Form Wt Transmittal for Paper 2013-2026

What is the Form WT Transmittal for Paper?

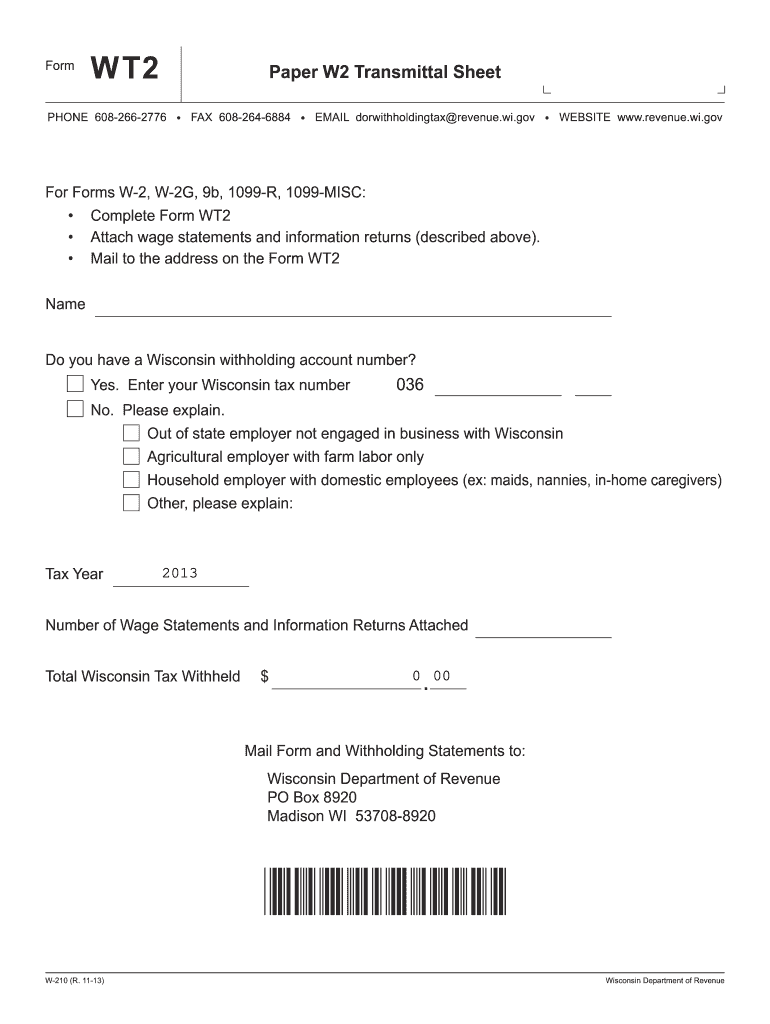

The Form WT Transmittal for Paper is a document used primarily in the state of Wisconsin for reporting wages and withholding information to the Department of Revenue. This form serves as a cover sheet for submitting paper W-2 forms, ensuring that all necessary information is organized and presented clearly. It is crucial for employers to complete this form accurately to comply with state tax regulations and facilitate the processing of employee wage data.

How to Use the Form WT Transmittal for Paper

Using the Form WT Transmittal for Paper involves several straightforward steps. First, gather all W-2 forms that need to be submitted. Next, fill out the transmittal form with essential information, including the employer's name, address, and identification number. Once completed, attach the W-2 forms to the transmittal and ensure that all documents are securely fastened. Finally, submit the entire package to the appropriate state department, either by mail or in person, depending on the submission guidelines.

Steps to Complete the Form WT Transmittal for Paper

Completing the Form WT Transmittal for Paper requires attention to detail. Follow these steps:

- Begin by entering your business name and address at the top of the form.

- Provide your Employer Identification Number (EIN) to identify your business.

- Indicate the total number of W-2 forms being submitted.

- Check the appropriate boxes to confirm the type of forms included and any other relevant information.

- Review all entries for accuracy before finalizing the form.

Legal Use of the Form WT Transmittal for Paper

The Form WT Transmittal for Paper is legally required for employers in Wisconsin who are submitting paper W-2 forms. This requirement ensures compliance with state tax laws and helps maintain accurate records of employee wages and withholdings. Failure to use this form appropriately can result in penalties or delays in processing tax information.

IRS Guidelines

While the Form WT Transmittal for Paper is specific to Wisconsin, it is essential to adhere to IRS guidelines when filing federal tax forms. Employers should ensure that the information reported on the W-2 forms matches the details submitted to the IRS. This alignment helps avoid discrepancies that could lead to audits or penalties. Additionally, understanding the IRS's requirements for electronic filing may benefit employers considering transitioning from paper to digital submissions in the future.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines for the Form WT Transmittal for Paper. Typically, the form and accompanying W-2s must be submitted to the Wisconsin Department of Revenue by the end of January following the tax year. It is crucial to stay informed about any changes to these deadlines, as late submissions can incur penalties and interest on unpaid taxes.

Quick guide on how to complete paper wt2 transmittal sheet form

Your assistance manual for preparing your Form Wt Transmittal For Paper

If you wish to understand how to generate and submit your Form Wt Transmittal For Paper, here are some brief instructions on simplifying your tax submission process.

To begin, simply set up your airSlate SignNow account to revolutionize the management of your documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that empowers you to modify, create, and finalize your tax documents with ease. By utilizing its editor, you can navigate between text, checkboxes, and eSignatures, returning to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and convenient sharing options.

Follow these steps to complete your Form Wt Transmittal For Paper in just a few minutes:

- Create your account and start editing PDFs right away.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Press Get form to access your Form Wt Transmittal For Paper in our editor.

- Complete the required fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Double-check your document and amend any errors.

- Store changes, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to digitally file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to errors in returns and delays in refunds. Before e-filing your taxes, make sure to verify the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

FAQs

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

How do I fill out the exam form for a due paper of Rajasthan University?

Either through your college or contact to exam section window (depends on your course) with your previous exam result, fee receipt, etc.

-

In the NEET paper 2, I wrote the right roll number, code, and the right answer sheet number but filled it out incorrectly in the bubble form. Will my sheet be checked?

unfortunately if you havnt informed this to the exam center authority it will not be valued.Sorry. All the Best

Create this form in 5 minutes!

How to create an eSignature for the paper wt2 transmittal sheet form

How to generate an electronic signature for the Paper Wt2 Transmittal Sheet Form in the online mode

How to create an eSignature for the Paper Wt2 Transmittal Sheet Form in Google Chrome

How to generate an electronic signature for signing the Paper Wt2 Transmittal Sheet Form in Gmail

How to make an electronic signature for the Paper Wt2 Transmittal Sheet Form straight from your smart phone

How to make an eSignature for the Paper Wt2 Transmittal Sheet Form on iOS

How to create an eSignature for the Paper Wt2 Transmittal Sheet Form on Android

People also ask

-

What is the Form Wt Transmittal For Paper used for?

The Form Wt Transmittal For Paper is typically used to submit information regarding withholding tax to the IRS. It serves as a transmittal form that accompanies various tax documents. Using airSlate SignNow, you can easily prepare and eSign this form, streamlining your tax submission process.

-

How does airSlate SignNow simplify the Form Wt Transmittal For Paper process?

airSlate SignNow simplifies the Form Wt Transmittal For Paper process by providing an intuitive platform that allows users to create, send, and eSign documents seamlessly. With features like templates and automated workflows, you can ensure that your transmittal form is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Form Wt Transmittal For Paper?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for those who frequently use the Form Wt Transmittal For Paper. The pricing is competitive and designed to provide signNow value, considering the time and resources saved through our streamlined eSigning process.

-

Can I integrate airSlate SignNow with other software for managing the Form Wt Transmittal For Paper?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, allowing you to manage the Form Wt Transmittal For Paper alongside your existing software. This ensures a cohesive workflow, making it easier to track and organize your tax documents.

-

What are the security features of airSlate SignNow when handling the Form Wt Transmittal For Paper?

Security is a top priority at airSlate SignNow. When handling the Form Wt Transmittal For Paper, your documents are protected with industry-leading encryption, secure access controls, and audit trails. This ensures that your sensitive tax information remains confidential and secure throughout the eSigning process.

-

Can I save templates for the Form Wt Transmittal For Paper in airSlate SignNow?

Yes, airSlate SignNow allows you to create and save templates for the Form Wt Transmittal For Paper. This feature enables you to quickly generate new forms with pre-filled information, saving you time and reducing the chances of errors when preparing your documents.

-

How quickly can I complete the Form Wt Transmittal For Paper using airSlate SignNow?

Using airSlate SignNow, you can complete the Form Wt Transmittal For Paper in just a few minutes. The platform’s user-friendly interface and streamlined eSigning process allow for quick document preparation, review, and signing, helping you meet your filing deadlines effortlessly.

Get more for Form Wt Transmittal For Paper

Find out other Form Wt Transmittal For Paper

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe