Application for Credit Form

What is the application for credit?

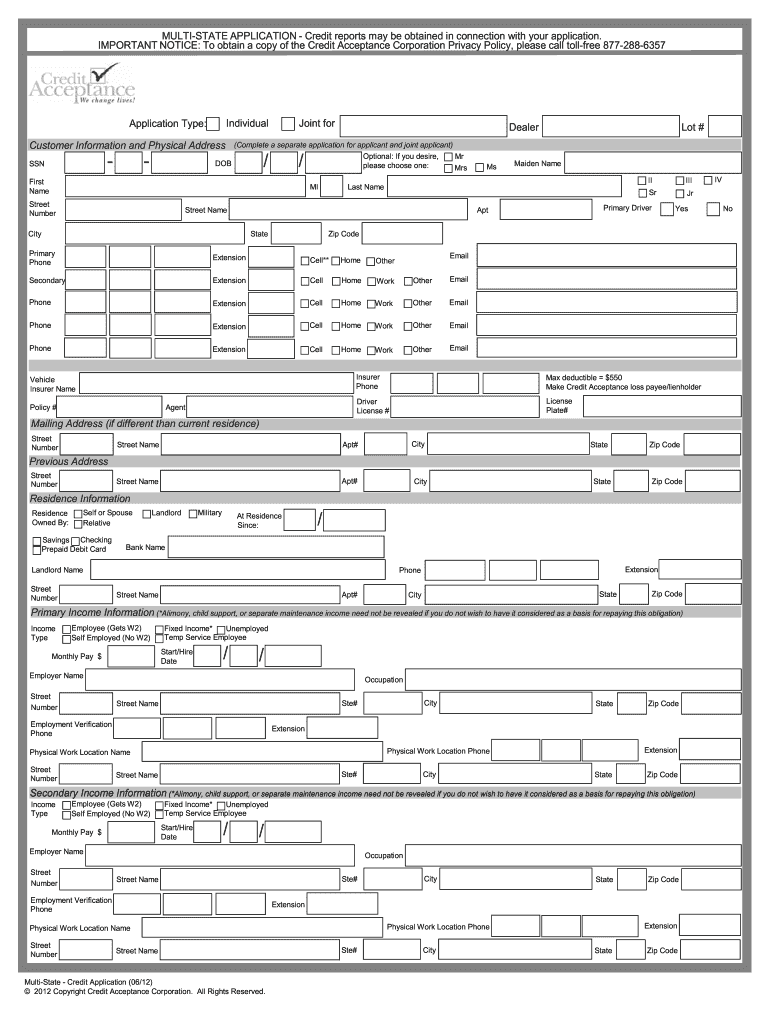

The application for credit is a formal document that individuals or businesses submit to financial institutions to request credit. This document typically includes personal information, financial history, and details about the requested credit amount. It serves as a basis for the lender to evaluate the applicant's creditworthiness and make informed lending decisions. The application process is crucial for establishing trust between the borrower and the lender, ensuring that both parties understand the terms and conditions of the credit being offered.

Steps to complete the application for credit

Completing the application for credit involves several key steps to ensure accuracy and compliance with lending requirements. Here are the essential steps:

- Gather necessary personal and financial information, including Social Security number, income details, and employment history.

- Choose the type of credit you are applying for, such as a personal loan, credit card, or mortgage.

- Fill out the application form accurately, ensuring all information is complete and truthful.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Legal use of the application for credit

The legal use of the application for credit is governed by various regulations that protect both the lender and the borrower. To be legally binding, the application must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents hold the same legal weight as their paper counterparts. It is essential for applicants to understand their rights and obligations under these laws to avoid potential disputes.

Key elements of the application for credit

Understanding the key elements of the application for credit can help applicants prepare effectively. Important components typically include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and income.

- Financial Information: Existing debts, assets, and monthly expenses.

- Credit Request: Desired credit amount and purpose of the loan.

How to obtain the application for credit

Obtaining the application for credit can be done through several channels. Most financial institutions provide access to their credit applications online through their websites. Applicants can also request a physical application at local branches or customer service centers. Additionally, some lenders may offer mobile applications for easier access. It is advisable to compare different lenders' applications to find the one that best fits your needs.

Form submission methods

There are various methods to submit the application for credit, each with its own advantages. Common submission methods include:

- Online Submission: Many lenders allow applicants to fill out and submit the application directly through their websites, providing a quick and convenient option.

- Mail Submission: Applicants can print the completed application and send it via postal service to the lender's designated address.

- In-Person Submission: Visiting a local branch allows applicants to submit their application directly to a representative, who can also answer any questions.

Quick guide on how to complete application for credit

Complete Application For Credit effortlessly on any device

Online document administration has become increasingly favored among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Application For Credit on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The most efficient way to alter and eSign Application For Credit without hassle

- Locate Application For Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Application For Credit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Credit Acceptance Corporation and how does it work?

What is Credit Acceptance Corporation? It is a financing company that specializes in auto loans for consumers with varying credit histories. By offering vehicle financing solutions, Credit Acceptance Corporation enables dealerships to cater to a broader range of customers.

-

What services does Credit Acceptance Corporation provide?

What is Credit Acceptance Corporation known for? The company primarily provides automotive financing, working with car dealerships to offer flexible loan options for customers. They focus on helping individuals who may have difficulty obtaining financing through traditional means.

-

What are the benefits of using Credit Acceptance Corporation?

What is Credit Acceptance Corporation's advantage for consumers? The primary benefit is its ability to approve a higher percentage of loan applications, allowing more individuals to secure financing for their vehicle. This inclusivity helps customers build or improve their credit scores over time.

-

How does Credit Acceptance Corporation impact dealership sales?

What is Credit Acceptance Corporation's role for car dealerships? The company increases sales opportunities for dealerships by enabling them to offer financing to a wider range of customers. This helps dealerships close more deals, improving overall profitability.

-

What are the pricing options available with Credit Acceptance Corporation?

What is Credit Acceptance Corporation's pricing structure? The company typically charges a higher interest rate compared to traditional lenders, reflecting the risk associated with subprime lending. It’s important for customers to evaluate the total cost of financing based on their specific loan terms.

-

What documents are required to apply for financing through Credit Acceptance Corporation?

What is Credit Acceptance Corporation's application process like? To apply for financing, customers need to provide basic personal information, proof of income, and details about the vehicle they wish to purchase. These requirements help facilitate a smooth approval process.

-

Are there any limitations on the vehicles financed through Credit Acceptance Corporation?

What is Credit Acceptance Corporation's vehicle policy? Generally, they finance used vehicles, with certain age and mileage limitations. It’s crucial to consult the dealership or Credit Acceptance Corporation for specific eligible vehicle criteria.

Get more for Application For Credit

Find out other Application For Credit

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF