Keystone Collections Forms

What are Keystone Collections Tax Forms?

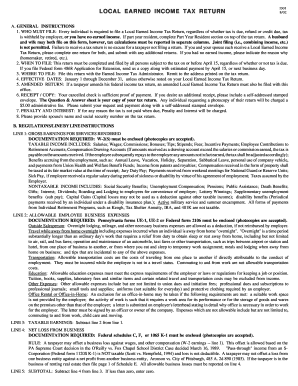

The Keystone Collections tax forms are essential documents used for tax reporting and collection purposes in the United States. These forms facilitate the accurate assessment and collection of local taxes, ensuring compliance with state and federal regulations. They are typically utilized by businesses and individuals who owe taxes to local municipalities. The forms are designed to capture various types of tax-related information, including income, deductions, and credits applicable to the taxpayer's situation.

How to Use the Keystone Collections Tax Forms

Using the Keystone Collections tax forms involves several steps to ensure accurate completion and submission. First, identify the specific form required based on your tax obligations. Next, gather all necessary financial documents, such as income statements and prior tax returns. Fill out the form carefully, ensuring all information is accurate and complete. Once completed, review the form for any errors before submission. You can submit the form online, by mail, or in person, depending on your local municipality's guidelines.

Steps to Complete the Keystone Collections Tax Forms

Completing the Keystone Collections tax forms can be straightforward if you follow these steps:

- Identify the correct form needed for your tax situation.

- Collect all relevant financial documents, including W-2s, 1099s, and other income records.

- Fill out the form, ensuring that you provide accurate information regarding your income, deductions, and credits.

- Double-check all entries for accuracy and completeness.

- Submit the form according to your local municipality's submission methods, which may include online options.

Legal Use of the Keystone Collections Tax Forms

The Keystone Collections tax forms are legally binding documents that must be completed accurately to comply with tax laws. Falsifying information or failing to submit the required forms can lead to penalties or legal action. It is crucial to understand the legal implications of these forms, including the requirement for accurate reporting of income and adherence to local tax regulations. Utilizing a reliable eSignature solution can enhance the legal validity of the completed forms.

Filing Deadlines / Important Dates

Filing deadlines for Keystone Collections tax forms vary by municipality, but it is essential to be aware of these dates to avoid penalties. Typically, local tax forms are due on or before April fifteenth of each year. Some municipalities may have different deadlines for specific types of taxes, so it is advisable to check with local tax authorities for the most accurate information. Keeping track of these deadlines helps ensure timely submission and compliance with local tax laws.

Form Submission Methods

There are several methods for submitting Keystone Collections tax forms, depending on local regulations. Common submission methods include:

- Online submission through the municipality's official website.

- Mailing the completed forms to the designated tax office.

- In-person submission at local tax offices or designated locations.

Choosing the appropriate submission method can streamline the process and ensure your forms are received promptly.

Quick guide on how to complete keystone collections forms

Effortlessly Prepare Keystone Collections Forms on Any Device

Online document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Keystone Collections Forms across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven operation today.

How to Modify and Electronically Sign Keystone Collections Forms with Ease

- Obtain Keystone Collections Forms and click Get Form to begin.

- Leverage the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Keystone Collections Forms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the keystone collections forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are keystone collections tax forms?

Keystone collections tax forms are specialized documents used to report and manage tax obligations linked to outstanding debts. These forms help businesses ensure compliance with tax laws while efficiently managing their collection processes. By utilizing airSlate SignNow, you can easily create, sign, and send these forms, streamlining your workflow.

-

How does airSlate SignNow help with keystone collections tax forms?

airSlate SignNow simplifies the process of managing keystone collections tax forms by providing an easy-to-use platform for document creation and electronic signatures. With our solution, you can quickly send forms for eSigning, track their status, and store them securely, allowing for better organization and compliance management.

-

What features does airSlate SignNow offer for handling keystone collections tax forms?

Our platform includes features like customizable templates for keystone collections tax forms, automated reminders for signers, and real-time status tracking. Additionally, you can integrate with various third-party applications to enhance workflow efficiency. These features make managing your tax forms simple and effective.

-

Is there a specific pricing plan for keystone collections tax forms?

airSlate SignNow offers several pricing plans that cater to businesses of all sizes looking to manage keystone collections tax forms. Choose from individual, professional, or business plans depending on your needs and the volume of forms you handle. Each plan includes essential features for tax form management at competitive rates.

-

Can I integrate airSlate SignNow with my existing software for keystone collections tax forms?

Yes, airSlate SignNow seamlessly integrates with numerous business applications, making it easy to manage keystone collections tax forms alongside your daily operations. Whether you use CRM systems, accounting software, or other tools, our platform can help streamline your workflow. Check our integration directory for specific software compatibilities.

-

What are the benefits of using airSlate SignNow for keystone collections tax forms?

Using airSlate SignNow for keystone collections tax forms provides numerous benefits, including enhanced accuracy, reduced turnaround time, and improved compliance. Our electronic signature capabilities minimize paperwork and the risk of errors while maintaining a secure and legally binding process. This ultimately saves your business time and resources.

-

How secure is the process of signing keystone collections tax forms with airSlate SignNow?

AirSlate SignNow prioritizes security, ensuring that your keystone collections tax forms are protected with robust encryption and secure storage. Additionally, we comply with industry regulations to safeguard your information. You can trust that your documents remain confidential and secure throughout the signing process.

Get more for Keystone Collections Forms

Find out other Keystone Collections Forms

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement