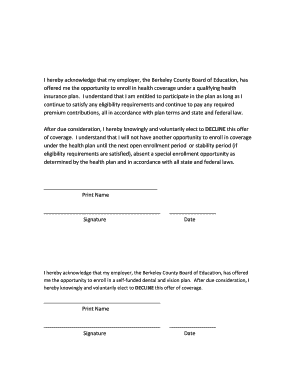

Insurance Decline Letter Form

What is the Insurance Decline Letter

An insurance decline letter is a formal document that individuals use to notify an insurance provider that they are opting out of coverage. This letter serves as a written record of the decision to decline insurance, which can be important for both the individual and the insurance company. It typically includes personal information, the type of insurance being declined, and a clear statement of the decision. The letter may also specify the reasons for declining coverage, although this is not always necessary.

Key Elements of the Insurance Decline Letter

When drafting an insurance decline letter, certain key elements should be included to ensure clarity and completeness:

- Sender's Information: Include your full name, address, and contact details at the top of the letter.

- Date: The date on which the letter is written should be clearly stated.

- Insurance Provider's Information: Provide the name and address of the insurance company to which the letter is addressed.

- Subject Line: A brief subject line indicating the purpose of the letter, such as "Decline of Insurance Coverage."

- Body of the Letter: Clearly state your intention to decline coverage and include any relevant details, such as policy numbers or types of coverage.

- Signature: End the letter with your signature and printed name to authenticate the document.

Steps to Complete the Insurance Decline Letter

Completing an insurance decline letter involves a few straightforward steps:

- Gather Information: Collect all necessary information, including your personal details and the insurance policy information.

- Draft the Letter: Use a clear and professional tone to write the letter, ensuring all key elements are included.

- Review the Letter: Check for any spelling or grammatical errors and ensure that all information is accurate.

- Sign the Letter: Add your signature at the end of the letter to validate it.

- Send the Letter: Choose a method of delivery, such as mailing or emailing the letter to the insurance provider.

Legal Use of the Insurance Decline Letter

The insurance decline letter can serve as a legally binding document, provided it meets certain criteria. To ensure its legal validity, the letter should be signed by the individual declining coverage. Additionally, it should be sent to the insurance provider in a manner that allows for confirmation of receipt, such as certified mail or a secure email. This documentation can be important in case of any disputes regarding the coverage status in the future.

How to Obtain the Insurance Decline Letter

Obtaining an insurance decline letter is typically a straightforward process. Many individuals choose to draft their own letter using templates available online. Alternatively, some insurance companies may provide a standard form or template for declining coverage. It is essential to ensure that any template used includes all necessary elements and complies with legal requirements. If unsure, consulting with a legal professional can provide additional guidance.

Examples of Using the Insurance Decline Letter

There are various scenarios in which an insurance decline letter may be used:

- Declining Health Insurance: An employee may use this letter to formally decline health insurance offered by their employer.

- Rejecting Auto Insurance: A customer might decline auto insurance coverage after purchasing a vehicle.

- Opting Out of Life Insurance: Individuals may choose to decline life insurance policies offered by financial institutions.

Quick guide on how to complete insurance decline letter

Complete Insurance Decline Letter effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Insurance Decline Letter on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign Insurance Decline Letter with ease

- Find Insurance Decline Letter and click on Get Form to start.

- Use the tools we provide to finalize your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Insurance Decline Letter and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insurance decline letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample letter to decline insurance coverage?

A sample letter to decline insurance coverage is a template that individuals can use to formally refuse an insurance policy. This letter typically includes personal details, the reason for declining, and may also provide feedback to the insurance provider. Using a sample letter simplifies the process and ensures that all necessary information is included.

-

How can airSlate SignNow help me create a sample letter to decline insurance coverage?

airSlate SignNow provides users with an easy-to-use platform to draft and eSign documents, including a sample letter to decline insurance coverage. With customizable templates, you can quickly modify the wording to fit your specific situation. The platform ensures that your letter is sent securely and promptly.

-

Is there a cost associated with using airSlate SignNow for a sample letter to decline insurance coverage?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial period for new users. Once enrolled, you can create an unlimited number of documents, including a sample letter to decline insurance coverage, all integrated into your plan's cost. Check the website for the latest pricing details.

-

Can I integrate airSlate SignNow with other tools for creating insurance documents?

Yes, airSlate SignNow can seamlessly integrate with various CRM and document management systems. This feature allows you to easily access a sample letter to decline insurance coverage and other documents without switching platforms. Integrations help streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my insurance communication?

The primary benefits of using airSlate SignNow include enhanced efficiency, security, and convenience in managing your documents. You can create and send a sample letter to decline insurance coverage quickly, ensuring that it signNowes its destination without unnecessary delays. The platform's eSigning capabilities offer legally binding signatures without the hassle of paper.

-

Are there templates for a sample letter to decline insurance coverage available on airSlate SignNow?

Yes, airSlate SignNow provides various templates that can be customized, including a sample letter to decline insurance coverage. You can easily edit these templates to meet your specific needs, ensuring that all relevant information is included. This feature saves time and helps ensure that your communication is effective.

-

How secure is the information I share when using airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect sensitive information while using its platform. When you create and send a sample letter to decline insurance coverage, your data is kept confidential and secure. The platform is compliant with industry standards to safeguard your documents.

Get more for Insurance Decline Letter

- Form 59a

- Au digital computershare com w8ben form

- Formato de solicitud y notificacin detranscripcin para

- Colorado dr0021 form

- The hartford forms online

- Elsa referral form

- Application to rent screening fee fillable form 404801995

- Sv 120 response to petition for private postsecondary school violence restraining orders form

Find out other Insurance Decline Letter

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself