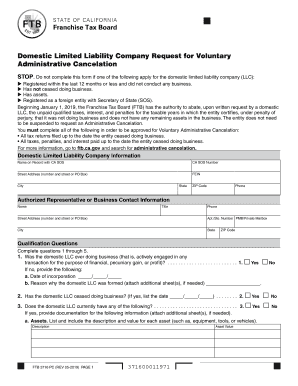

Form 3716 2019

What is the Form 3716

The FTB Form 3716 is a tax-related document used by the California Franchise Tax Board. This form is specifically designed for individuals and businesses to report certain financial information for tax purposes. It plays a crucial role in ensuring compliance with California tax laws and regulations. Understanding the purpose of this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the Form 3716

Using the FTB Form 3716 involves several steps. First, gather all necessary financial documents and information that pertain to your income and deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted either electronically or by mail, depending on your preference and eligibility.

Steps to complete the Form 3716

Completing the FTB Form 3716 requires attention to detail. Follow these steps:

- Obtain the form from the California Franchise Tax Board website or through authorized channels.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income, deductions, and any applicable tax credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 3716

The FTB Form 3716 must be used in accordance with California tax laws. It is legally binding once signed, and any inaccuracies or omissions can lead to penalties or audits. Taxpayers are responsible for ensuring that the information provided is truthful and complete. Understanding the legal implications of this form is essential for compliance and to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the FTB Form 3716 are critical for compliance. Typically, the form must be submitted by the due date of your tax return. It is advisable to check the California Franchise Tax Board's official website for any updates or changes to deadlines. Missing these deadlines can result in penalties, so staying informed is crucial for all taxpayers.

Form Submission Methods (Online / Mail / In-Person)

The FTB Form 3716 can be submitted through various methods. Taxpayers have the option to file online, which is often the fastest and most efficient method. Alternatively, the form can be printed and mailed to the appropriate address provided by the California Franchise Tax Board. In-person submissions may also be possible at designated tax offices. Each method has its own processing times, so it is important to choose the one that best suits your needs.

Create this form in 5 minutes or less

Find and fill out the correct form 3716

Create this form in 5 minutes!

How to create an eSignature for the form 3716

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb form 3716?

The ftb form 3716 is a tax form used by California taxpayers to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily fill out and eSign the ftb form 3716, streamlining your tax filing process.

-

How can airSlate SignNow help with the ftb form 3716?

airSlate SignNow provides a user-friendly platform to complete and eSign the ftb form 3716 efficiently. With features like templates and cloud storage, you can manage your documents seamlessly. This ensures that your tax forms are filled out accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the ftb form 3716?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides excellent value for the features offered, including the ability to eSign documents like the ftb form 3716. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the ftb form 3716?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking for the ftb form 3716. These tools enhance efficiency and ensure that your documents are processed quickly. Additionally, you can collaborate with others directly within the platform.

-

Can I integrate airSlate SignNow with other applications for the ftb form 3716?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the ftb form 3716. Whether you use CRM systems or cloud storage services, you can connect them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the ftb form 3716?

Using airSlate SignNow for the ftb form 3716 provides numerous benefits, including time savings and improved accuracy. The platform simplifies the eSigning process, reducing the chances of errors. Additionally, it enhances security and compliance, giving you peace of mind during tax season.

-

Is airSlate SignNow secure for handling the ftb form 3716?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the ftb form 3716. The platform uses encryption and secure storage to protect your data. You can trust that your information is safe while using our services.

Get more for Form 3716

Find out other Form 3716

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple