Nyc 210 Form

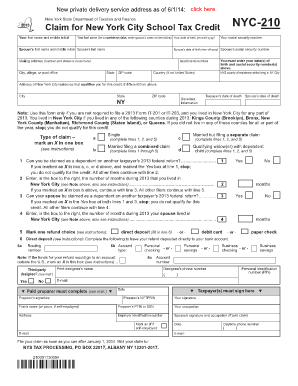

What is the NYC 210 Form?

The NYC 210 Form is a tax form used by individuals and businesses in New York City to report certain income and expenses. It is primarily associated with the city’s personal income tax and is essential for ensuring compliance with local tax regulations. This form is particularly relevant for residents and non-residents who earn income within the city limits. Understanding the purpose and requirements of the NYC 210 Form is vital for accurate tax reporting and avoiding potential penalties.

How to Obtain the NYC 210 Form

The NYC 210 Form can be obtained through several methods. Taxpayers can download the form directly from the official New York City Department of Finance website. Additionally, physical copies may be available at local tax offices or libraries. It is advisable to ensure that you are using the correct version of the form for the specific tax year you are filing, as forms may change from year to year.

Steps to Complete the NYC 210 Form

Completing the NYC 210 Form involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income and any deductions or credits you are eligible for.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Legal Use of the NYC 210 Form

The NYC 210 Form is legally binding when completed and submitted according to the guidelines set forth by the New York City Department of Finance. To ensure its legal validity, it is crucial to provide accurate information and adhere to all filing deadlines. Additionally, electronic signatures may be accepted, provided they comply with the relevant eSignature laws, making it easier to submit the form digitally.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 210 Form typically align with the federal tax deadlines. For most taxpayers, this means the form must be filed by April fifteenth of each year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the NYC 210 Form on time or providing inaccurate information can lead to significant penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action. To avoid these consequences, it is essential to understand the requirements of the form and ensure timely and accurate submissions.

Quick guide on how to complete nyc 210 form

Prepare Nyc 210 Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed files, as you can access the right form and safely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and eSign your documents rapidly without any hold-ups. Manage Nyc 210 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

The easiest way to modify and eSign Nyc 210 Form seamlessly

- Locate Nyc 210 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Nyc 210 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 210 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 210 form 2015?

The NYC 210 form 2015 is a tax form that New York City residents must complete to claim certain deductions and credits. It helps streamline the filing process by providing essential information about income and tax liabilities. Using airSlate SignNow, you can easily manage the NYC 210 form 2015 and ensure all necessary signatures are obtained electronically.

-

How can airSlate SignNow assist with the NYC 210 form 2015?

airSlate SignNow offers a user-friendly platform for electronically signing and sharing the NYC 210 form 2015 with ease. You can quickly prepare documents, gather eSignatures, and track their status all in one place. This solution simplifies compliance by ensuring your forms are completed and submitted accurately and timely.

-

Is airSlate SignNow cost-effective for filing the NYC 210 form 2015?

Yes, airSlate SignNow provides a cost-effective solution for managing the NYC 210 form 2015, offering various pricing plans to fit your needs. By reducing reliance on paper processes and minimizing time spent on document management, you will save on costs associated with traditional filing methods. The investment pays off in increased efficiency and convenience.

-

What features does airSlate SignNow offer for handling the NYC 210 form 2015?

With airSlate SignNow, you get a variety of features tailored for efficient document handling, including customizable templates for the NYC 210 form 2015, in-app eSignature capabilities, and secure storage. Additionally, the platform provides tracking and notifications, ensuring you stay updated on document status. These features enhance the likelihood of timely submissions.

-

Are there integrations available for handling the NYC 210 form 2015?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office, allowing easy access and management of the NYC 210 form 2015. These integrations facilitate smooth workflows and ensure you can work within your preferred software without hassle. Enhance your productivity by leveraging these integrations.

-

Can I collaborate with others on the NYC 210 form 2015 using airSlate SignNow?

Yes, airSlate SignNow enables collaboration with colleagues and tax professionals on the NYC 210 form 2015. You can invite others to review, edit, and sign documents in real-time, regardless of their location. This feature fosters teamwork and ensures that all necessary parties are involved in the filing process.

-

What benefits does airSlate SignNow provide for the NYC 210 form 2015?

The primary benefits of using airSlate SignNow for the NYC 210 form 2015 include increased efficiency, reduced paperwork, and enhanced compliance. You can complete, sign, and submit your documents from anywhere, all while maintaining security and audit trails. This streamlined process alleviates stress and keeps you organized during tax season.

Get more for Nyc 210 Form

Find out other Nyc 210 Form

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast