Why Providing Ministers with an Expense Account is a Best 2015-2026

What is the purpose of providing ministers with an expense account?

Providing ministers with an expense account serves multiple purposes, primarily aimed at facilitating their duties effectively. These accounts allow ministers to cover necessary expenses incurred while performing their official responsibilities. This includes travel costs, accommodation, meals, and other related expenditures. By having access to an expense account, ministers can focus more on their roles without the added stress of managing personal finances related to their official duties.

How to use an expense account effectively

Using an expense account effectively involves understanding the guidelines and limitations set forth by the governing body. Ministers should keep detailed records of all expenditures, including receipts and invoices, to ensure transparency and accountability. It is essential to categorize expenses accurately, distinguishing between personal and official costs. Regularly reviewing the account can help ministers stay within budget and avoid overspending, ensuring that funds are used appropriately for their intended purpose.

Key elements of an expense account

An expense account typically includes several key elements that govern its use. These include:

- Documentation requirements: Ministers must provide receipts and detailed descriptions of their expenses.

- Spending limits: There may be caps on certain types of expenses, such as meals or travel.

- Approval processes: Some expenditures may require prior approval from a designated authority.

- Reporting timelines: Ministers must submit their expense reports within specific timeframes to ensure timely reimbursement.

Legal considerations for expense accounts

Legal considerations surrounding expense accounts are crucial for maintaining compliance with federal and state regulations. Ministers must adhere to laws governing public funds, ensuring that all expenditures are justified and documented. Misuse of an expense account can lead to legal repercussions, including fines or disciplinary actions. It is vital for ministers to familiarize themselves with relevant laws and guidelines to avoid potential pitfalls.

Examples of appropriate expenses

Understanding what constitutes appropriate expenses is vital for ministers managing an expense account. Examples of acceptable expenses include:

- Travel costs for official events or meetings

- Accommodation expenses while attending conferences

- Meals during official business meetings

- Materials or supplies necessary for conducting official duties

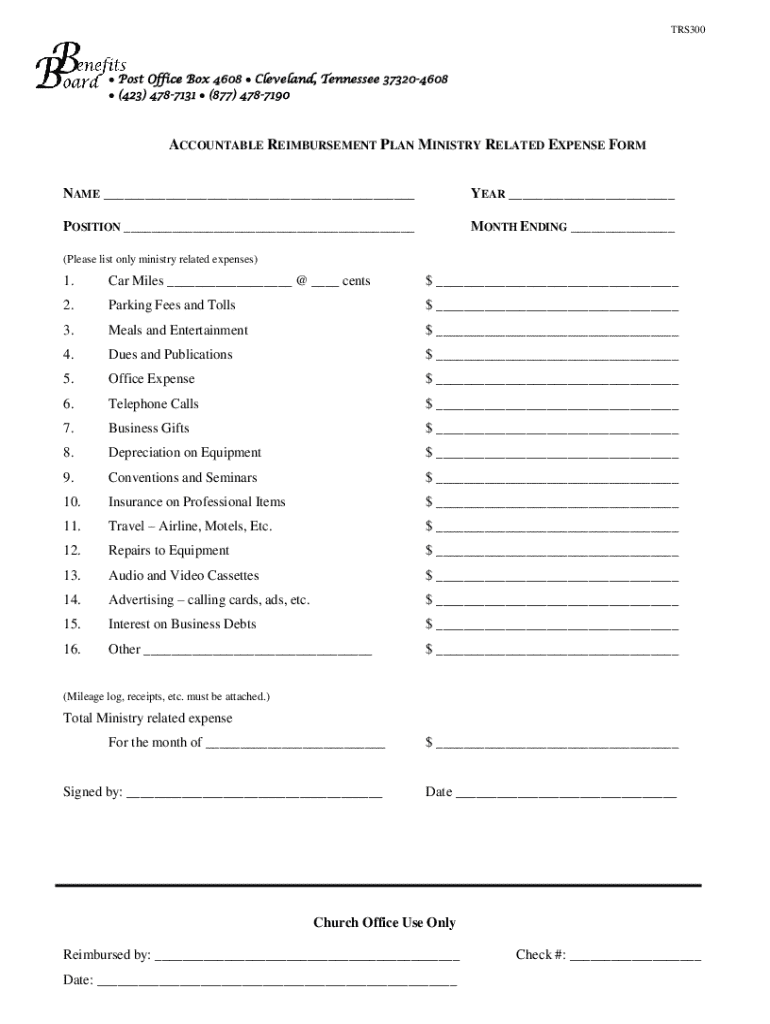

Steps to complete an expense report

Completing an expense report involves several steps to ensure accuracy and compliance. Ministers should follow these steps:

- Collect all receipts and documentation related to expenses.

- Fill out the expense report form, detailing each expense with corresponding amounts.

- Attach all necessary receipts and supporting documents.

- Review the report for accuracy and completeness.

- Submit the report to the appropriate authority for approval.

Create this form in 5 minutes or less

Find and fill out the correct why providing ministers with an expense account is a best

Create this form in 5 minutes!

How to create an eSignature for the why providing ministers with an expense account is a best

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of providing ministers with an expense account?

Providing ministers with an expense account is a best practice as it ensures transparency and accountability in financial dealings. It allows ministers to manage their expenses effectively, leading to better budgeting and resource allocation. Additionally, it fosters trust among stakeholders by demonstrating responsible financial management.

-

How does airSlate SignNow facilitate expense account management for ministers?

airSlate SignNow simplifies the process of managing expense accounts by allowing ministers to easily send and eSign documents related to their expenses. This streamlined approach reduces paperwork and enhances efficiency, making it easier for ministers to track and report their expenditures. Ultimately, this supports the idea of why providing ministers with an expense account is a best.

-

What features does airSlate SignNow offer for expense tracking?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking of expenses. These tools help ministers manage their accounts more effectively and ensure that all transactions are documented and easily accessible. This aligns with why providing ministers with an expense account is a best, as it promotes organized financial practices.

-

Is airSlate SignNow cost-effective for managing expense accounts?

Yes, airSlate SignNow is a cost-effective solution for managing expense accounts. With competitive pricing and a range of features designed to streamline document management, it provides excellent value for organizations looking to enhance their financial processes. This reinforces why providing ministers with an expense account is a best, as it can lead to signNow savings.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow can seamlessly integrate with various financial software, enhancing its functionality for expense account management. This integration allows for better data synchronization and reporting, which is crucial for understanding why providing ministers with an expense account is a best practice.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information shared during the expense account management process. This commitment to security supports the notion of why providing ministers with an expense account is a best, as it safeguards public trust.

-

What support does airSlate SignNow offer for new users?

airSlate SignNow provides comprehensive support for new users, including tutorials, customer service, and a knowledge base. This ensures that users can quickly learn how to manage their expense accounts effectively. Understanding how to use the platform reinforces why providing ministers with an expense account is a best, as it empowers them to utilize the tools available.

Get more for Why Providing Ministers With An Expense Account Is A Best

Find out other Why Providing Ministers With An Expense Account Is A Best

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now