Affidavit of Domestic Partnership Harris County Texas Form

What is the Affidavit of Domestic Partnership in Texas?

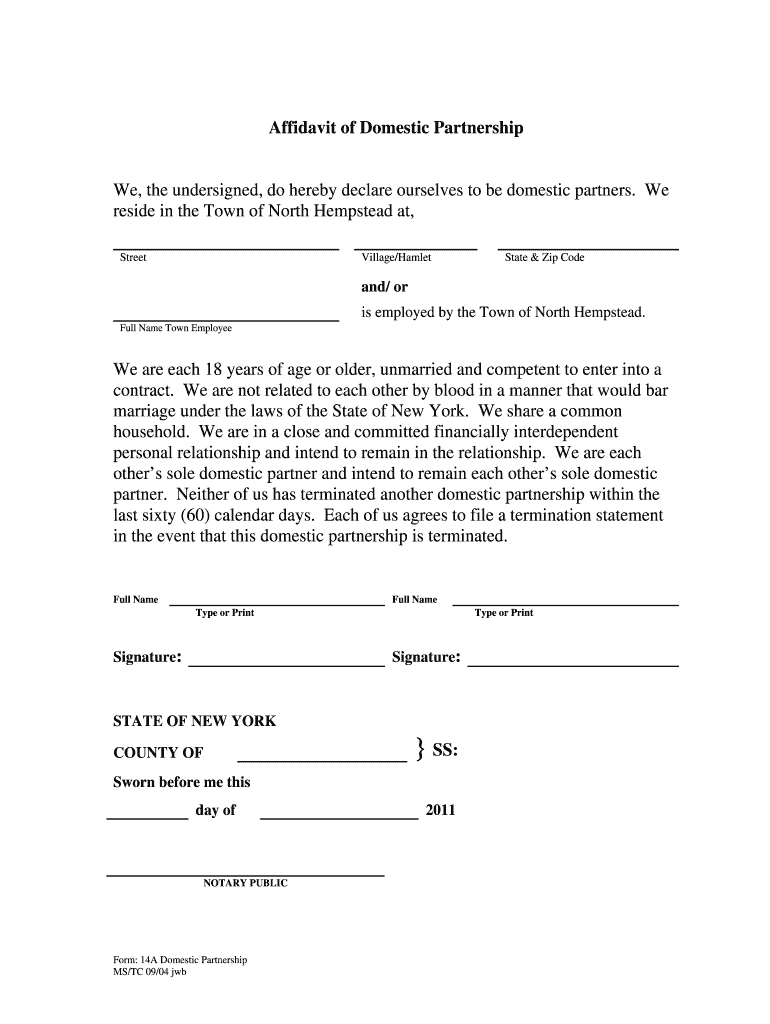

The Affidavit of Domestic Partnership is a legal document that establishes a domestic partnership in Texas. This form is typically used by couples who wish to formalize their relationship without marrying. It serves as a declaration of the couple's commitment to one another and can provide certain legal rights and responsibilities similar to those of marriage. The affidavit outlines the partners' names, addresses, and the nature of their relationship, affirming that they meet the criteria set by Texas law for domestic partnerships.

Key Elements of the Affidavit of Domestic Partnership in Texas

Several essential components make up the Affidavit of Domestic Partnership. These include:

- Identification of Partners: Full names and addresses of both partners.

- Declaration of Partnership: A statement affirming the partners' commitment to each other.

- Eligibility Criteria: Confirmation that both partners meet the legal requirements, such as being at least eighteen years old and not being closely related.

- Signature and Notarization: Both partners must sign the affidavit in the presence of a notary public to validate the document.

Steps to Complete the Affidavit of Domestic Partnership in Texas

Completing the Affidavit of Domestic Partnership involves several steps:

- Gather Required Information: Collect personal information, including full names, addresses, and proof of eligibility.

- Obtain the Affidavit Form: Access the official Affidavit of Domestic Partnership form, which can typically be found online or at local government offices.

- Fill Out the Form: Complete the form with accurate information, ensuring all sections are filled out as required.

- Sign in Front of a Notary: Both partners must sign the affidavit in the presence of a notary public to ensure its legality.

- Submit the Affidavit: Depending on local regulations, submit the completed affidavit to the appropriate government office or agency.

Legal Use of the Affidavit of Domestic Partnership in Texas

The Affidavit of Domestic Partnership can serve various legal purposes. It may be used to establish rights related to health care decisions, inheritance, and benefits. Additionally, it can provide access to certain legal protections under state law, similar to those afforded to married couples. However, it is essential to understand that the legal recognition of domestic partnerships may vary by jurisdiction within Texas, so consulting with a legal professional is advisable for specific applications.

Eligibility Criteria for the Affidavit of Domestic Partnership in Texas

To qualify for filing an Affidavit of Domestic Partnership in Texas, both partners must meet specific criteria:

- Age: Both partners must be at least eighteen years old.

- Relationship Status: Partners must not be married to anyone else or related by blood in a way that would prohibit marriage.

- Shared Residence: Partners must share a common residence and intend to live together as a couple.

- Mutual Commitment: Both partners must demonstrate a mutual commitment to a long-term relationship.

How to Obtain the Affidavit of Domestic Partnership in Texas

Obtaining the Affidavit of Domestic Partnership typically involves the following steps:

- Visit Local Government Offices: Check with your local county clerk or government office for the availability of the affidavit form.

- Download Online: Many counties provide the form online, allowing couples to download and print it for completion.

- Consult Legal Resources: Consider seeking legal advice or resources that provide guidance on completing the affidavit accurately.

Quick guide on how to complete declaration of domestic partnership form

Complete Affidavit Of Domestic Partnership Harris County Texas seamlessly on any device

Digital document management has become increasingly favored among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Affidavit Of Domestic Partnership Harris County Texas on any device via the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Affidavit Of Domestic Partnership Harris County Texas effortlessly

- Locate Affidavit Of Domestic Partnership Harris County Texas and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Affidavit Of Domestic Partnership Harris County Texas to ensure effective communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Is the Shiv Nadar University's application form to be filled out after the declaration of the respective board results?

Hey there! You can start filling the form beforehand. You can write your Statement of Purpose (SOP) and fill other details. Once you get your Board results, enter the marks. The form allows you to save your application and complete it later. Hope this helps!

Create this form in 5 minutes!

How to create an eSignature for the declaration of domestic partnership form

How to make an electronic signature for the Declaration Of Domestic Partnership Form online

How to generate an eSignature for the Declaration Of Domestic Partnership Form in Google Chrome

How to make an eSignature for putting it on the Declaration Of Domestic Partnership Form in Gmail

How to create an eSignature for the Declaration Of Domestic Partnership Form straight from your smart phone

How to generate an electronic signature for the Declaration Of Domestic Partnership Form on iOS

How to generate an electronic signature for the Declaration Of Domestic Partnership Form on Android

People also ask

-

What is a domestic partner affidavit?

A domestic partner affidavit is a legal document that certifies the relationship between two individuals who live together and share a domestic life but are not married. This affidavit often serves to provide evidence of the partnership for legal or financial purposes, such as health benefits or taxes.

-

How can airSlate SignNow help me create a domestic partner affidavit?

With airSlate SignNow, you can easily create and eSign your domestic partner affidavit using our user-friendly platform. Our templates and guided workflow make it simple to fill in the necessary information and ensure your affidavit is legally compliant.

-

Is there a cost associated with using airSlate SignNow for a domestic partner affidavit?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, and creating a domestic partner affidavit is included in those plans. You can choose a plan that best fits your requirements and budget, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing domestic partner affidavits?

airSlate SignNow offers features like customizable templates, secure eSigning, document tracking, and integration with other applications to manage your domestic partner affidavit efficiently. These features help streamline the process, ensuring you can handle all your documents in one place.

-

Are there benefits to using an electronic domestic partner affidavit over a paper one?

Using an electronic domestic partner affidavit with airSlate SignNow offers several benefits, including faster processing times, reduced paper usage, and enhanced security. You can also share the document easily with all relevant parties, making it a more efficient option.

-

Can I integrate airSlate SignNow with other tools for managing my domestic partner affidavit?

Yes, airSlate SignNow offers integration with various tools such as cloud storage services, CRM systems, and office software. This allows you to manage your domestic partner affidavit and related documents seamlessly across different platforms.

-

Is the domestic partner affidavit I create with airSlate SignNow legally binding?

Yes, the domestic partner affidavit created and eSigned using airSlate SignNow is legally binding, provided that it meets your state’s legal requirements. We recommend reviewing your local laws to ensure compliance, ensuring that your affidavit holds up in legal contexts.

Get more for Affidavit Of Domestic Partnership Harris County Texas

Find out other Affidavit Of Domestic Partnership Harris County Texas

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online