Vat Form 001

What is the taxpayer registration input form TRIF 2006 001 COYS

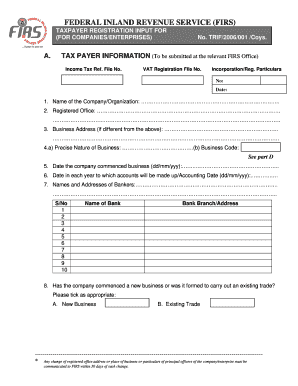

The taxpayer registration input form TRIF 2006 001 COYS is an essential document used for registering taxpayers within specific jurisdictions. This form collects vital information necessary for tax identification and compliance. It is particularly relevant for businesses and individuals who need to establish their taxpayer status with the appropriate tax authorities. The form typically requires details such as the taxpayer's name, address, and identification numbers, which are crucial for tax processing and record-keeping.

How to obtain the taxpayer registration input form TRIF 2006 001 COYS

The TRIF 2006 001 COYS form can be obtained through official government websites or tax offices. It is important to ensure that you are accessing the most current version of the form to avoid any compliance issues. Many state tax agencies provide downloadable PDFs of this form, allowing users to print and fill it out at their convenience. Additionally, some tax preparation software may include this form as part of their offerings, facilitating easier access for users.

Steps to complete the taxpayer registration input form TRIF 2006 001 COYS

Completing the TRIF 2006 001 COYS form involves several key steps:

- Begin by gathering all necessary information, including your personal identification details and business information if applicable.

- Carefully fill out each section of the form, ensuring accuracy to prevent delays in processing.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form where required to validate your submission.

Legal use of the taxpayer registration input form TRIF 2006 001 COYS

The TRIF 2006 001 COYS form is legally binding when completed and submitted according to the guidelines set forth by tax authorities. It must be filled out truthfully and accurately, as providing false information can lead to penalties or legal repercussions. Electronic submissions of this form are also considered valid, provided they comply with relevant eSignature laws, ensuring that the document is recognized legally.

Key elements of the taxpayer registration input form TRIF 2006 001 COYS

Key elements of the TRIF 2006 001 COYS form include:

- Taxpayer Identification Number (TIN): Essential for identifying the taxpayer.

- Name and Address: Required for establishing the taxpayer's identity and location.

- Business Structure: Information on whether the taxpayer is an individual, partnership, corporation, or other entity.

- Signature: Required to authenticate the form and confirm the accuracy of the information provided.

Form submission methods for the taxpayer registration input form TRIF 2006 001 COYS

The TRIF 2006 001 COYS form can be submitted through various methods, depending on the regulations of the issuing authority. Common submission methods include:

- Online: Many jurisdictions allow for electronic submission through their official websites.

- Mail: The completed form can be sent to the appropriate tax office via postal service.

- In-Person: Taxpayers may also submit the form directly at local tax offices for immediate processing.

Quick guide on how to complete vat form 001

Complete Vat Form 001 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Vat Form 001 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to alter and eSign Vat Form 001 without hassle

- Obtain Vat Form 001 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Leave behind concerns about missing or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Vat Form 001 and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat form 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to download the taxpayer registration input form TRIF 2006 001 COYS?

To download the taxpayer registration input form TRIF 2006 001 COYS, simply navigate to our forms section on the airSlate SignNow website. Look for the specific form and click the download button. This quick process ensures you have the latest version at your fingertips.

-

Is airSlate SignNow free to use for downloading the taxpayer registration input form TRIF 2006 001 COYS?

While downloading the taxpayer registration input form TRIF 2006 001 COYS is free, airSlate SignNow offers various pricing plans tailored for businesses. These plans provide additional features such as eSigning and document management, which enhance productivity and streamline workflows.

-

What features does airSlate SignNow offer that assist with the taxpayer registration input form TRIF 2006 001 COYS?

airSlate SignNow allows for easy editing and signing of the taxpayer registration input form TRIF 2006 001 COYS directly within the platform. In addition, you can securely store and share the completed form, ensuring seamless collaboration among team members.

-

Can I integrate airSlate SignNow with other applications while working with the taxpayer registration input form TRIF 2006 001 COYS?

Yes, airSlate SignNow supports integration with various third-party applications, making it easy to enhance your workflow while managing the taxpayer registration input form TRIF 2006 001 COYS. Popular integrations include Google Drive, Dropbox, and more, facilitating effortless file access and sharing.

-

What benefits can I expect from using airSlate SignNow for the taxpayer registration input form TRIF 2006 001 COYS?

Using airSlate SignNow for the taxpayer registration input form TRIF 2006 001 COYS offers several benefits, including time savings and reduced paperwork. The platform simplifies the signing and document management process, which can lead to increased efficiency for your business.

-

How secure is the airSlate SignNow platform when handling the taxpayer registration input form TRIF 2006 001 COYS?

airSlate SignNow prioritizes security, ensuring that your transactions involving the taxpayer registration input form TRIF 2006 001 COYS are protected with advanced encryption and secure cloud storage. You can trust that your sensitive information remains confidential and secure.

-

Is there customer support available when using airSlate SignNow to download the taxpayer registration input form TRIF 2006 001 COYS?

Absolutely! Our dedicated customer support team is available to assist you with any questions or concerns regarding airSlate SignNow and downloading the taxpayer registration input form TRIF 2006 001 COYS. You can signNow them via chat, email, or phone for prompt assistance.

Get more for Vat Form 001

- Algebra 2 formula sheet

- Cooking competition registration form

- Baltimore city zip codes map form

- Ssa 3373 bk function report adult ssa form

- Chitha for surveyed villages form

- Limited special occasion permit application nc gov form

- About notice 797 possible federal tax refund due to the form

- John hancock rollover form

Find out other Vat Form 001

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed