. These regulations ensure that the warrants are treated as negotiable instruments, allowing shareholders to cash them at their financial institutions. Proper adherence to these legal requirements helps prevent disputes and ensures smooth transactions.

Examples of using the dividend warrant format

Examples of using the dividend warrant format can be found in various corporate scenarios. For instance, a publicly traded company may issue dividend warrants to its shareholders following a successful quarterly earnings report. Another example is a private company distributing dividend warrants to its investors after a profitable fiscal year. Each instance demonstrates how the dividend warrant format facilitates the distribution of profits to shareholders in a clear and structured manner.

Quick guide on how to complete dividend warrant format

Effortlessly Prepare Dividend Warrant Format on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Dividend Warrant Format on any device using the airSlate SignNow applications for Android or iOS, and enhance any paper-based procedure today.

The Easiest Way to Modify and Electronically Sign Dividend Warrant Format Seamlessly

- Locate Dividend Warrant Format and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Produce your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click the Done button to preserve your changes.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Dividend Warrant Format and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dividend warrant format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dividend warrant sample?

A dividend warrant sample is a document issued by a company to its shareholders, indicating the payment of dividends. It includes details such as the amount, date of payment, and the shareholder's information. Utilizing airSlate SignNow, you can create, sign, and send dividend warrant samples efficiently.

-

How can I create a dividend warrant sample using airSlate SignNow?

Creating a dividend warrant sample with airSlate SignNow is simple. You can use our user-friendly template editor to customize your document according to your company's requirements. Once modified, you can easily send it for eSignature to expedite the approval process.

-

What are the benefits of using airSlate SignNow for dividend warrants?

By using airSlate SignNow for dividend warrants, you ensure a streamlined and secure method of document management. The platform offers automated workflows, improving efficiency and reducing paper usage. Additionally, it enhances compliance by providing a clear audit trail for every dividend warrant sample.

-

Is airSlate SignNow suitable for small businesses looking to manage dividend warrants?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective solutions make it easy for small businesses to create and manage their dividend warrant samples without incurring high costs associated with traditional methods.

-

Can I integrate airSlate SignNow with my existing accounting software for dividend warrants?

Yes, airSlate SignNow offers integration capabilities with various accounting software. This means you can easily synchronize your dividend warrant sample workflow with your existing systems, ensuring a smooth process and minimizing the chance of errors during data entry.

-

How secure is the information in my dividend warrant samples on airSlate SignNow?

Security is a priority at airSlate SignNow. All dividend warrant samples and related data are encrypted and stored securely. Additionally, our platform complies with industry standards to protect your sensitive information throughout the signing and document storage processes.

-

What pricing plans are available for using airSlate SignNow for dividend warrants?

airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose from free trials, monthly subscriptions, or annual plans based on your usage and features required to manage dividend warrant samples effectively. You can check our website for detailed pricing information.

Get more for Dividend Warrant Format

- Nys certificate of surrender of authority section 806 form

- Petition for pardon after completion of sentence form

- Form 420 request for new chemical approval gmp sop logo

- Citizenship grades meaning form

- House registration form

- Fa 29 form

- Guide letters wisconsin department of workforce development form

- Defendants default was entered by the clerk upon plaintiffs application form

Find out other Dividend Warrant Format

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document