Mv 30 Form

What is the MV 30 Form?

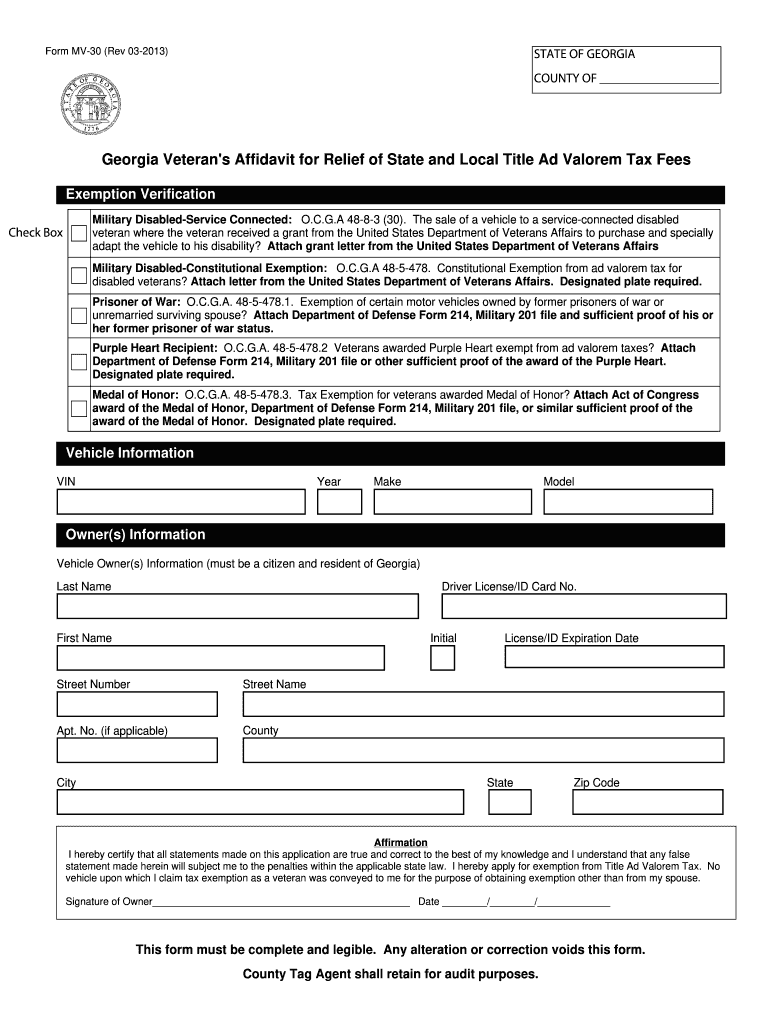

The MV 30 form, also known as the Georgia MV 30 form, is a document used in the state of Georgia primarily for requesting an exemption from certain vehicle registration fees. This form is essential for individuals or organizations seeking to claim exemptions based on specific criteria set by the Georgia Department of Revenue. Understanding the purpose and requirements of the MV 30 form is crucial for ensuring compliance with state regulations.

How to Use the MV 30 Form

Using the MV 30 form involves several steps to ensure that the application is completed accurately. First, gather all necessary information, including details about the vehicle and the reason for the exemption. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, submit it to the appropriate county tax office for processing. It is important to keep a copy of the submitted form for your records.

Steps to Complete the MV 30 Form

Completing the MV 30 form requires attention to detail. Follow these steps:

- Obtain the MV 30 form from the Georgia Department of Revenue's website or your local tax office.

- Provide accurate vehicle information, including the Vehicle Identification Number (VIN), make, model, and year.

- Indicate the reason for the exemption, ensuring it aligns with state guidelines.

- Sign and date the form to certify the information provided is true and accurate.

- Submit the completed form to your local county tax office, either in person or by mail.

Legal Use of the MV 30 Form

The legal use of the MV 30 form is governed by state regulations. It is essential to ensure that the form is used solely for its intended purpose, which is to apply for vehicle registration fee exemptions. Misuse of the form can lead to penalties or denial of the exemption request. Compliance with state laws and regulations is critical to maintaining the validity of the exemption.

Required Documents

When submitting the MV 30 form, certain documents may be required to support your exemption claim. These documents can include:

- Proof of eligibility for the exemption, such as a tax-exempt status letter for organizations.

- Identification documents that verify the identity of the applicant.

- Any additional documentation requested by the county tax office based on the exemption reason.

Form Submission Methods

The MV 30 form can be submitted through various methods, providing flexibility for applicants. These methods include:

- In-person submission at your local county tax office.

- Mailing the completed form to the appropriate county office.

- Some counties may offer online submission options, allowing for a more convenient process.

Quick guide on how to complete mv 30

Complete Mv 30 effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Mv 30 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and electronically sign Mv 30 without stress

- Obtain Mv 30 and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your preference. Modify and electronically sign Mv 30 and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mv 30

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mv30 form and why do I need it?

The mv30 form is a vital document used for vehicle registration and title applications. By completing the mv30 form, you ensure that your vehicle is properly registered, which is essential for legal compliance.

-

How can airSlate SignNow help me complete the mv30 form?

airSlate SignNow provides an efficient platform to fill out, eSign, and send the mv30 form online. Our solution simplifies the process, allowing you to complete the form quickly and securely from anywhere.

-

Is there a cost associated with using airSlate SignNow for the mv30 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including the processing of the mv30 form. Our plans are designed to be cost-effective while providing valuable features.

-

What features does airSlate SignNow offer for the mv30 form?

With airSlate SignNow, you can easily fill out and eSign the mv30 form digitally. Additional features include templates, document tracking, and secure storage, making it a comprehensive solution for managing your documents.

-

Can I integrate airSlate SignNow with other applications for the mv30 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the mv30 form alongside your other business tools. This enhances your workflow and boosts efficiency.

-

What are the benefits of using airSlate SignNow for the mv30 form?

Using airSlate SignNow for the mv30 form streamlines your document management process, saving you time and reducing errors. The platform is user-friendly and meets all legal standards for eSignature compliance.

-

How secure is the data when using airSlate SignNow for the mv30 form?

Security is a top priority for airSlate SignNow. When you complete the mv30 form with our platform, your data is protected with advanced encryption and complies with industry standards to ensure your information is safe.

Get more for Mv 30

- Boehringer ingelheim patient assistance printable renewal forms

- Fm 043 instructions form

- Form a2 202765151

- Pag ibig fund pagibigfund gov form

- Aacc 2019form

- Borang rb ii form rb ii medical report for malaysia my mm2h gov

- Hospital tengku ampuan rahimah klang htar form

- Fillable online application to travel out of province bcsoccer net form

Find out other Mv 30

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors