Mary Kay Tax Worksheet Form

What is the Mary Kay Tax Worksheet

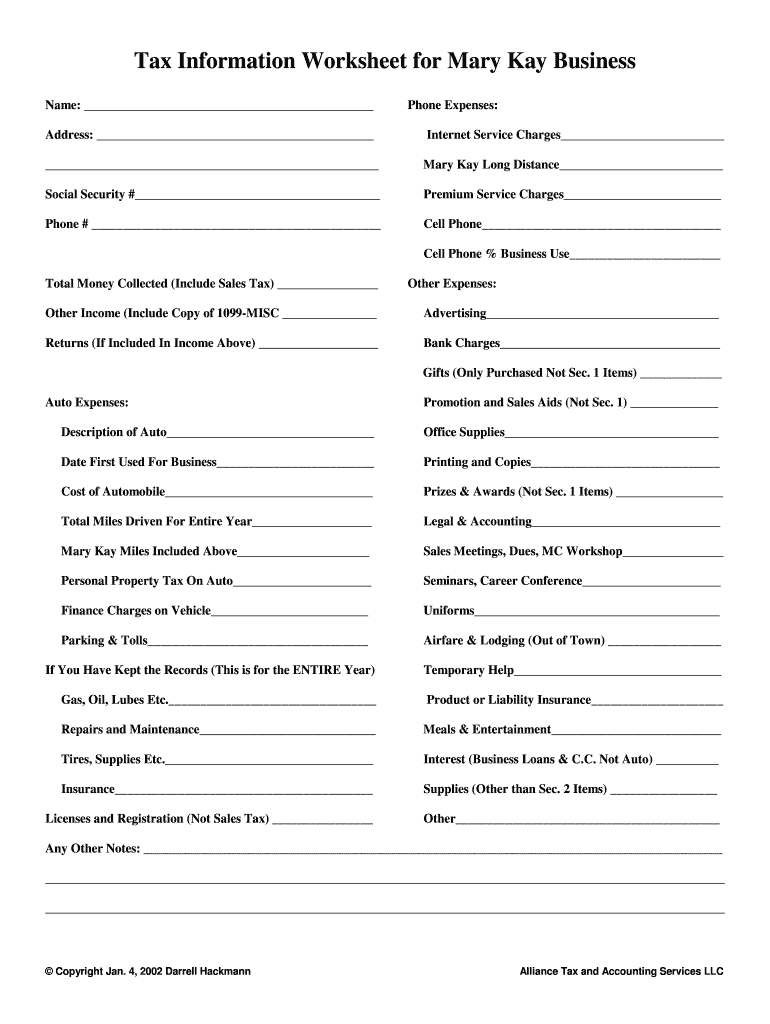

The Mary Kay Tax Worksheet is a specialized form designed for independent beauty consultants to track their income and expenses throughout the year. This worksheet simplifies the process of preparing taxes by summarizing essential financial data, including sales, commissions, and deductible expenses. By using this form, consultants can ensure they accurately report their earnings and maximize their eligible deductions, ultimately leading to a more efficient tax filing process.

How to use the Mary Kay Tax Worksheet

Using the Mary Kay Tax Worksheet involves several straightforward steps. First, gather all relevant financial documents, such as sales receipts, invoices, and expense records. Next, fill in the worksheet with your total sales, commissions earned, and any business-related expenses incurred during the tax year. It's essential to categorize your expenses accurately to ensure compliance with IRS regulations. After completing the worksheet, review it for accuracy before using it to prepare your tax return.

Steps to complete the Mary Kay Tax Worksheet

Completing the Mary Kay Tax Worksheet requires careful attention to detail. Follow these steps for accuracy:

- Collect all sales and expense documentation.

- Enter your total sales figures in the designated section.

- Document all commissions earned from sales.

- List all deductible expenses, such as inventory costs, marketing materials, and travel expenses.

- Review the completed worksheet for any errors or omissions.

Legal use of the Mary Kay Tax Worksheet

The Mary Kay Tax Worksheet is legally valid when filled out correctly and used in accordance with IRS guidelines. To ensure its legal standing, consultants must maintain accurate records and provide truthful information. The worksheet serves as a supporting document for tax returns, and it is essential to keep it on file for at least three years in case of an audit. Utilizing this form helps consultants demonstrate their income and expenses clearly, which is crucial for compliance with tax laws.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for independent consultants using the Mary Kay Tax Worksheet. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding due dates and to plan ahead to avoid late penalties. Additionally, if you require an extension, ensure you file the appropriate forms before the original deadline.

Examples of using the Mary Kay Tax Worksheet

There are various scenarios in which the Mary Kay Tax Worksheet can be beneficial. For instance, a consultant who has made significant sales during the year can use the worksheet to calculate their total income and identify potential deductions. Another example is a consultant who has incurred travel expenses for business-related events; the worksheet allows them to document these expenses accurately. By providing clear examples of income and expenses, the worksheet facilitates a smoother tax preparation process.

Quick guide on how to complete mary kay tax worksheet

Complete Mary Kay Tax Worksheet effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Mary Kay Tax Worksheet on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Mary Kay Tax Worksheet with ease

- Obtain Mary Kay Tax Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or black out sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Mary Kay Tax Worksheet and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mary kay tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mary kay tax worksheet 2023 printable?

The mary kay tax worksheet 2023 printable is a specially designed document that helps Mary Kay consultants track their expenses and income. This worksheet simplifies the tax preparation process, ensuring all necessary financial details are organized effectively.

-

How can I access the mary kay tax worksheet 2023 printable?

You can access the mary kay tax worksheet 2023 printable directly from the airSlate SignNow website, where it is available for download without any cost. Simply navigate to the resources section and search for the worksheet to get started.

-

Is the mary kay tax worksheet 2023 printable customizable?

Yes, the mary kay tax worksheet 2023 printable can be easily customized to fit your unique business needs. Users can edit sections to include specific expenses or income relevant to their Mary Kay business.

-

What are the benefits of using the mary kay tax worksheet 2023 printable?

The benefits of using the mary kay tax worksheet 2023 printable include better organization of financial data, simplified tax filing, and ensuring you capture all deductible expenses. This tool ultimately saves time and reduces stress during tax season.

-

Can I integrate the mary kay tax worksheet 2023 printable with other software?

While the mary kay tax worksheet 2023 printable is primarily a standalone document, you can easily import the data into accounting software if needed. This flexibility allows you to maximize its functionality based on your workflow.

-

What are the costs associated with the mary kay tax worksheet 2023 printable?

The mary kay tax worksheet 2023 printable is offered for free on the airSlate SignNow platform. This makes it a cost-effective solution for Mary Kay consultants looking to streamline their tax preparation.

-

Is the mary kay tax worksheet 2023 printable user-friendly?

Absolutely! The mary kay tax worksheet 2023 printable is designed to be user-friendly, making it accessible even for those who may not have advanced accounting skills. It features clear sections and instructions to guide you through the process.

Get more for Mary Kay Tax Worksheet

- Irs publication 786 form

- Sjk c pei hwa exam paper pdf 366496021 form

- Ctos consent form 212145397

- Hea 2709 application for certified copies of birth certificate rev 06 butlercountyprobatecourt form

- Model format table of shipboard working arrangements pdf

- Application form to undertake research in fiji

- Do you reimburse expenses when people paid cash and form

- Objective 37 il adv final student workbook winter 2009doc form

Find out other Mary Kay Tax Worksheet

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer