Online W9 Form

What is the Online W-9

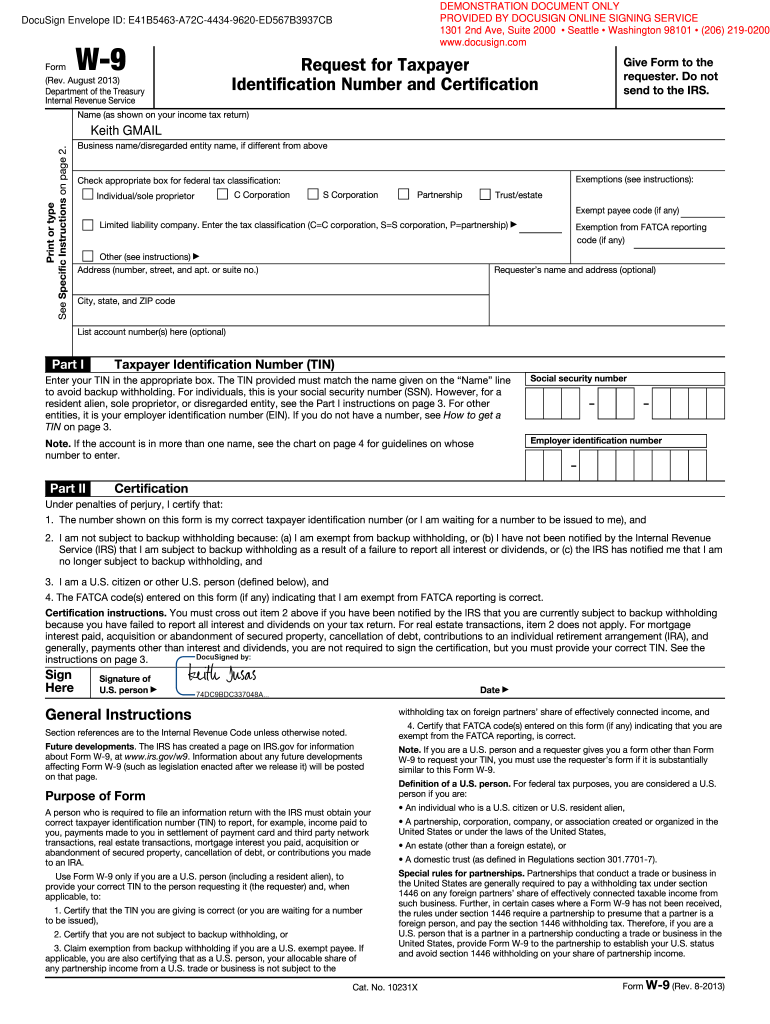

The Online W-9 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to entities that need to report income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals who receive payments from clients. By completing the W-9, you certify your taxpayer status and provide your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN). This information allows the requester to accurately report the payments made to you to the Internal Revenue Service (IRS).

How to Use the Online W-9

Using the Online W-9 is straightforward. First, access the form through a trusted electronic signature platform. Once you have the form open, fill in your personal details, including your name, business name (if applicable), address, and taxpayer identification number. After completing the form, review the information for accuracy. Finally, sign the document electronically using the platform's secure eSignature feature. This ensures that your submission is legally binding and compliant with IRS regulations.

Steps to Complete the Online W-9

Completing the Online W-9 involves several key steps:

- Open the Online W-9 form on a secure eSignature platform.

- Enter your full name and business name, if applicable.

- Provide your address, ensuring it matches your tax records.

- Input your taxpayer identification number, either your SSN or EIN.

- Review all entered information for accuracy.

- Sign the form electronically to validate your submission.

- Save or send the completed form to the requesting party.

Legal Use of the Online W-9

The Online W-9 is legally recognized as a valid document when completed and signed electronically. To ensure its legality, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures hold the same weight as handwritten signatures, provided that the signer has consented to use electronic records and signatures. Utilizing a reputable eSignature platform like signNow ensures that your Online W-9 is executed in compliance with these legal standards.

IRS Guidelines

The IRS provides specific guidelines for completing the W-9 form. It is essential to ensure that all information is accurate and matches IRS records to avoid issues with tax reporting. The form should be submitted to the entity requesting it, not directly to the IRS. Additionally, if any information changes, such as your name or taxpayer identification number, you must submit a new W-9 to the requester. Following these guidelines helps maintain compliance and prevents potential penalties.

Examples of Using the Online W-9

There are various scenarios where the Online W-9 is utilized:

- A freelancer providing services to a client who needs to report payments to the IRS.

- A contractor working with a company that requires tax information for payment processing.

- A business owner who needs to provide their EIN to a vendor for tax reporting purposes.

In each case, the Online W-9 serves as a crucial document for ensuring accurate tax reporting and compliance.

Quick guide on how to complete online w9

Prepare Online W9 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents since you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Handle Online W9 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Online W9 without hassle

- Find Online W9 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Alter and eSign Online W9 and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Online W9 and how does it work?

An Online W9 is a digital version of the IRS form W-9, used to request taxpayer information from individuals and businesses. With airSlate SignNow, you can easily fill out, sign, and send your Online W9 securely from any device. Our solution streamlines the process, eliminating the need for physical paperwork while ensuring compliance.

-

How can airSlate SignNow benefit my business when using Online W9 forms?

Using airSlate SignNow for Online W9 forms simplifies the documentation process, allowing for swift eSigning and enhanced workflow efficiency. Businesses can save time and reduce operational costs associated with printing and mailing physical forms. Additionally, our platform ensures the security of sensitive information, giving you peace of mind.

-

What are the pricing options for using airSlate SignNow for Online W9?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including a free trial to help you explore our features. Our plans are designed to be cost-effective, especially for those needing to handle multiple Online W9 forms regularly. Check our website for detailed pricing structures and choose the plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for my Online W9 needs?

Absolutely! airSlate SignNow supports integrations with numerous applications, including popular platforms like Google Drive, Dropbox, and accounting software. This means you can manage your Online W9 documents seamlessly alongside your existing workflows, enhancing productivity and collaboration.

-

Is it safe to use airSlate SignNow for submitting Online W9 forms?

Yes, airSlate SignNow prioritizes security, using industry-standard encryption to protect your data when you send and manage Online W9 forms. Our platform complies with relevant regulations, ensuring confidentiality and safety for sensitive information. You can trust our solution for secure online transactions.

-

How quickly can I complete an Online W9 using airSlate SignNow?

Completing an Online W9 with airSlate SignNow can be done in just a few minutes. The intuitive interface allows you to fill out the form, sign it, and send it all within the same session, signNowly speeding up the processing time compared to traditional methods.

-

Can multiple users sign an Online W9 through airSlate SignNow?

Yes, airSlate SignNow allows multiple users to sign an Online W9 form as needed. This feature is particularly useful for businesses where multiple stakeholders need to approve or provide their billing information quickly and efficiently.

Get more for Online W9

- Zetron 1512 manual form

- Coventry health care coordination of benefits cob questionnaire form

- Anniskelualueen rajaamista koskeva suunnitelma lhsto004 fi lomake form

- James casbolt michael prince form

- Psa submission form 467058131

- Dc couartly statement filing for retaurant and hotel licensees form

- Standard subcontractor agreement template form

- Startup ceo employment agreement template form

Find out other Online W9

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online